How Much Can Roche’s Share Price Grow If Ocrevus Doubles Its Share In Multiple Sclerosis Market?

Roche Holding’s (NASDAQ:RHHBY) Ocrevus has been on a stellar run with sales exceeding $2.4 billion in 2018, reflecting a growth of 2.8x over the prior year. This can be attributed to its high efficacy and modest pricing. The drug’s peak sales are estimated to be north of $4 billion. The drug is estimated to have a 13% share in the global multiple sclerosis market, based on its 2018 sales. In this note we discuss the potential upside to Roche’s earnings and share price if Ocrevus were to double its share by 2025. We have created an interactive dashboard analysis ~ What’s The Upside For Roche If Ocrevus Doubles Its Share of The Global Multiple Sclerosis Market By 2025? You can adjust various drivers to see the impact on the company’s earnings, and price estimate, based on Ocrevus sales. Also, here’s more Healthcare Data.

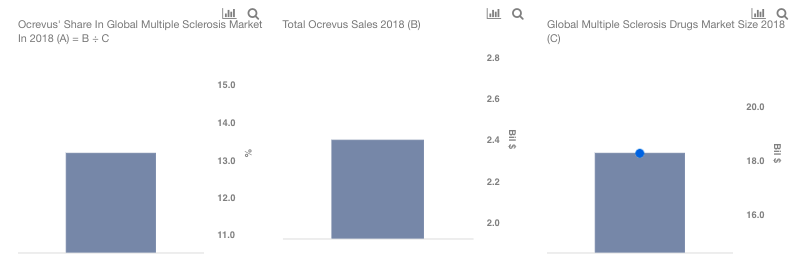

Ocrevus’ Current Market Share ~ 13%

Ocrevus’ current market share of 13% is derived from its reported sales of $2.4 billion (CHF 2.35 billion), and an estimated global multiple sclerosis market size of a little over $18 billion in 2018. Ocrevus is used for the treatment of relapsing and primary progressive forms of multiple sclerosis, which is a nervous system disease that affects brain and spinal cord.

Global Multiple Sclerosis Market Size Is Estimated To Grow In Mid-Single-Digits

The global multiple sclerosis market is estimated to grow at a CAGR of 6.3% to $28 billion by 2025. This growth will likely be led by rising prevalence of multiple sclerosis. It is estimated that over 2.3 million people worldwide are affected by multiple sclerosis, and it is one of the most common causes of neurological disability in young adults.

If Ocrevus manages to double its market share by 2025, it will result in sales of over $7 billion, which appears to be very high, and above the peak sales estimate of $4 billion. Having said that, Ocrevus has several advantages over other drugs in the market. Most importantly, its modest pricing of $65,000 per year compares with an $80,000 to $90,000 range for Novartis’ Gilenya, Teva’s Copaxone, Biogen’s Tecfidera and Avonex, among others. Apart from pricing, Ocrevus is the first drug to be approved for the treatment of both relapsing, as well as primary, progressive forms of multiple sclerosis. It also offers significant dosing advantage. For instance, Tecfidera, and Gilenya are dosed between one and three times daily, while Ocrevus is dosed just once every 6 months. Given these factors, Ocrevus will likely see continued strong growth in the coming years, and garner higher share in the global multiple sclerosis market.

How Does Ocrevus’ Market Share Gains Impact Roche’s Earnings & Price Estimate?

If Ocrevus manages to double its share in the multiple sclerosis market, it will result in $0.27 incremental earnings on an adjusted basis. We use 26.3% adjusted net income margin, similar to that for overall Roche in calculating the EPS impact. We use a price to earnings multiple of 16x to arrive at a $4 impact on Roche’s share price, or 13% of its current market price of $34.

What’s behind Trefis? See How it’s Powering New Collaboration and What-Ifs

For CFOs and Finance Teams | Product, R&D, and Marketing Teams

Like our charts? Explore example interactive dashboards and create your own.