Oracle Ready To Sail The Cloud Wave As Future Revenues And Margins Look Strong After FY’17 Results

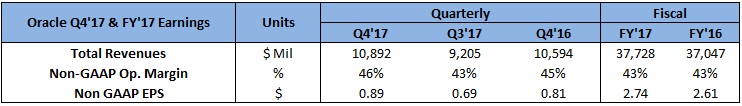

Oracle (NYSE:ORCL) released its Q4’17 and annual FY’17 earnings on June 21, and managed to beat its own earnings guidance and analyst estimates by a comfortable margin of over 10 cents per share. The revenues, too, exceeded the analyst estimates by over $300 million, which led its stock to jump by around 10% after this earnings release.

The reason behind Oracle’s successful quarter and fiscal year was its deals with some of the large enterprises such as AT&T, Netflix, BNP Paribas, Kraft Heinz, and more. The company was able to return to growth in terms of GAAP revenues after 2 years of soft performance. The annual recurring revenue of the company is at an all time high of over $2 billion which is healthy for its future performance. A 69% constant currency rise in the software-as-a-service revenue on an annual basis has resulted in the 14% margin expansion for the division, which has been instrumental in the 6% rise in the non-GAAP EPS.

FY’17 is being termed as the turnaround year for Oracle and the company is likely to experience similar growth in the upcoming year given the fact that transition phase to cloud is in its final stages, and the company is all set to take advantage of its growth phase. Rising margins with the top-line growth will be an added advantage to boost the bottom-line in the future.

See our complete analysis for Oracle

Cloud ERP, PaaS & IaaS Can Be The Leaders In Oracle’s Growth

Oracle is claiming itself to be a leader in the cloud ERP (Enterprise Resource Planning) software market which according to alliedmarketresearch is expected to grow by 7% annually to reach over $40 billion by the end of 2020. Oracle’s SaaS revenues are growing faster than this rate, so it is evident that it is moving in the right direction as far as gaining market share is concerned. Therefore, growth in ERP will play an important factor in Oracle’s future with cloud.

Also, Oracle’s combined PaaS (Platform-as-a-service) and IaaS (Infrastructure-as-a-Service) revenue rose by 42% in Q4. Chairman Larry Ellison is signaling that this segment will grow faster than SaaS in the future, which if this materializes, can become a major source of revenue for the company. He plans to compete directly with Amazon in IaaS and has often claimed that Oracle’s second generation data centers are superior to Amazon’s AWS.

While it will not be appropriate to compare Oracle with its bigger cloud counterparts such Salesforce and Amazon as of yet, but on an individual basis, Oracle has been successful in implementing a slight turnaround in its position in the industry and the above factors can help it to compete head on with these major players in the next few years.

Future Margins Are Looking Strong

On the margins front, SaaS business is on the right track to reach 80% gross margin as guided by the company. So both the revenue and margin growth in this business can boost the EPS growth in the upcoming year. On the other hand, IaaS margin is navigating the declining curve right now, but this is normal as it is undergoing higher expenses and investments in the initial phase. Once it passes this phase, it is likely to return to the margins of over 40% by early in the next decade according to our estimate. Therefore all the factors as of now are indicating toward an overall increase in the future margins which are a positive signal for Oracle’s future EPS growth.

See More at Trefis | View Interactive Institutional Research (Powered by Trefis)