Can Oracle Continue Surprising The Market In Q3?

Oracle (NYSE:ORCL) will report its fiscal Q3 results on Thursday, March 14. If the company can continue to build on Larry Ellison’s Analyst Day narrative and again beat consensus expectations as it did in Q2, the stock’s valuation could have some upside.

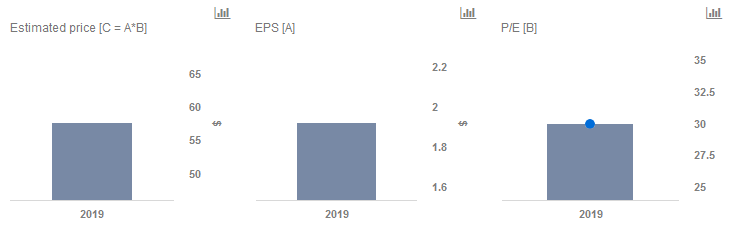

We have a price estimate of $58 per share for Oracle, which is around 10% higher than the current market price. Our interactive dashboard on Oracle’s Price Estimate outlines our forecasts and estimates for the company. You can modify any of the key drivers to visualize the impact of changes on its valuation, and see all of our technology company data here.

In Q2, Oracle registered its seventh consecutive quarter of double-digit EPS growth. In addition to the cloud business, the highlight was the ERP and HCM business having reached annualized revenues of $2.6 billion, representing annual growth of over 20%.

All About The Cloud

During the company’s Analyst Day in October, Larry Ellison stated that if Oracle could move Oracle database and other workloads to the Oracle cloud, it could potentially be a $100 billion opportunity. He also shared expectations that the beginning of this transformative opportunity could come in 2019, without giving specific timelines. In context of the momentum seen by the company (Oracle had seen nearly 200 of its ERP customers move to the cloud in Q2) and the value proposition that customers have been able to achieve, we will be watching closely to see if this opportunity begins to show in the company’s revenue figures.

While we expect to hear about competitive wins, we will also be listening for developments on the case involving Google allegedly having infringed on Oracle’s IP (Java) and specific milestones around when cloud business growth can potentially offset the decline in the legacy businesses.

Do not agree with our forecast? Create your own price forecast for Oracle by changing the base inputs (blue dots) on our interactive dashboard.

Like our charts? Explore example interactive dashboards and create your own.