Rio Tinto’s 2017 Production Review: Iron Ore Output Is Expected to Remain Steady in the Upcoming Year

Rio Tinto (NYSE:RIO), the world’s second largest iron ore producer, released its full year production review on January 16. The company reported a stagnant year-over-year growth in iron ore shipments from its Pilbara mines in Western Australia in 2017, which is relatively modest compared to the growth seen over the previous three years.

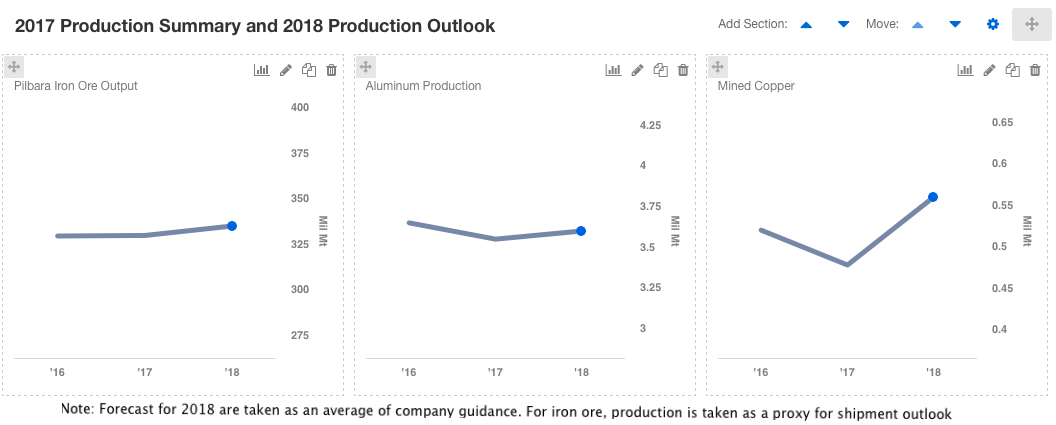

The chart below summarizes the production figures for the major commodities produced by Rio Tinto coupled with the company’s production forecast for the upcoming year. Rio’s iron ore shipment in 2018 is expected to grow by 3% at most, in an optimistic scenario. Keeping iron ore production within the current levels reiterates Rio’s focus on “value over volume.”

- Is Rio Tinto Stock Attractive At $62

- Down 9% This Year, What’s Next For Rio Tinto Stock?

- After Tough 2022 Results, What’s Next For Rio Stock?

- Is Rio Tinto Stock Still Good Value Following The Recent Iron Ore Rally?

- With Iron Ore Prices Under Pressure, What’s Next For Rio Stock?

- With Iron Ore Prices Volatile, Is Rio Tinto Stock Worth A Look?

China, the world’s largest iron ore consumer is expected to experience a stagnated demand for steel in 2018 as per the latest data released by the World Steel Association (WSA). In such a context, it seems accurate for Rio to not display a significant rise in its production volume in the upcoming year. Rio will continue to realize higher prices for its premium grade iron ore as China’s fight against pollution continues.

We have created an interactive model that details Rio’s changes in production volume for its major commodities. Rio will release its Q4 and full year financials on February 7 which will provide us a deeper insight into its operational performance for 2017.

We have a $47 price estimate for Rio Tinto, which is below the market price.

Have more questions about Rio Tinto? See the links below.

- How Rio’s Access to High Grade Iron Ore Would Remain Advantageous to the Company in Q4

- Why Rio’s Interest in SQM Makes Sense

Notes: