What Key Factors Drove Charles Schwab’s Q1 Results?

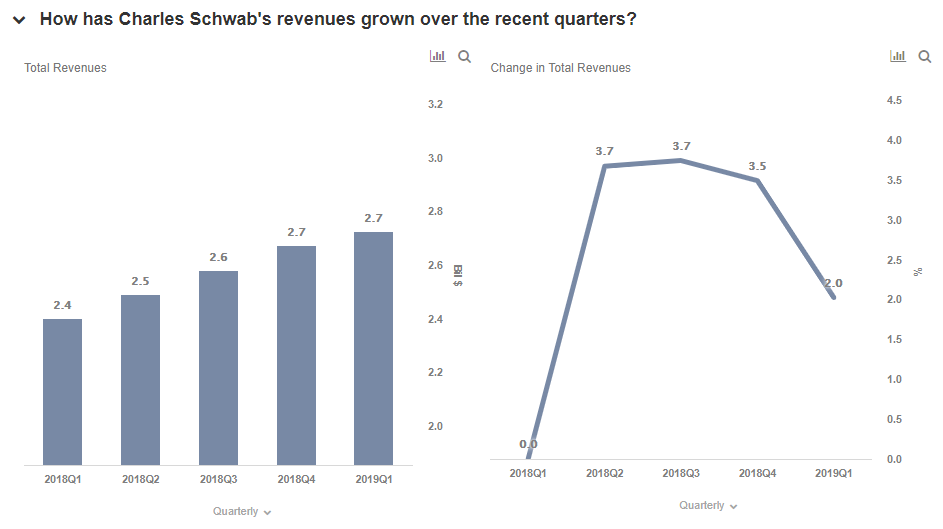

Charles Schwab (NYSE:SCHW) released its first quarter results on April 15, with net revenues and EPS increasing by 14% and 26%, respectively, over the prior year quarter. The brokerage’s net revenues and EPS came in at $2.7 billion and $0.69, respectively, towards the higher side of street estimates.

The Trefis price estimate for Charles Schwab stands at $44 per share, which is about in line with the market price. You can view our interactive dashboard on How have Charles Schwab’s earnings fared in recent quarters? to observe the quarterly revenue trends and modify yearly earnings to gauge the impact on the stock price, and see more of our financial services company data here.

Interest Income drove Charles Schwab’s earnings this quarter

- Net Interest Revenue: The series of rate hikes by the Fed last year has been the strongest driver of Schwab’s earnings, as net interest revenues contribute nearly 60% of its total revenues. Net interest revenues increased by 33% over the prior year quarter to $1.68 billion but were largely stable sequentially. With the inversion of the yield curve in March and lower chances of further rate hikes in the near term (per CME FedWatch Tool), we have revised our forecasts to 3.00% average yield on interest-earning assets in the coming years.

- Asset Management and Administration Fees: The company earns fees from managing proprietary money market mutual funds, ETFs, and advisory services, in addition to some third-party funds. The segment’s revenues declined by 11% to $755 million over the prior year quarter, and have remained flat compared to the last quarter, primarily due to lower money market fund revenues and fee reductions in the last two years.

- Trading Revenues: The revenues from this segment are largely dependent on client trading activity and market volatility. Trading revenues declined by 8% to $185 million over the previous year quarter, due to lower trading activity compared to the beginning of 2018. Despite consistent growth in brokerage accounts and trading activity, the revenue for this segment has been declining due to significant trading price reductions since 2017.

Expense Management

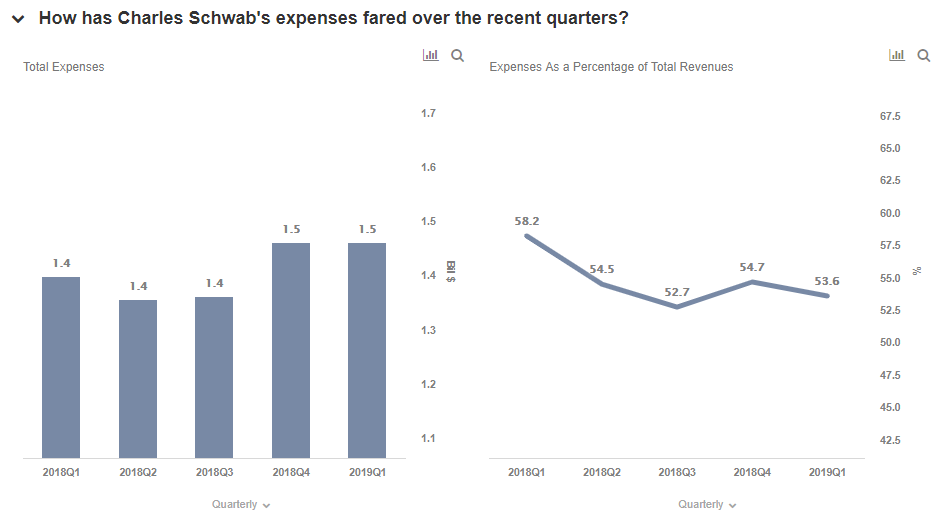

Total expenses as a percentage of total revenues declined from 58% in the first quarter of 2018 to 54% this quarter. An expense reduction trend is observed over the last year as the company is trying to improve efficiency in response to heightened competition from low- and no-fee brokerages. Despite an increase of 2% in total revenues, the total expenses have remained flat over the previous quarter, largely driven by a reduction in advertising and marketing, professional services, and other expenses.

What’s behind Trefis? See How it’s Powering New Collaboration and What-Ifs

For CFOs and Finance Teams | Product, R&D, and Marketing Teams

Like our charts? Explore example interactive dashboards and create your own