Nike: The Calendar Year In Review

Throughout the year, Nike (NYSE:NKE) has managed to beat the consensus revenue and earnings estimates. However, the stock price has tumbled by almost 20% since its August high. The company has recently been struggling with increased competition from a resurgent Adidas and is facing pressure from Under Armour in its basketball division in North America. This has affected Nike’s revenue growth over the last few quarters. Future orders in the year were down year over year. This has greatly affected investor sentiment. All in all, this was not the best year for the leading sportswear manufacturer.

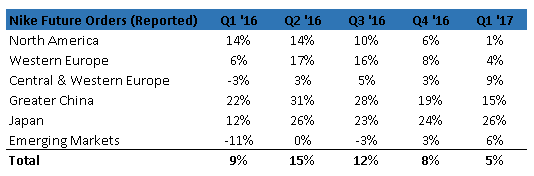

Future Orders Suffered Throughout The Year

Nike’s future orders have come in lower than expected in every quarter this year. The latest quarter witnessed the lowest future orders in the last five quarters. Future orders are a key metric used to gauge sales in the coming quarters; it is directly indicative of the demand for Nike products. To put this into perspective, in 2015, 87% of Nike’s wholesale footwear shipments were made through future orders, as was 67% of Nike’s U.S. wholesale apparel.

- Down 19% In Last Twelve Months, Will Nike Stock Gain Following Q3 Results?

- Nike Stock Could Rise 70% If It Recovers To Pre-Inflation Shock Highs

- What To Expect From Nike’s Stock Post Q4 Results?

- What To Expect From Nike’s Stock Post Q3 Results?

- Nike’s Stock Down 13% Over Last Year. What’s Next?

- Company Of The Day: Nike

In the last quarter, Nike mentioned that it would no longer provide this figure in its earnings releases. This is primarily because it feels that over the recent quarters, the focus has been to sell to the web and in its branded stores, making the metric less relevant than a few years ago.

All said and done, declining future orders is a matter of great concern for the company. Low future orders portray the sentiment of the retailers. Heavy competition from Adidas and Under Armour has put immense pressure on Nike’s sales, leading to a slowing demand for its products.

Nike Lost Out In Footwear

As mentioned previously, Nike dealt with intense competition in the footwear market, primarily from Adidas and Under Armour, throughout the year. In the basketball segment specifically, Under Armour has emerged as a major competitor driven by Stephen Curry’s popularity. The Curry series of basketball shoes has been selling much better in the last few quarters than Nike’s Jordan or LeBron series. This forced the company to release cheaper variants of its KD and LeBron shoes in an effort to regain some of the lost market share, even though this move dented margins.

Adidas has primarily scored with fashion shoes promoted by celebrities such as Kanye West. In June, Adidas expanded its partnership with this artist, who moved to the company from Nike in 2013 due to creative differences. In the first quarter of FY 2017, Adidas managed to post a 31% increase in sales of footwear in North America, driven primarily by its Yeezy designs and retro shoes.

North American Growth Was Led by DTC

Revenues in North America, which accounts for roughly half of the total revenues, grew notably throughout the year. Growth in the region was propelled primarily by DTC (Direct-To-Consumer). In comparison to last year, the company witnessed double-digit traffic increases, higher conversion rates and higher dollars per transaction across brick and mortar stores and nike.com.

Furthermore, Nike invested heavily in reinventing the retail experience and opened new concept stores in the year. In the latest quarter, the sportswear giant opened a massive 55,000 square feet store in New York City’s prime Soho neighborhood. The store has generated considerable buzz and has led to strong traffic growth. The store is a powerful look at the future of retailing. It allows consumers to get product trials with experts, elevated personalized experiences and heightened member engagement, all while seamlessly combining digital and physical retailing.

Nike is opening another such store on Fifth Ave, and it promises to be even bigger and better. Both these moves are bound to help Nike’s brand awareness and brick-and-mortar traffic. The opening of these stores is part of the company’s strategy to focus primarily on its DTC channels.

View Interactive Institutional Research (Powered by Trefis):

Global Large Cap | U.S. Mid & Small Cap | European Large & Mid Cap

More Trefis Research