Sina Earnings Preview: Strength In Advertising To Help Sustain Growth Spree

Sina (NASDAQ:SINA) is scheduled to announce its second quarter earnings on Wednesday, August 9. The company has reported strong growth in ad revenues over the past few quarters due to the increasing popularity of its websites and apps such as the Sina mobile app and social media platform Weibo. The company generates a significant portion of its revenues from online brand advertising and marketing on its websites and social media platforms – particularly from Weibo.

We have a $75 price estimate for Sina’s stock,which is around 20% below the current market price. Sina’s stock price has surged by over 50% since the beginning of the year due to a strong set of results in recent quarters complemented by a healthier balance sheet.

See our complete analysis for Sina.

- Why Sina’s Revenues Will Likely See Only A Marginal Growth in 2020

- Decline In Sina’s Q3 Advertising Revenue Isn’t A Cause For Concern Yet

- Can Sina’s Revenue Growth Numbers Recover This Year?

- Sina’s Strength In Fintech Should Make Up For Weakness In Weibo Going Forward

- Sina Likely To Report Forgettable Q1 Results, But Revenues Should Recover Sharply In The Near Future

- How Much Can Chinese Stimulus Impact Sina’s Valuation?

Robust Growth In Weibo Ad Segment

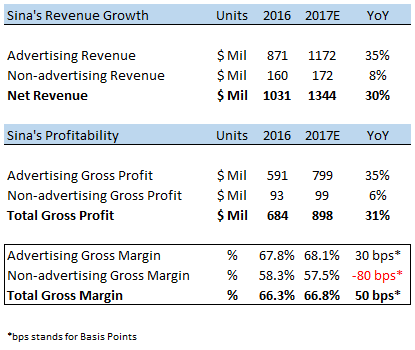

Sina’s advertising revenues were up by 17% to $871 million through 2016, while non-advertising revenues were up 16% to $160 million. Within the advertising segment, Weibo has been instrumental in driving growth for the company, while portal advertising revenues on Sina’s platforms struggled last year. Weibo’s ad revenues were up by 41% y-o-y to $567 million, while portal advertising revenues (generated from online brand advertising on Sina.com and Sina mobile properties) last year fell by around 11% year-over-year to $304 million.

A similar trend was observed in the March quarter as well, with Weibo ad revenues primarily driving growth for Sina. Over the last couple of years, Weibo has become a popular advertising space among digital brand advertisers in China, led by a significant increase in Weibo’s active user base.

Growth Spree To Continue In 2017

We forecast ad revenues to continue to drive top line growth for Sina through 2017, with a significant contribution from Weibo. Comparatively, growth in non-ad revenues is expected to slow down to high single digits, as shown below. In addition, we forecast advertising gross profit margins to expand by around 30 basis points through the year to help improve the company-wide gross margins.

In addition to strong growth from its primary revenue streams, Sina has been successful in restricting growth in net operating expenses. This trend is likely to continue through the year, with operating expenses increasing by around 20% over 2016 levels to $542 million. This should help the company expand its margins, as shown below. We forecast Sina’s non-GAAP diluted earnings per share to stand at just over $3 per share for the year, compared to a Reuters’ consensus estimate of around $2.80.

View Interactive Institutional Research (Powered by Trefis):

Global Large Cap | U.S. Mid & Small Cap | European Large & Mid Cap

More Trefis Research