How Will Pandora Perform In Q1?

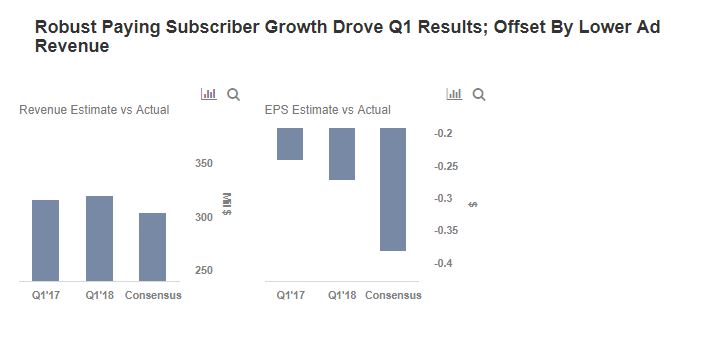

Pandora (NASDAQ: P) is expected to publish its Q1 2018 results on May 3, reporting on what is likely to be a fairly sluggish quarter. Consensus market estimates call for the company to report revenue of $304 million and a loss of 38 cents per share on an adjusted basis. Advertising revenue contributes nearly 75% of its overall revenue, and the company has seen its active monthly users and total listener hours decline steadily over the years. The company expects the advertising headwinds to continue the into the first quarter. As is typical in the industry, Q1 should be the weakest quarter for ad revenue and the metric should improve as the year continues. On the other hand, subscription growth is set to continue with growth in premium subscribers. In addition, any changes to royalty payments should increase expenses for the company, but could limit damages charged in related lawsuits. Further, the organizational redesign should help it to improve margins. Below, we take a look at what to expect when the company reports earnings.

We have a price a $7 price estimate for Pandora, which is higher than the current market price. The charts have been made using our interactive platform. You can click here to modify the different driver assumptions, and gauge their impact on the earnings and price per share metrics.

- Can Pandora End The Year On A Strong Note After Solid Q3?

- Is SiriusXM Paying The Right Price For Pandora?

- How Will Subscriber Growth Drive Pandora In The Second Half Of 2018?

- Can Subscriber Growth Drive Pandora’s Q2?

- Spotify Has Seen A Big Rally, But Still Faces Some Challenges

- How Much Can Pandora Benefit From Snapchat Partnership?

For 2018, Pandora remains optimistic about further expanding its subscriber base driven by including podcast services, more device partnerships, and increased music consumption. In addition, its latest acquisition of AdsWizz – a digital audio ad tech company – which is likely to expand its addressable market, should provide decent medium-term growth opportunities and boost its advertising revenues. We expect the positive outlook for Pandora to continue into 2018, driven primarily by the massive growth opportunity in the digital audio market, smart speakers, and increased consumption of podcasts.

What’s behind Trefis? See How it’s Powering New Collaboration and What-Ifs

For CFOs and Finance Teams | Product, R&D, and Marketing Teams

More Trefis Research

Like our charts? Explore example interactive dashboards and create your own