A Look At Our $304 Price Estimate For Netflix

Netflix (NASDAQ: NFLX) continues to see strong growth, and now has over 117 million streaming subscribers in over 190 countries with a vast range of TV shows and movies, including original series, documentaries and feature films. In 2017, the company’s revenues increased 32% year-over-year (y-o-y) to $11.6 billion, largely driven by growth in the average number of paid streaming international subscribers. The company’s solid international growth has come despite stiff competition from the likes of Amazon and Hulu, as well as local content providers in various markets. This will likely continue going forward, as the company continues to invest in original content.

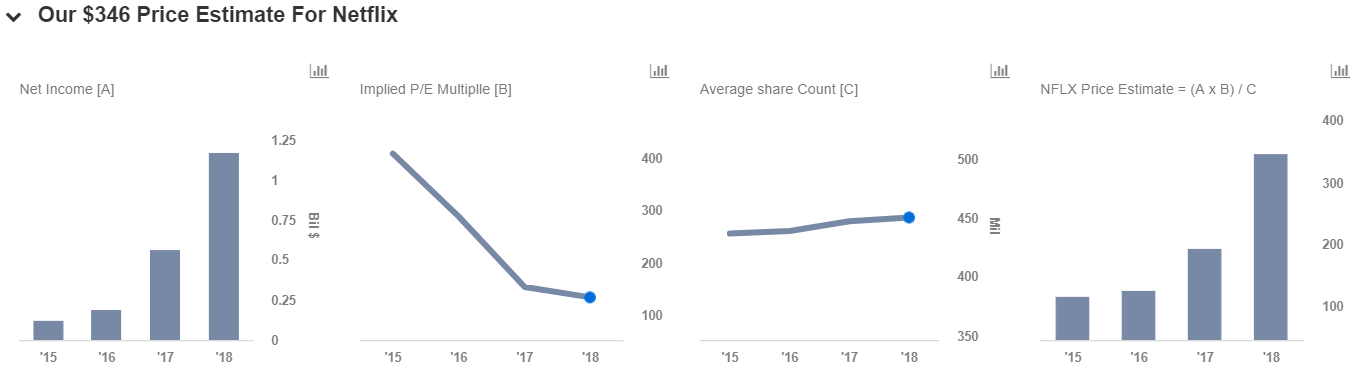

We have a $304 price estimate for Netflix, which is slightly ahead of the current market price. Our interactive dashboard details our forecasts and estimates for the company. Below we outline the key drivers of our price estimate for the company.

Overview Of Estimates

- Up 27% Year To Date, Will Q1 Results Drive Netflix Stock Higher?

- Netflix On A Roll As It Benefits From Paid Sharing And Ads. Is The Stock Undervalued At $610?

- Up 50% Over Last Year, Will Q4 Earnings Drive Netflix Stock Higher?

- Will Netflix Stock Rally 40% To Return To Pre-Inflation Shock Highs?

- How Will The Password Sharing Crackdown Help Netflix Q3 Results?

- Will Netflix Stock Return To Pre-Inflation Shock Highs Of Over $650?

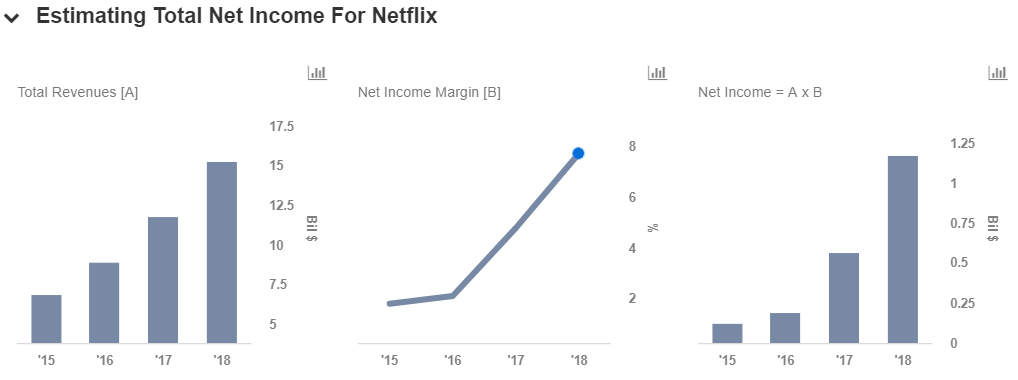

We expect Netflix to generate around $15 billion in revenues in 2018, and earnings of over $1 billion. Our revenue forecast of $15 billion represents year-on-year growth of around 30%. Of the total expected revenues in 2018, we estimate $7.5 billion in the Domestic Streaming business, over $7 billion for the International Streaming business, and nearly $400 million for the Domestic DVD business. Netflix has some 80 individual film projects on the slate, in terms of productions and acquisitions, for 2018. The company also has some interesting launches lined up for this year, including second seasons of French series Marseille, Everything Sucks!, and new installments of David Letterman’s show, My Next Guest Needs No Introduction, to name a few. The company has a long-term goal of ensuring that nearly 50% of the content streamed on its platform is original. As a result, it is spending a significant portion of its content budget on original shows. The company plans to spend as much as $8 billion on shows and movies in 2018, up from $6 billion earmarked for content in 2017, which should drive subscriber growth but will weigh on margins.

Streaming Business Forecasts

We expect Netflix to reach 60 million subscribers in the U.S. with an average monthly fee per subscriber of $10.30, translating into $7.5 billion in domestic streaming revenues in fiscal 2018. In addition, we also expect close to 81 million subscribers in international markets with an average monthly fee per subscriber of $7.40, translating into $7.2 billion in international streaming revenues in the same period. Netflix has been growing its subscribers at an annual rate of 10% in the U.S. and nearly 40% in the international markets in the last two years, leveraging its original content slate and the growth in streaming. We expect this trend to continue in the near term as well.

Netflix saw its stock gain nearly 50% in 2017, and is now up more than 30% year-to-date as of March 29. The company should continue to benefit from its strong foothold in the streaming business as well as a robust lineup of TV shows and films in 2018. Our valuation dashboard suggests that Netflix’s valuation still has more upside, and we expect the company to grow at a similar pace as that of 2017 going forward.

What’s behind Trefis? See How It’s Powering New Collaboration and What-Ifs

For CFOs and Finance Teams | Product, R&D, and Marketing Teams

Like our charts? Explore example interactive dashboards and create your own.