Will Sprint’s Aggressive Promos Help Its Q1 Results?

Sprint (NYSE:S) is expected to publish its Q1 FY’18 results on Wednesday, August 1, reporting on a quarter that saw the company announce that it would merge with larger rival T-Mobile. Here’s a quick rundown of what to expect when the company publishes earnings Wednesday.

We have created an interactive dashboard analysis that outlines our expectations for Sprint over FY 2018 and FY 2019 (Fiscal years end in March). You can modify the key drivers to arrive at your own revenue and EPS estimates for Sprint.

Will Subscriber Adds Face Pressure?

- Sprint’s Stock Looks Expensive Compared To AT&T After Rising 93% In 2 Months!

- Sprint’s Stock Price Doubled In 15 Days; Is Market Overvaluing Sprint Just Before Its Merger With T-Mobile?

- Where Is Sprint Corp Spending Most Of Its Money?

- Machine Learning Answers: Sprint Stock Is Down 15% Over The Last Quarter, What Are The Chances It’ll Rebound?

- Sprint Valuation: Fairly Priced

- How Does Sprint Make Money?

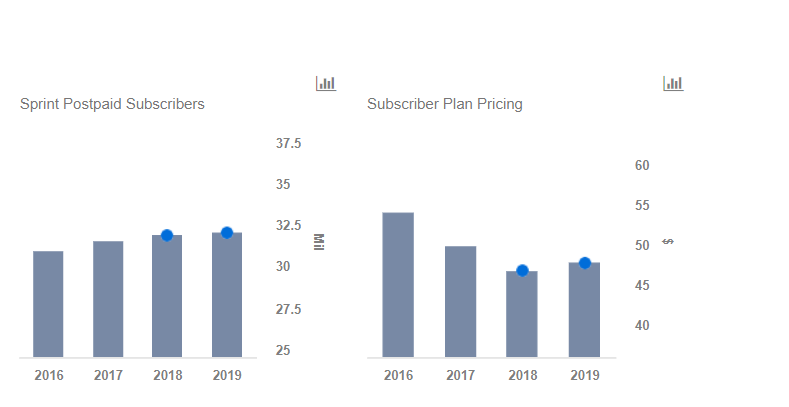

Over Q4 FY’17, Sprint added 55k net postpaid phone subscribers, marking its 11th straight quarter of postpaid phone net additions. However, the metric was down from about 184k net adds in Q3, amid more intense competition from AT&T and Verizon, who have improved their subscriber adds in recent quarters. That said, Sprint has been offering attractive equipment promos and service plans, and it’s possible that this could help the company’s postpaid phone net adds for the quarter. On the prepaid front, Sprint has also been looking to shore up its business, by focusing on higher-value brands such as Boost and Virgin while de-emphasizing lower value plans. We will be looking for updates on how this business is faring.

The U.S. wireless market saw improved pricing trends over June, as major carriers scaled back on promotional activity. The BLS reported that the consumer price index for wireless phone services rose by 0.3% year-over-year in June, marking the first increase since July 2016. While Sprint has marginally increased pricing on some plans in recent months, indicating that further price hikes could be in the offing, the carrier still offered some aggressive promos over the first quarter. For instance, Sprint ran a limited time promotion that offered customers who switch from other carriers an unlimited plan priced at just $15 a line – well below the company’s standard $60 plan.

What’s behind Trefis? See How It’s Powering New Collaboration and What-Ifs

For CFOs and Finance Teams | Product, R&D, and Marketing Teams

Like our charts? Explore example interactive dashboards and create your own.