What To Expect As Netflix Publishes Q2 Results?

Netflix (NASDAQ:NFLX) is expected to publish its Q2 2019 results shortly. While we expect growth in the company’s international subscriber base to be the key driver of results, its U.S. streaming business could slow down on account of higher pricing and growing competition. Below, we take a look at some of the key trends that have impacted the company’s revenues in recent quarters and how the company could fare in Q2.

View our interactive dashboard analysis What To Expect From Netflix In Q2 2019? to see a breakdown of the company’s quarterly revenues, expenses and EPS expectations.

1) How have Netflix’s Revenues changed over recent quarters?

- Up 27% Year To Date, Will Q1 Results Drive Netflix Stock Higher?

- Netflix On A Roll As It Benefits From Paid Sharing And Ads. Is The Stock Undervalued At $610?

- Up 50% Over Last Year, Will Q4 Earnings Drive Netflix Stock Higher?

- Will Netflix Stock Rally 40% To Return To Pre-Inflation Shock Highs?

- How Will The Password Sharing Crackdown Help Netflix Q3 Results?

- Will Netflix Stock Return To Pre-Inflation Shock Highs Of Over $650?

Netflix’s overall revenues have increased in the recent quarters, largely due to the growing subscriber base. In Q1, the company’s revenues grew a robust 22% year-over-year (y-o-y) to $4.5 billion, driven by growth in subscribers across both the U.S. and international streaming markets. The international subscriber base continued to increase at a rapid pace (33% y-o-y) once again, while the domestic subscriber base growth stabilized in the low double-digits. We expect revenues to grow to about $4.9 billion in Q2 2019.

1.1 How Have Netflix Revenues Trended?

1.2) Which of Netflix’s key revenue components have driven changes in the top line over recent quarters? How does it change in Q2 2019?

Key Revenue Driver 1:

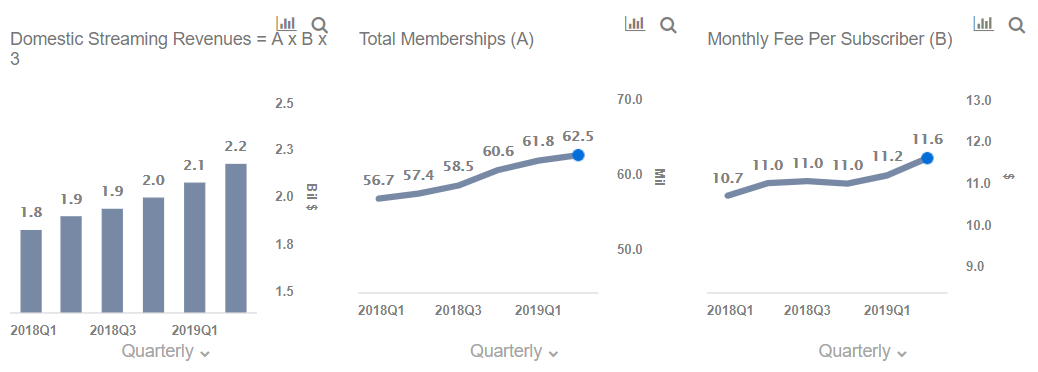

Domestic Streaming Revenues

- We expect domestic streaming revenues to grow to about $2.2 billion in Q2 2019, up from $2.1 billion in Q1 2019 and $1.9 billion in Q2 2018.

- Paid subscriber growth in the U.S. market is expected to slow down to about 300k in Q2, per the company, down from 1.74 million in Q1.

- This could be due to higher pricing and growing competition.

Key Revenue Driver 2:

International Streaming Revenues

- We expect International streaming revenues to grow to about $2.7 billion in Q2’19, up from around $2.4 billion in Q1’19 and $1.9 billion in Q2’18.

- Netflix continues to see strong international subscriber base growth, though price sensitivity may cap growth in monthly fees.

- We estimate a comparatively slower rate of growth in subscribers in 2019, as competition in the streaming market could intensify with the addition of Disney’s direct-to-consumer streaming offering.

Key Revenue Driver 3:

Domestic DVD Revenues

- Netflix’s DVD business continues to lose steam, largely due to the availability of various OTT (over the top) platforms in the market.

What’s behind Trefis? See How It’s Powering New Collaboration and What-Ifs

For CFOs and Finance Teams | Product, R&D, and Marketing Teams

Like our charts? Explore example interactive dashboards and create your own.