Cloud Business Continues To Boost SAP’s 3Q’18 Earnings; Raises Outlook For 2018

SAP (NYSE: SAP), the German software giant, reported another quarter of strong financial results last week driven by the solid growth in its cloud business. The company witnessed triple digit growth in its C/4 HANA and S/4 HANA platforms, which drove its cloud revenue. Its cloud gross margins also improved notably, driven by strong top-line growth and higher operational efficiency. This enabled the company to revise its 2018 outlook for the third time since the beginning of the year. Based on the fast adoption of its cloud platform, we expect SAP’s cloud business to continue to drive its value in the near term as well as long term.

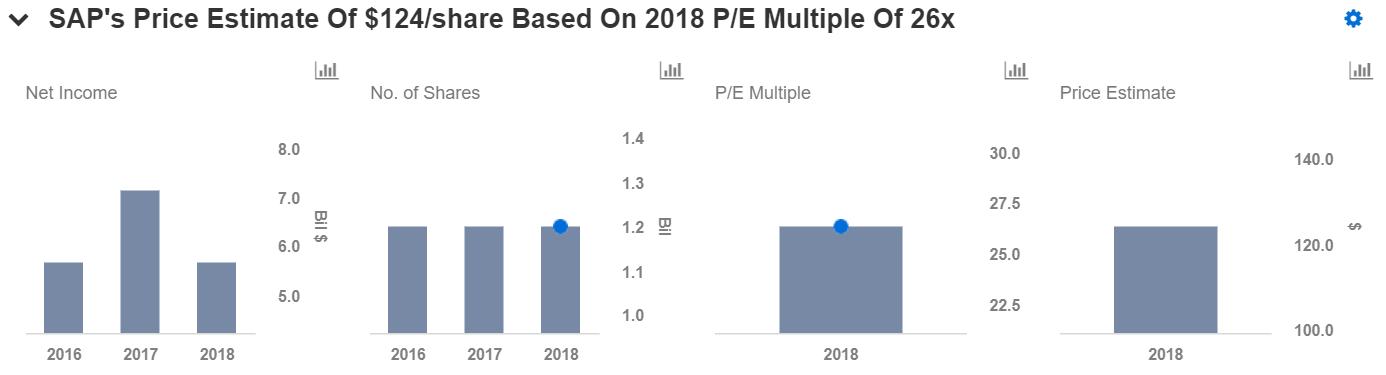

We currently have a price estimate of $124 per share for SAP, which is higher than its market price. View our interactive dashboard – SAP’s Price Estimate and modify the revenue and earnings to visualize the impact of any changes on the company’s valuation.

- Flush With Cash Following Qualtrics Deal, Is SAP Stock A Buy?

- With Enterprise Spending Slowing, Is SAP Stock Still A Good Buy?

- Up 29% Over The Past Month, What’s Next For SAP Stock?

- Where Is SAP Stock Headed Following Q2 Results?

- Forecast Of The Day: SAP’s Cloud Subscriptions And Support Revenue

- SAP’s Q1 Results Were Mixed, But The Stock Still Looks Like A Buy

Key Takeaways From SAP’s 3Q’18 Results

- SAP recorded a 41% growth in its cloud revenue, driven by triple digit growth in high growth, high potential cloud solutions, like S/4 HANA cloud and C/4 HANA. In addition, the company saw strong performance from its pay-as-you-go businesses, such as Rebar, Concur, and Fieldglass, as well as its digital platform, which further bolstered its cloud revenue. The company has more than 170 million cloud users and its cloud revenue has superseded its on premise license revenue due to robust adoption of its cloud solutions.

- Further, SAP’s license business remained resilient even as the company continues to grow its cloud business. Support revenue grew by 6% driven by strong renewals, indicating the stickiness of the company’s support services with its customers. The combined cloud and software revenue grew by 10% in the quarter.

- On the profitability front, SAP’s cloud gross margin expanded by 3 percentage points to 64%, while the SaaS and PaaS gross margin increased by 4 percentage points to 60%. As the company continues to invest in its Converged Cloud Infrastructure, and migrate to its cloud-based solutions, it expects to witness further margin expansions over the course of 2019.

- With a strong top-line growth, cloud gross margin improvement, and operational discipline, SAP reported an 11% jump in its operating profit during the quarter. Consequently, the company’s operating margin rose by 10 basis points during the quarter, despite headwinds from the Callidus acquisition and higher personnel cost.

Going Forward

- Driven by the strong adoption of its cloud business, SAP has raised the 2018 outlook for the third time this year. The company expects its Non-IFRS cloud and software revenue to be in a range of €21.15-€21.35 billion, up from the previous range of €21.02-€21.25 billion.

- Further, the company now expects its Non-IFRS total revenue to be in a range of €25.2-€25.5 billion, higher than its previous guidance of €24.975-€25.300 billion at constant currencies.

- Also, SAP anticipates its Non-IFRS operating profit to come in at €7.425-€7.525 billion, up from its previous guidance range of €7.4-€7.5 billion at constant currencies.

- In order to build on its growth momentum, SAP recently launched the Open Data Initiative with Microsoft and Adobe to provide more choices to customers by standardizing the data model for customer experience. Further, the company expanded its partnership with Alibaba to help customers in China to transition to the cloud. These partnerships will enable the company to expand its customer base and boost its top-line growth in the long term.

- SAP’s HANA data management, end-to-end cloud applications, and business networks will allow it to continue to capture market share in the business intelligence space and maintain its leadership position in the industry.

Disagree with our forecasts? Create your own price estimate for SAP by changing the base inputs (blue dots) on our interactive dashboard.

What’s behind Trefis? See How It’s Powering New Collaboration and What-Ifs

For CFOs and Finance Teams | Product, R&D, and Marketing Teams

Like our charts? Explore example interactive dashboards and create your own.