Netflix Stock Is Up 28% In 4 Months; Can It Still Head Higher?

Netflix (NASDAQ: NFLX) saw its stock price jump by almost 28% over the last four months, on account of better than expected international streaming growth and continuously improving profitability. Though the company beat revenue and earnings consensus for Q4 and FY 2019, the stock price fell by 3.5% a day after the earnings announcement, as Netflix missed new subscription growth in the US for the third quarter in a row. However, the company’s international streaming growth surpassed expectations. Based on its current market price and future growth prospects, Netflix still looks undervalued. Trefis has a price estimate of $363 per share for Netflix’s stock, which is higher than its current market price of $349 as on January 23, 2020. This reflects an upside of ~4% from its current level.

View the Trefis interactive dashboard on Netflix Valuation that details the factors driving a higher stock price estimate for the company, where you can alter the key assumptions to arrive at your own estimate for Netflix’s stock.

Company Overview

- Netflix is mainly a streaming service which runs TV series, documentaries, and feature films across a wide variety of genres and languages.

- Subscribers can watch as much as they want, anytime, anywhere, on any internet-connected screen. They can play, pause, and resume watching, all without commercials or commitments.

- Primary competitors include Amazon Prime, Hulu, Youtube, Peacock (Comcast), Apple+, HBO Max and DirecTV (AT&T), Sling TV (Dish Network), Disney+ and Hotstar (Disney).

- Up 27% Year To Date, Will Q1 Results Drive Netflix Stock Higher?

- Netflix On A Roll As It Benefits From Paid Sharing And Ads. Is The Stock Undervalued At $610?

- Up 50% Over Last Year, Will Q4 Earnings Drive Netflix Stock Higher?

- Will Netflix Stock Rally 40% To Return To Pre-Inflation Shock Highs?

- How Will The Password Sharing Crackdown Help Netflix Q3 Results?

- Will Netflix Stock Return To Pre-Inflation Shock Highs Of Over $650?

Healthy Revenue Growth

- Netflix’s Total Revenue has grown a stellar 128% from $8.8 billion in 2016 to almost $20.2 billion in 2019.

- It is expected to grow almost 43% to around $28.8 billion in the next 2 years.

- Revenue growth of about $8.6 billion over two years to be driven by contribution of about $6.1 billion from the International Streaming segment, and about $2.6 billion from the Domestic streaming segment, partially offset by lower DVD revenues.

International Streaming

- Overall, International Streaming revenue increased from $3.2 billion in 2016 to $10.6 billion in 2019, driven by a robust increase in memberships.

- We expect revenue to grow by 58% in the next two years, to about $16.7 billion by 2021, driven by its investments in original content, which should help it to add subscribers, despite increasing competition.

- This segment sales contributed 53% of total revenue in 2019. This share is expected to go up to 58% by 2021.

- Netflix continues to see strong international subscriber base growth, though price sensitivity may cap growth in monthly fees.

- We estimate a comparatively slower rate of growth in subscribers in 2020 and 2021, as competition in the streaming market could intensify with the addition of Apple’s and Disney’s direct-to-consumer streaming offering, along with AT&T’s HBO Max and Comcast’s Peacock expected to be launched in 2020.

Domestic Streaming

- Q4 2019 was the third quarter in a row when Netflix missed its subscriber addition forecast in the US.

- Netflix added 420,000 new subscribers in the U.S., missing its goal of 600,000.

To see what impact this miss is expected to have on the revenue performance of the domestic streaming division over the next two years, view our interactive dashboard analysis – Netflix Revenues: How Does Netflix Make Money?

Rising Net Income

- Net Income increased from $0.2 billion in 2016 to $1.9 Billion in 2019, and we expect it to almost double to $3.7 billion by 2021.

- This growth will likely be led by higher margins and elevated revenue level.

- Netflix’s net income margin has continuously increased from 2.1% in 2016 to 9.3% in 2019 and we expect it to go up to 12.9% by 2021.

- The company’s margins have been expanding primarily because Netflix pays for its single largest expense – content – on a fixed cost basis, i.e. for every piece of content that Netflix either licenses or self-produces, it pays a fixed dollar amount regardless of how many people watch it or how many subscribers the company has. As a result, each additional subscriber comes with very little extra cost and is therefore extremely profitable.

- Netflix has been able to grow subscribers at a rapid rate over the years, which has led to revenue growth being much more than expense growth, which has, in turn, pushed margins higher.

Estimating Earnings Per Share

- EPS has continuously increased from $0.43 per share in 2016 to $4.13 per share in 2019.

- A continuous rise in net profits, partially offset by marginally higher share count, is expected to push EPS higher to $5.46 in 2020 and $8.19 in 2021.

Share Price Estimation

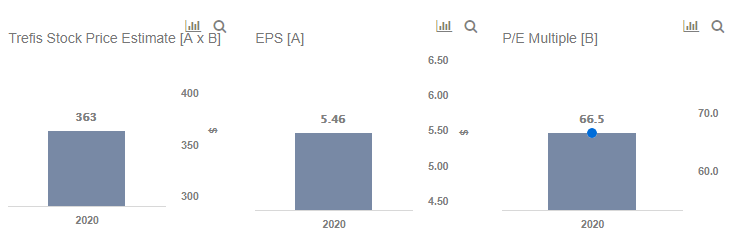

- As per Netflix Valuation by Trefis, we have a price estimate of $363 per share for the company’s stock.

- The stock price estimate is arrived at by using the discounted cash flow valuation technique, which you can find in Netflix’s detailed financial model here.

- Based on projected EPS of $5.46 per share and a stock price estimate of $363 per share, Netflix’s forward price-to-earnings (P/E) multiple stands at 66.5x.

To understand how Netflix’s P/E multiple over the years stands in comparison to major peers such as Amazon and Disney, view our interactive dashboard.

See all Trefis Price Estimates and Download Trefis Data here

What’s behind Trefis? See How It’s Powering New Collaboration and What-Ifs For CFOs and Finance Teams | Product, R&D, and Marketing Teams