What To Expect From Nike’s 4Q’18 Earnings

Nike (NYSE:NKE) is all set to report its earnings for 4Q 2018 and full year 2018 financial results after the market closes on 28th June. The market expects the company to report a good quarter as well as full year numbers backed by the growing optimism for the company’s growth strategies. Further, the company’s gross margins are likely to expand after a long period due to foreign exchange headwinds, higher direct-to-customer selling, and improved pricing experienced during the quarter. While the Athleisure trend is expected to drive Nike’s growth in the coming years, the rising competition in North America could cause concerns over the company’s target of $50 billion in sales in the next five years.

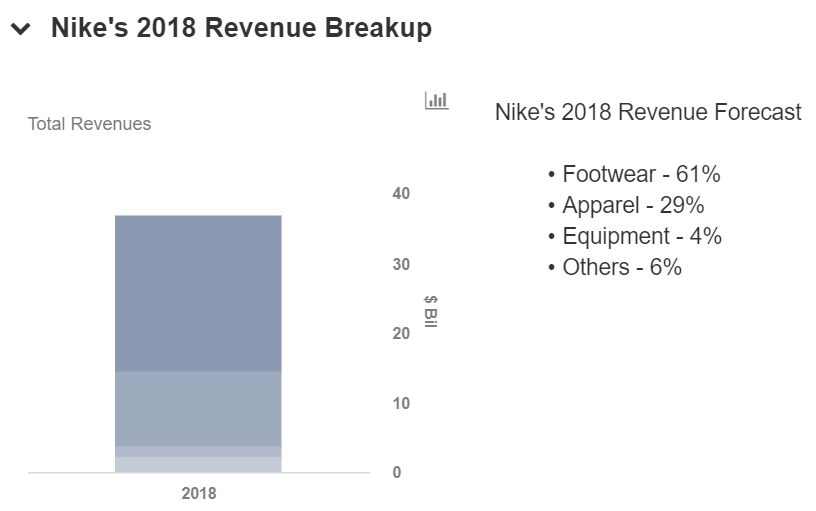

Feel free to create your own forecast for Nike’s 2018 revenue and earnings using our interactive dashboard for Nike’s 2018 performance.

- Down 19% In Last Twelve Months, Will Nike Stock Gain Following Q3 Results?

- Nike Stock Could Rise 70% If It Recovers To Pre-Inflation Shock Highs

- What To Expect From Nike’s Stock Post Q4 Results?

- What To Expect From Nike’s Stock Post Q3 Results?

- Nike’s Stock Down 13% Over Last Year. What’s Next?

- Company Of The Day: Nike

Key Trends To Watch In 4Q’18 Results

- Nike’s 4Q’18 revenue is likely to remain subdued as the company has locked itself into a pricing war with Puma and Adidas in its biggest market – North America. Further, the sustained slump in the saturated US markets could further worsen things for Nike.

- That said, the exceptional growth for Nike’s products in China and Europe is likely to more than offset this decline in revenue. Further, the company’s focus on international and emerging markets will complement its sales for the quarter.

- Additionally, Nike’s top rated running shoes – the Air Max series – and basketball shoes – LeBron 15 – both have received great responses from customers and are likely to drive the company’s results in this quarter. These new and innovative products are expected to witness a surge in demand in the coming quarters as well. Nike has plans to launch more innovative products in order to meet its sales target for the coming years.

- As mentioned earlier, Nike’s gross margins are expected to grow on the back of better foreign exchange rate, higher direct-to-customer selling, and improved average selling price for its products.

- Also, Nike is increasingly shifting its focus toward digital selling. The company believes that a digital ecosystem could allow it to better understand its customer’s needs and provide ease of access to customers. The company believes digital sales will account for almost 30%, up from the current figure of 15%, over the next five years.

Do not agree with our forecast? Create your own forecast for Nike by changing the base inputs (blue dots) on our interactive platform.