What To Expect As Nokia Publishes Q2 2019 Results?

Nokia (NYSE:NOK) is expected to publish its Q2 2019 results on July 25, reporting on a quarter that likely saw the company’s networking business gain some traction driven by commercial 5G deployments in the United States. In this interactive analysis, we take a look at some of the trends that drove the company’s recent quarterly results and the outlook for Q2.

View our interactive dashboard analysis What To Expect From Nokia’s Q2 2019 Earnings?

How Have Nokia’s Revenues Trended And What’s The Outlook For Q2

- Revenues grew modestly from around EUR 4.9 billion in Q1’18 to about EUR 5 billion in Q1’19.

- We expect revenues to grow to about EUR 5.4 billion by Q2’19

What Are The Key Drivers Of Nokia’s Revenues?

Key Driver 1: Networks

- This segment sells radio access network and related equipment and accounts for over 75% of Nokia’s total revenue.

- Revenue growth remained sluggish during Q1’19 as growth in IP routing was offset by weakness in the mobile and fixed access space.

- Things could improve slightly in Q2, driven by 5G deployments.

- Nokia had 36 commercial 5G wins as of April 2019 and it’s likely that this will be the biggest driver of the company’s results over 2019.

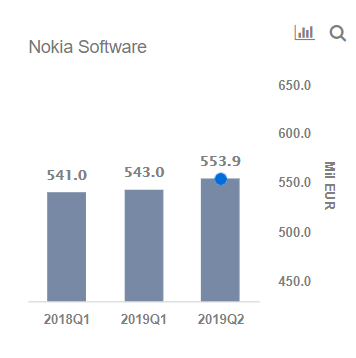

Key Driver 2: Software

- Nokia’s software business accounted for about 11% of revenues in Q1.

- While software revenues remained almost flat YoY in Q1, it’s possible that sales could improve slightly over Q2.

Key Driver 3: Nokia Technologies

- Nokia technologies primarily licenses the company’s intellectual property. The segment accounted for about 7% of total revenues in Q1.

- Revenues could improve slightly over Q2.

Calculating Nokia’s EPS

- We expect Nokia to just about break-even over Q2 2019.

What’s behind Trefis? See How It’s Powering New Collaboration and What-Ifs

For CFOs and Finance Teams| Product, R&D, and Marketing Teams

Like our charts? Explore example interactive dashboards and create your own.