Schwab’s Interest Earning Assets Offset Declines In Trading Commissions In Q3

After a strong first half of the year, Charles Schwab’s (NYSE:SCHW) impressive performance continued in Q3, as the company reported nearly 13% growth in revenue and 23% growth in net income. Interest earning assets continued to be the primary growth driver, aided by the Fed’s interest rate hikes, while assets under management also saw growth. The company’s foray into digital advisory, with Schwab Intelligent Platform, and strong position in the ETF market drove nearly a 9% increase in earnings from this segment. A rise in trading volumes partially offset the losses the company saw due to a price cut in trading commissions. Operating expenses grew nearly 9% in comparison to the prior year comparable period, due to higher compensation and infrastructure spending to cater to the expanding customer base.

Rate Hike Boosted Interest Earning Assets And Net Interest Margins

Interest earning assets account for nearly half of Charles Schwab’s revenue. These assets saw nearly 10% growth along with a 28 basis point increase in yield, resulting in over 28% growth in the segment’s revenues. With the Fed’s indication of another rate hike in the year ahead, we expect the growth momentum to sustain through the year.

We expect another 5 basis points of improvement in yield and a similar growth in assets for the entire year.

Digital Advisory And New Products Helped

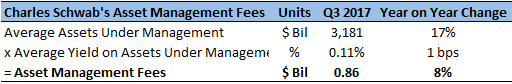

Assets under management generate around 40% of Charles Schwab’s revenue, and the segment saw around 8% revenue growth. The company has introduced many ETFs over the past few years and is among the top five ETF providers in the U.S. In addition, the company’s robo-advisory services have helped attract more investors, given the lack of advisory fees and enhanced customer support for portfolio management.

The company has focused on its client engagement and advisory services and consequently expanded its customer base. We expect the asset base to reach $3.5 trillion for the year, which could increase the revenues from these assets by more than 25% in 2017.

Trading Volumes Recovered But Revenues Declined Due To Cut In Commissions

The first quarter saw a nearly 21% decline in trading revenues amid falling revenue per trade, which can be primarily attributed to the company’s decision to slash its commissions to $4.95 per trade. However, the quarter saw a significant recovery in trading volumes (+16% y-o-y), which helped offset some of the losses from the price cut.

See our complete analysis for Charles Schwab.

View Interactive Institutional Research (Powered by Trefis):

Global Large Cap | U.S. Mid & Small Cap | European Large & Mid Cap