Can Philip Morris Manage To Surprise Markets With An Earnings Beat For 2019?

Philip Morris (NYSE: PM) is slated to release its Q4 and full-year 2019 results on February 6, 2020. Trefis details expectations from the company in an interactive dashboard, parts of which are highlighted below. We believe that Philip Morris’ revenue and earnings are expected to beat consensus marginally, resulting in its stock price rising post earnings release. We expect Philip Morris to report revenue of $30 billion (vs. consensus estimate of $29.9 billion), which would be 1.4% higher than 2018, primarily due to strong growth in the heated tobacco segment, partially offset by lower cigarette volume sold. Earnings are expected to come in at $5.21 (vs. consensus estimate of $5.20), which would be 2.5% higher than $5.09 reported in 2018, due to higher revenue, with expenses increasing at a lower rate, thus pushing net income margin higher. We believe that marginally stronger-than-expected revenue and earnings for 2019 will likely result in Philip Morris’ stock price rising once earnings are announced. In fact, our forecast indicates that Philip Morris Valuation is $93 a share, which is roughly 12% above its current market price of $83.

A] Revenue To Marginally Beat Consensus

- Total revenues have increased at a CAGR of 5.4% over the previous two reported years, with the company adding over $2.9 billion to its revenue base between 2016 and 2018.

- Trefis estimates Philip Morris’ revenues to be $30 billion in 2019, marking a y-o-y growth of 1.4%.

- Cigarette shipments have been declining over recent years, due to changing consumer preferences as more people are moving toward non-combustible offerings. Combustible products’ revenue is expected to decrease in the next two years due to lower volume, partially offset by price increase to mitigate the effect of lower shipments. Revenue is projected to decrease from $25.5 billion in 2018 to $24.8 billion in 2019 and to $24.5 billion in 2020.

- Heated products segment revenues are expected to see a healthy increase from $4.1 billion in 2018 to $5.2 billion in 2019 and further to $6.6 billion by 2020, driven by rising volume and gradual phasing out of discounts and promotional offers. Philip Morris’ rising market share for its heated product segment in the EU region, Japan, and Russia could drive its segment revenue growth in the medium-term. The FDA’s approval for marketing and sale of IQOS (PM’s flagship heated tobacco product) in the US is likely to boost segment revenues, as PM could now cater to the vast US market which is currently being dominated by JUUL.

In our interactive dashboard – Philip Morris Revenues: How Does Philip Morris Make Money? – we detail the trend in Philip Morris’ revenues and how each segment is performing, along with the outlook for 2019 and 2020.

- Should You Pick Philip Morris Stock After 7% Fall This Year And Q4 Miss?

- Will Philip Morris Stock Rebound After A 10% Fall This Year?

- After 8% Drop This Year, Pricing Growth To Bolster Philip Morris’ Q3

- Pricing Gains To Drive Philip Morris’ Q2?

- Does Philip Morris Stock Have Upside Potential To Its Pre-Inflation Peak?

- Here’s What To Expect From Philip Morris’ Q1

B] EPS To Beat Consensus

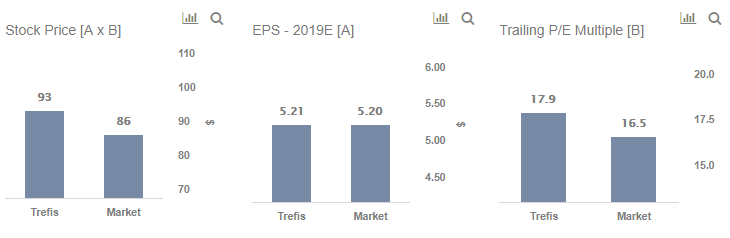

- Philip Morris’ 2019 earnings per share (EPS) is expected to be $5.21 per Trefis analysis, slightly ahead of the consensus estimate of $5.20 per share.

- An increase in revenue as detailed above, coupled with steady share count will drive EPS growth on a y-o-y basis.

- As we forecast Philip Morris’ Revenues to grow at a faster rate than Expenses in 2019 (1.4% vs. 0.9%), this will result in a slight increase in Philip Morris’ Net Income Margin figure from 26.7% in 2018 to 27% in 2019.

- For 2020, we forecast a modest rise in revenue as well as expense growth rates. However, with revenue growth still expected to remain slightly higher than expense growth rate, the net income margin is likely to rise marginally to 28%.

View our interactive dashboard How Does Philip Morris Spend Its Money? to understand the company’s key expense trends

C] Stock Price Estimate Higher Than Market Price

- A trailing P/E multiple of 17.9x looks appropriate for Philip Morris’ stock, as opposed to the current implied P/E multiple of 16.6x.

- Trefis’ forecast for Philip Morris’ 2019 earnings and P/E multiple is higher than consensus, working out to a fair value of $93 for Philip Morris’ stock, as opposed to the current market price of around $83.

Additionally, you can input your estimates for Philip Morris’ key metrics in our interactive dashboard on Philip Morris’ pre-earnings, and see how that will affect the company’s stock price.

See all Trefis Price Estimates and Download Trefis Data here

What’s behind Trefis? See How It’s Powering New Collaboration and What-Ifs For CFOs and Finance Teams | Product, R&D, and Marketing Teams