Cloud Continues To Boost SAP And Expected To Be At Forefront For Fiscal Year 2019

SAP (NYSE: SAP), the German software giant, announced its fourth quarter and full year results on January 29, 2019. The results were mixed as the company beat revenue estimates for the 4th quarter but fell short on the consensus earnings for the quarter. For the full year the company’s Cloud revenue led the growth with a 32% year on year (YOY) growth and posted €4,993 million. Cloud and Software combined had a growth of 10% YOY, while Cloud and Software (new orders) increased by 14% YOY. Overall Total revenue grew by 5 and operating margin by 10%.

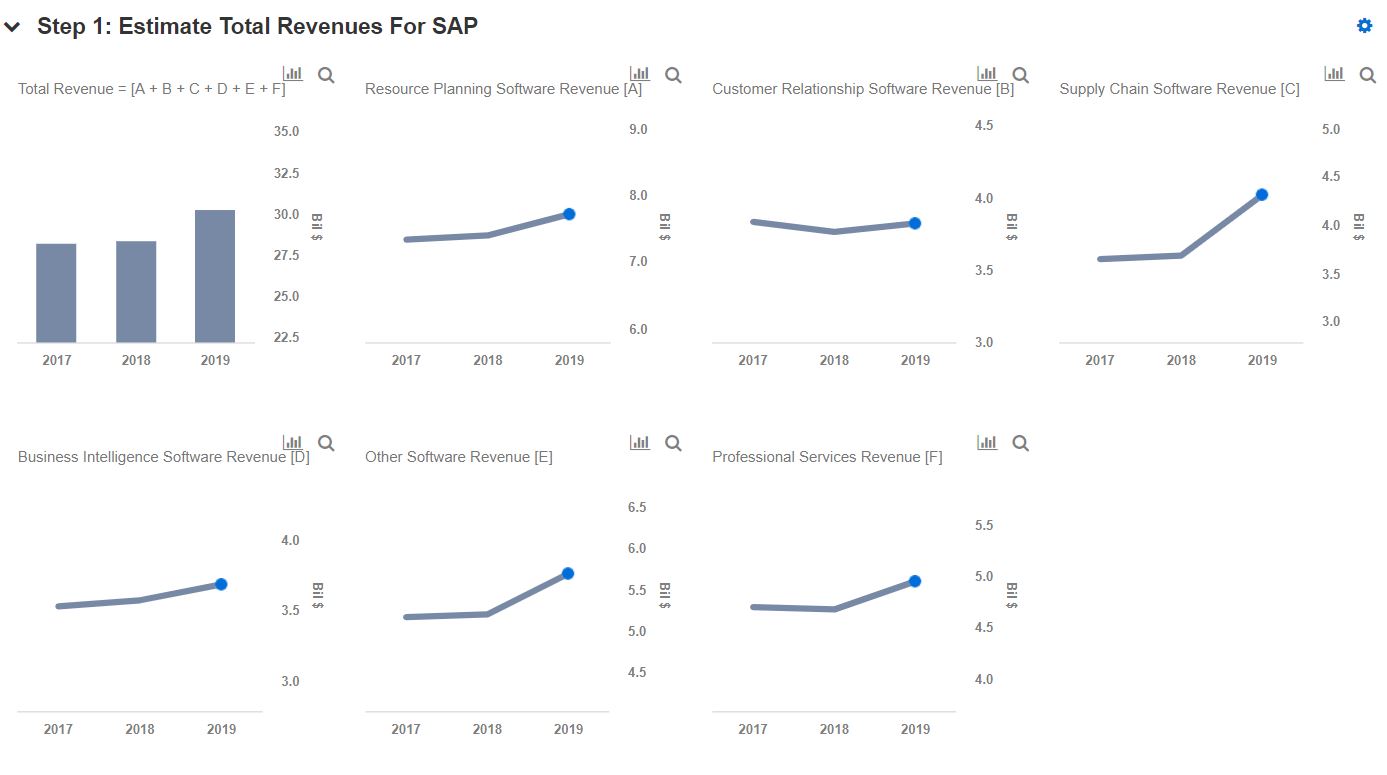

We have a price estimate of $110 for the company. View our interactive dashboard – Our Outlook For SAP In FY 2019– and modify the key assumptions to arrive at your own price estimate for the company.

- Flush With Cash Following Qualtrics Deal, Is SAP Stock A Buy?

- With Enterprise Spending Slowing, Is SAP Stock Still A Good Buy?

- Up 29% Over The Past Month, What’s Next For SAP Stock?

- Where Is SAP Stock Headed Following Q2 Results?

- Forecast Of The Day: SAP’s Cloud Subscriptions And Support Revenue

- SAP’s Q1 Results Were Mixed, But The Stock Still Looks Like A Buy

Key Highlights for Fiscal Year 2018:

SAP is now the fastest growing cloud company by scale in the business software industry with the company already serving more than 180 million cloud users. Further, for the first time ever the cloud backlog has reached €10 million growing at 30% YOY, indicating huge potential. Customers are preferring solutions from C/4HANA to S/4HAaNA, SAP Cloud Platform, Analytics Cloud, and SAP SuccessFactors. The mix to cloud has affected the margin by 120 basis points, but the cloud and software margin in aggregate only declined by 90 basis points.

SAP is also moving towards being a sustainable and energy efficient company as it continues to reduce its carbon footprint. For the Fiscal year 2018, it grew in size by 10% but the carbon footprint was reduced by 5%.

Fiscal Year 2019 Outlook:

The company is expected to continue the strong momentum for the next Fiscal year and is targeting an increase in Cloud revenue segment by around 33-39%, while the cloud and software revenue combined is expected to grow by 8.5%-10%. The acquisition of Qualtrics recently will help achieve these targets. The Operating profit is also expected to grow by 7.5-11.5%. The company sees cloud as its main driving factor and targets Cloud revenue to be 3x times by 2023 with overall revenue to reach €35 billion.

The company has also announced a restructuring program to simplify structures and processes and to ensure adequate resource allocation. The company is expected to reach a headcount of more than 100,000 by the end of the Fiscal year 2019.

What’s behind Trefis? See How it’s Powering New Collaboration and What-Ifs

For CFOs and Finance Teams | Product, R&D, and Marketing Teams

Like our charts? Explore example interactive dashboards and create your own.