Currency Headwinds Result In Another Weak Quarter For Philip Morris

Currency has been a big headwind for Philip Morris International (NYSE:PM) in recent years, and continues to play a dampener on the company’s results. Its earnings came in at $1.14 per share, down by a penny over the corresponding prior year quarter, missing estimates by 9 cents. The revenues were up year-on-year, but this metric also missed the consensus expectations.

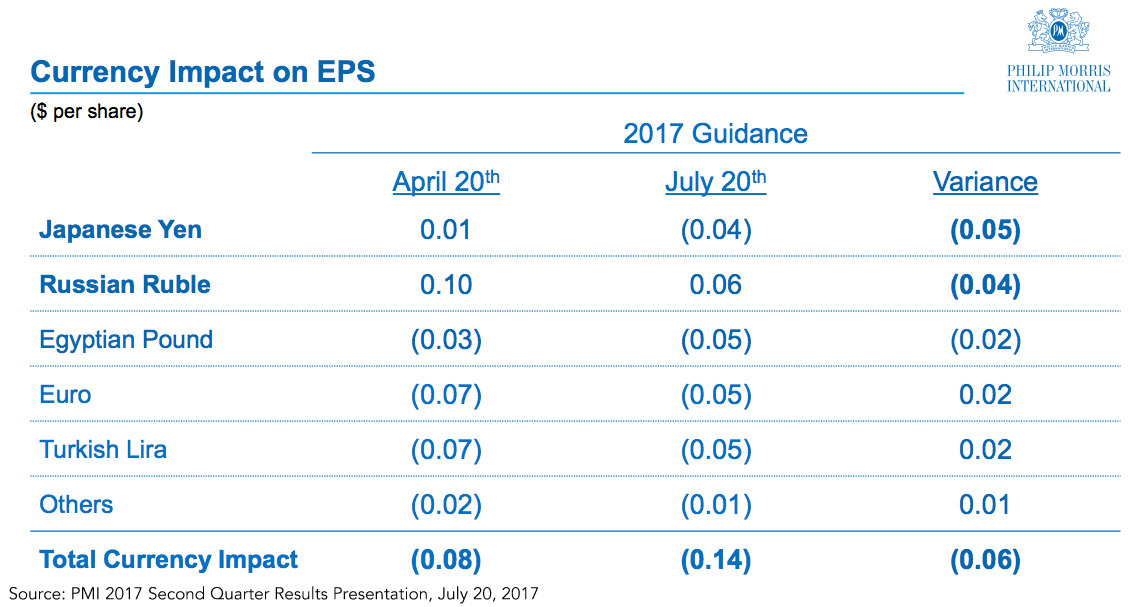

Negative Foreign Currency Impact

- If the foreign currency impact is discounted, the revenues would be up by 7%, while its EPS would be higher by an impressive 8.7%.

- A higher than expected unfavorable currency impact has also forced the company to lower its EPS guidance for the year, to a range between $4.78 and $4.93, as against $4.84 and $4.99 earlier.

- The negative impact is estimated to be $0.14, instead of $0.06 expected earlier.

- Price increases and the strong growth of iQOS have resulted in improved revenues for the company this time around.

- Should You Pick Philip Morris Stock After 7% Fall This Year And Q4 Miss?

- Will Philip Morris Stock Rebound After A 10% Fall This Year?

- After 8% Drop This Year, Pricing Growth To Bolster Philip Morris’ Q3

- Pricing Gains To Drive Philip Morris’ Q2?

- Does Philip Morris Stock Have Upside Potential To Its Pre-Inflation Peak?

- Here’s What To Expect From Philip Morris’ Q1

iQOS Continues Its Strong Sequential Growth

- The company’s reduced risk portfolio (RRPs) recorded net revenues of $615 million, 8.9% of the total revenue.

- iQOS contributes to 22% of this revenue. However, its margins continue to remain negative as a result of the introductory discounts offered to accelerate switching among adult consumers.

- In Japan, the brand’s shipment increased by 37% on a sequential basis, to reach 5.7 billion units. The weekly offtake share also trended upwards by 3.1 points, to 12.7% nationally.

- iQOS has now been launched in key cities in 27 markets globally, following city launches in Korea in May and the Czech Republic earlier this month. By the end of the year, the company is targeting the product to be present in 30 to 35 markets globally, subject to capacity.

- However, this product’s negative margins have pressured the margins of the company, which fell on a year-on-year basis.

Cigarette Volume Declines Continue

- The company recorded a sequential improvement in the total volume (cigarettes and heated tobacco units) decline.

- For the full year, the company anticipates a 3% to 4% fall in the total shipment volume.

- This implies further expected sequential improvement in the third and fourth quarter of 2017.

See Our Complete Analysis For Philip Morris International

Have more questions on Philip Morris? See the links below:

- Philip Morris: Focusing On A Smoke-Free Future

- Strong Demand For Smokeless Tobacco In Japan

- iQOS- A Product Of Innovation Or Necessity For Philip Morris?

Notes:

2) Figures mentioned are approximate values to help our readers remember the key concepts more