Shell’s Robust Project Portfolio To Contribute To Its Value In The Short Term

The commodity downturn that began in mid-2014 has uprooted the fundamentals of the commodity markets, leaving the oil and gas players wary of the future of the industry. However, unlike the smaller oil and gas producers, large integrated energy companies such as Royal Dutch Shell (NYSE:RDS.A) have figured out a way to survive in the volatile commodity markets. On the one hand, these companies have lowered their break-even price of production in order to sustain their profitability and returns, while on the other hand, they are investing in new, yet high-margin projects, that will allow them to leverage the recovery in the markets in the coming years. In this note, we discuss Shell’s robust portfolio of projects, which is expected to contribute significantly to its cash flows and valuation in the next few years. We have a price estimate of $63 per share for Shell, which is in line with its current market price.

See Our Complete Analysis On Royal Dutch Shell Here

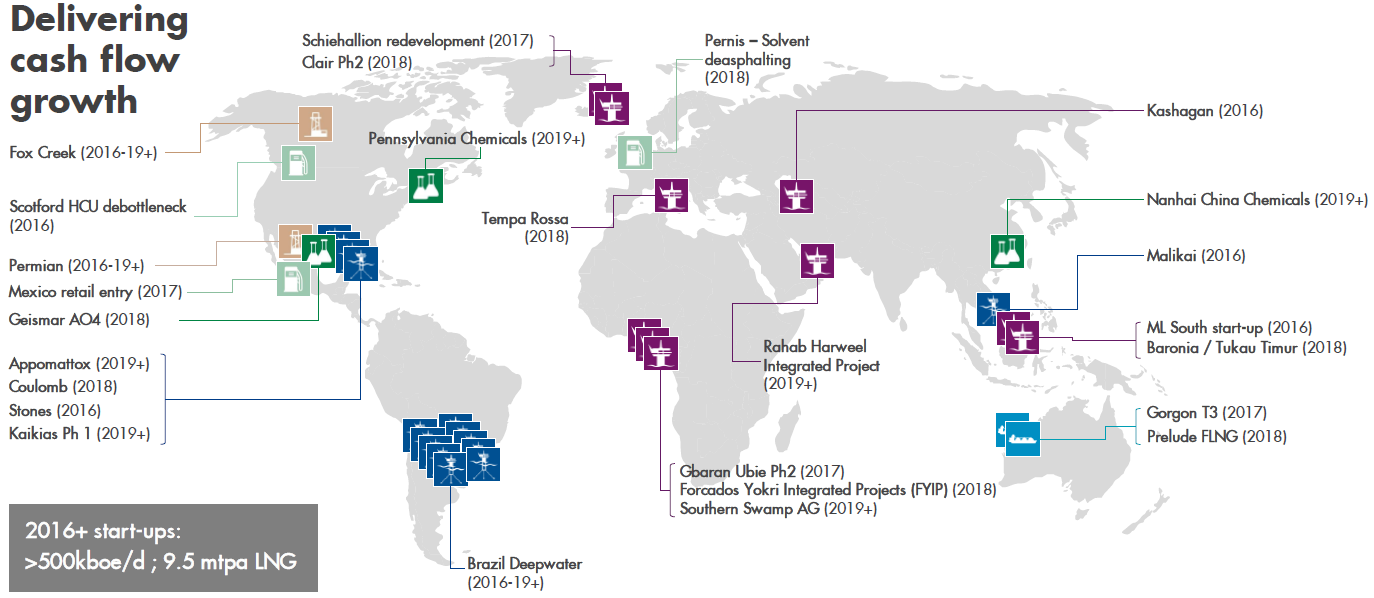

As part of its strategy to reshape itself, Shell has invested in a number of upstream projects over the last few years across business lines to ramp up its production and improve its profitability by taking advantage of the rising demand for various sources of energy. The company expects this wave of new projects to deliver an additional 1 million barrels of oil equivalent a day (boed) production capacity by 2018. Also, the company believes that the economics of these projects are much superior to its existing projects, and hence, estimates these projects to contribute roughly $10 billion in cash flows by 2018, assuming oil prices stay around $60 per barrel.

So far, Shell has successfully delivered 11 major projects since early 2016, adding 500,000 boed of average production to its existing capacity. Some of the projects that have recently come online include Stones deep-water oil and gas project in the Gulf of Mexico (GOM), the Kashagan field in Kazakhstan, and Queensland Curtis Liquefied Natural Gas (QCLNG) plant in Australia. Based on the company’s estimates, the current return on average capital employed (ROACE) on these projects is around 5%, generating about $5 billion in cash flows. However, the ramp of these projects, coupled with the start-up of newer projects, will cause the company’s cash flows to rise to $10 billion in 2018, and its ROACE to increase to 10% by 2020, at $60 per barrel oil prices.

In terms of the remaining projects, Shell has highlighted that it is on track to deliver its 1 million boed capacity by 2018. In fact, the company has already reached significant milestones for some of its upcoming projects such as the arrival of the Appomattox hull to Texas, and the start-up of production at Gbaran Ubie phase 2 in Nigeria and the Libra extended well test FPSO in Brazil. Some of the other major projects that are currently under construction include Clair Phase 2, Tempa Rossa and Kaikias, Pennsylvania petrochemical complex, Prelude Floating LNG facility, and the Nanhai expansion. In addition, there are a number of potential FIDs that are in the pipeline. These include Vito, Libra post 1st FPSO in Brazil deep water, Bonga South West, LNG Canada, and Lake Charles.

Based on our estimates, we expect Shell’s new projects to contribute notably to its upstream production in the remaining years of this decade. Accordingly, the company’s profits for its upstream operations are likely to improve significantly. You can create your own scenarios about Shell’s production and profits using our interactive platform.

View Interactive Institutional Research (Powered by Trefis):

Global Large Cap | U.S. Mid & Small Cap | European Large & Mid Cap