Nike’s Earnings and Revenues Beat Expectations, Though Orders Were Weak

Nike (NYSE:NKE) recently delivered solid fiscal Q1 2017 earnings, managing to beat revenues and earnings expectations by wide margins. (Fiscal years end with August.) However, its shares fell by close to 3% yesterday over concerns of a lower future orders figure, in fact missing analyst order estimates for the third quarter in a row. The company has recently been struggling with increased competition from a resurgent Adidas and has been seeing pressure from Under Armour in its basketball division in North America. This has affected Nike’s sale growth over the last few quarters.

That said, revenues were higher year on year, fueled by the Olympics hype and higher-than-expected earnings per share were driven by operating leverage, a lower effective tax rate and a lower average share count (Nike repurchased 19 million shares in the quarter).

The company expects Q2 sales to fall short of initial expectations, with growth coming in around the mid single-digit range. That said, management expects Q3 and Q4 to see high single-digit growth in sales.

- Down 19% In Last Twelve Months, Will Nike Stock Gain Following Q3 Results?

- Nike Stock Could Rise 70% If It Recovers To Pre-Inflation Shock Highs

- What To Expect From Nike’s Stock Post Q4 Results?

- What To Expect From Nike’s Stock Post Q3 Results?

- Nike’s Stock Down 13% Over Last Year. What’s Next?

- Company Of The Day: Nike

Nike Continues To Lose Out In Footwear

As mentioned previously, Nike has been dealing with intense competition in the footwear market, primarily from Adidas and Under Armour. In the basketball segment specifically, Under Armour has emerged as a major competitor driven by Stephen Curry’s popularity. The Curry series of basketball shoes have been selling much better in the last few quarters than Nike’s Jordan or LeBron series. This has forced the company to release cheaper variants of its KD and LeBron shoes in an effort to regain some of the lost market share, even though this move dents margins.

Adidas has primarily scored with fashion shoes promoted by celebrities such as Kanye West. In June, Adidas expanded its partnership with this artist, who moved to the company from Nike in 2013 due to creative differences. In the first quarter, Adidas managed to post a 31% increase in sales of footwear in North America, driven primarily by its Yeezy designs and retro shoes.

Future Order Flow Could Dampen 2017 Sales Figures

Nike’s future orders have come in lower than expected for the third quarter in a row. This quarter also witnessed the lowest future orders in the last five quarters. Future orders are a key metric used to gauge sales in the coming quarters; it is directly indicative of the demand for Nike products. To put this into perspective, in 2015, 87% of Nike’s wholesale footwear shipments were made through future orders, as was 67% of Nike’s U.S. wholesale apparel.

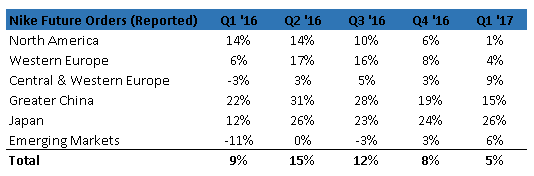

Worldwide future orders rose 7% to $12.3 billion excluding the effect of current translation. Analysts had expected an 8% increase. Future orders for the U.S., however, turned out to be the most disappointing, rising just 1% compared to analyst expectations of a 5% gain.

As can be seen in the table below, future orders have fallen substantially year over year, with only Japan and Emerging Markets witnessing an improvement.

See our full analysis for Nike

View Interactive Institutional Research (Powered by Trefis):

Global Large Cap | U.S. Mid & Small Cap | European Large & Mid Cap

More Trefis Research