Can Amazon And Comcast Really Eat Roku’s Lunch?

Roku (NASDAQ: ROKU) stock has seen a correction over the last few weeks, falling from around $151 at the end of August to around $100 currently. The sell-off has been driven by multiple factors including Comcast’s recent decision to offer its Xfinity Flex TV device for free to broadband customers, Amazon’s recent report of strong Fire TV streaming growth this year, and a bearish analyst report assigning a $60 price target for Roku. However, we believe a selloff could be overdone, considering that Roku’s core metrics have been improving in recent quarters.

View our interactive dashboard analysis on Can Roku Hold Its Own As Amazon & Comcast Double Down On Streaming Hardware?

- Down 37% This Year, Will Roku Stock Recover Following Q1 Results?

- Roku Stock Gained 56% Over The Last Three Months, Will It Rise Further Following Q4 Results?

- Up 40% Over The Last Week, Will Roku Stock Continue Its Strong Run?

- Roku Stock Up 50% This Year, Will It Rise Further Following Q3 Results?

- Will Cost Cuts, Improving Growth Continue To Power The Roku Stock Rally?

- Is Roku Stock A Buy Following Strong Q2 Results?

Amazon’s Fire TV user base appears to be growing faster than Roku’s, but Amazon likely falls behind in terms of monetization and in the Smart TV space

- Amazon’s FireTV is growing faster than Roku, with total active accounts standing at 37 million in September 2019, up from 30 million reported in January.

- In comparison, Roku’s active user base expanded from 27 million in December 2018 to 30.5 million in June 2019.

- While Amazon is aggressively marketing the device, with prices for the basic model falling to levels of as low as $15 with promotions, it is unlikely to be as successful with monetization (advertising etc).

- Moreover, Amazon remains weak in the smart TV space, with its FireTV OS present in less than 5% of smart TVs sold in the U.S. in Q1, versus over 30% for Roku.

Comcast threat may be overstated as most subscribers likely have streaming boxes already

- While Comcast’s move to offer its streaming hardware free of cost to its Internet users (about 28 million subscribers in total) is interesting, we believe the risks it poses to Roku may be exaggerated.

- It’s likely that a bulk of Comcast broadband users already have existing streaming hardware, with the Xfinity box unlikely to offer enough to make them switch.

- Moreover, there are some complexities with the new hardware, as users of premium channels apparently need to cancel and resubscribe to premium channels.

Roku’s strong position in Connected TV space could give it an edge, with lower subscriber churn

- Roku licenses its OS to smart TV manufacturers and this business is gaining traction, with over a third of smart TVs sold in North America over Q1 2019 being Roku powered. In comparison, Samsung’ Tizen has a ~20% share, with Amazon being a late entrant into the space, holding under a 5% share.

- The smart TV route might be a more efficient means of platform customer acquisition for Roku, as it only needs to license its OS to manufacturers.

- Smart TV-based Roku platform users could also be more loyal, as TV sets cost several hundreds of dollars and have long replacement cycles (7 to 10 years per IHS Markit).

- In comparison, switching costs for streaming hardware such as Roku and Amazon Fire Stick is likely to be low, considering its low price points ($30 onward).

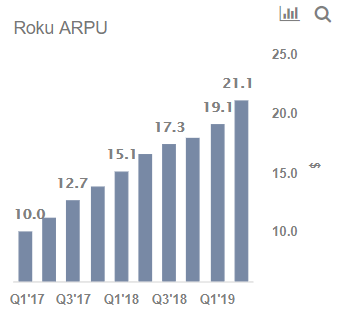

Roku is seeing increasing engagement while monetizing its user base

- Roku has been seeing increasing engagement, with the number of hours streamed per account rising from 2.5 hours in early 2017 to close to 3.5 hours currently.

- Annual ARPUs (TTM) stood at $21 in Q2 2019, up from levels of around $11 two years ago.

- The improvement is driven by higher advertising as well as higher transaction fees for content and subscription purchases on the Roku platform.

Conclusion

- While Amazon’s strong growth in the streaming space and Comcast’s move to offer its streaming hardware for free are something Roku investors should take note of, we believe that Roku does have some crucial advantages.

- The company’s intuitive software UI, its strong presence in the streaming TV market, and improving core engagement metrics should allow it to hold its own in the streaming platform space.

What’s behind Trefis? See How it’s Powering New Collaboration and What-Ifs

For CFOs and Finance Teams | Product, R&D, and Marketing Teams

Like our charts? Explore example interactive dashboards and create your own.