A Closer Look At Starbucks’ Growth

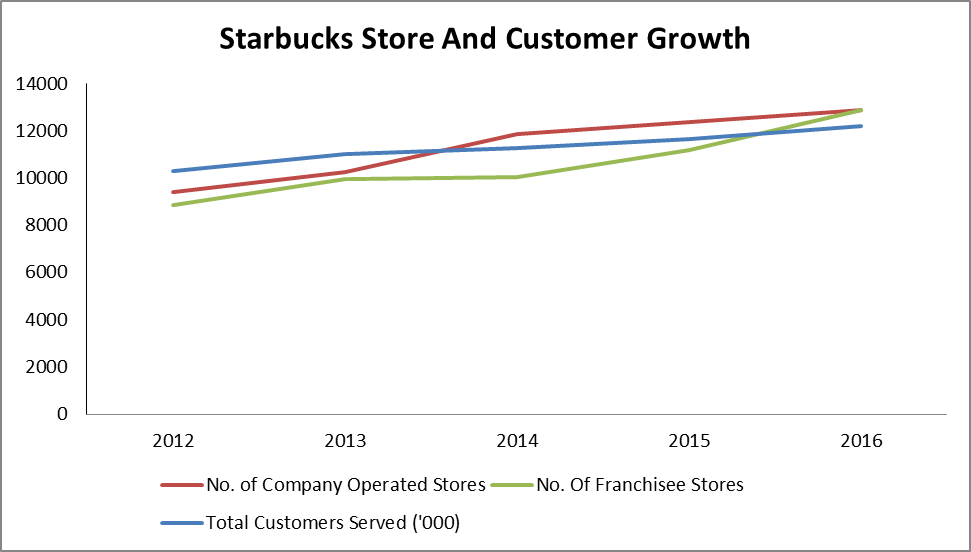

Starbucks (NYSE:SBUX) has been growing its stores aggressively, especially in China. Since 2012, the company has added more than 7,000 stores (both franchisee and company operated stores put together) and had more than 25,000 stores by the end of 2016.

- Down 7% Since 2023, Can Starbucks’ Stock Reverse This Trend Post Q1 Results?

- Down 26% From Its Pre-Inflation Shock High, What Is Next For Starbucks Stock?

- After 6% Drop This Year, Pricing Growth To Bolster Starbucks’ Q4

- Can Starbucks Stock Return To Pre-Inflation Shock Highs?

- Starbucks’ Stock To See Little Movement Past Q3?

- Starbucks Stock To Likely Trade Lower Post Q2

However, the rate of growth of customers served by these stores is much slower compared to the growth in number of restaurants. Between 2012 and 2016, the company registered a nearly 40% increase in the number of its stores. (18,278 stores in 2012 and 25,734 stores in 2016). However the company registered only a 19% increase in the number of customers served between this period. This indicates that the new stores are not able to attract enough customers and the company has not been able to grow its customer base at a pace similar to its store growth. While we expect this growth in stores to continue over our forecast period, we expect a decline in the average number of customers per store per day in the next few years, before this number increases and stabilizes over our forecast period.

Starbucks restaurants were serving around 563 customers on an average per day in 2012 when the company had fewer stores. We do not expect these levels of volumes to return over our forecast period and we expect this metric to be around 484 customers (average per restaurant per day) by the end of our forecast period. However, if the new restaurants are able to exploit their potential and attract new customers, there can be an upside to our price estimate. If the company is able to achieve the 2012 figure of daily customers per restaurant per day (with a significantly higher number of restaurants) by the end of our forecast period, there can be a nearly 10% upside to our price estimate.

Starbucks is now focusing on its gourmet stores (Starbucks Reserves and Roastaries) to drive revenues where the average customer’s spend would be higher. It is also working on innovations in its food menu to entice customers to spend more on food while they are at a Starbucks store. While store growth is driving revenues, the growth in number of customers has slowed down. We believe as the company focuses on higher average spend per customer rather than increasing the number of customers, this strategy can drive growth for Starbucks in the long term.

View Interactive Institutional Research (Powered by Trefis):

Global Large Cap | U.S. Mid & Small Cap | European Large & Mid Cap | More Trefis Research

Like our charts? Embed them in your own posts using the Trefis WordPress Plugin.