Shutterfly To Witness A Strong Quarter Backed By The Success Of Its Restructuring Initiatives

Keeping in mind the growth delivered in the last quarter, the market expects Shutterfly (NASDAQ:SFLY) to report a solid financial performance for its June quarter on 7th August 2018, driven by its improved customer experience and integrated product offering. Further, the success of the company’s restructuring and platform consolidation strategy is likely to reduce its operating costs and improve its operating margin. We expect the company’s initiatives to optimize its technology and a strong focus on building its brands to drive its value in the coming quarters.

We have a price estimate of $88 per share for the company, which is higher than its current market price. View our interactive dashboard – Shutterfly’s Outlook For 2018 and modify the key drivers to visualize their impact on its valuation.

- Why Is Apollo Global Management Acquiring Shutterfly?

- Lifetouch Powers Shutterfly’s Q1 Results, And Will Continue To Drive Growth Going Forward

- Lifetouch Acquisition To Continue To Drive Top-Line Growth For Shutterfly In Q1

- Breaking Down Shutterfly’s Key Revenue Drivers

- Lifetouch Acquisition Should Continue To Drive Growth For Shutterfly

- Can Lifetouch Acquisition Drive Shutterfly’s Q4?

Key Trends To Watch For In 2Q’18 Results

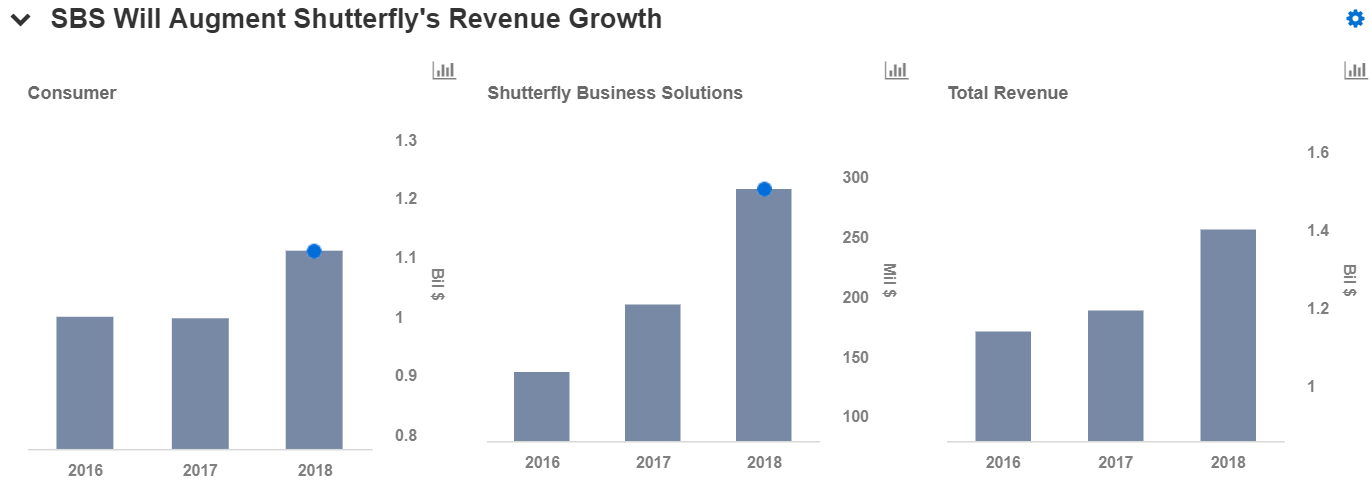

- Similar to the previous few quarters, the Shutterfly Business Solutions (SBS) segment is expected to deliver solid growth, which is likely to drive its top-line for the quarter. The SBS technology platform will enable the company to scale its business and establish itself as a major contender in the corporate stationery solutions business in the near term.

- In the Consumer segment, the average price per order is expected to rise gradually due to the change in product mix, which now includes items such as wedding and premium cards, stationery, photo prints, photo books, and photo gifts. The company had been aggressively promoting its premium product ranges, which could further boost the price per order, and, in turn, bolster the segment’s revenue. Further, repeat orders from loyal customers and strategic partnerships with retailers, such as Target and CVS, could improve the company’s order count.

- Shutterfly’s mobile app, which was launched in 2016, is expected to witness significant growth, with added products and styles to improve product creation and purchases. Increased mobile penetration and strategic investments are bound to help this channel grow in the coming quarters.

- Further, the company will continue to make investments in improving the mobile and consumer platforms and infrastructure upgrades, which will augment its top-line growth in the near term.

Do not agree with our forecast? Create your own price forecast for Shutterfly by changing the base inputs (blue dots) on our interactive dashboard.