What Is The Potential Upside To Netflix’s Domestic Streaming Business?

Netflix’s (NASDAQ:NFLX) domestic streaming business is the cash cow for the company, and one of the primary sources for funding its geographic and content expansion. While the domestic business has reported stellar growth in recent years, its growth is slowing down somewhat as the market matures. According to Trefis estimates, the U.S. streaming subscription business accounts for around 55% of Netflix’s value. In this note, we explore the upside to the domestic streaming businesses.

Our price estimate for Netflix stands at $181, which is slightly below the current market price. Take a look at our interactive breakdown of Netflix’s domestic business and the upside scenario to learn more.

Upside To Domestic Subscriber Base

- Up 27% Year To Date, Will Q1 Results Drive Netflix Stock Higher?

- Netflix On A Roll As It Benefits From Paid Sharing And Ads. Is The Stock Undervalued At $610?

- Up 50% Over Last Year, Will Q4 Earnings Drive Netflix Stock Higher?

- Will Netflix Stock Rally 40% To Return To Pre-Inflation Shock Highs?

- How Will The Password Sharing Crackdown Help Netflix Q3 Results?

- Will Netflix Stock Return To Pre-Inflation Shock Highs Of Over $650?

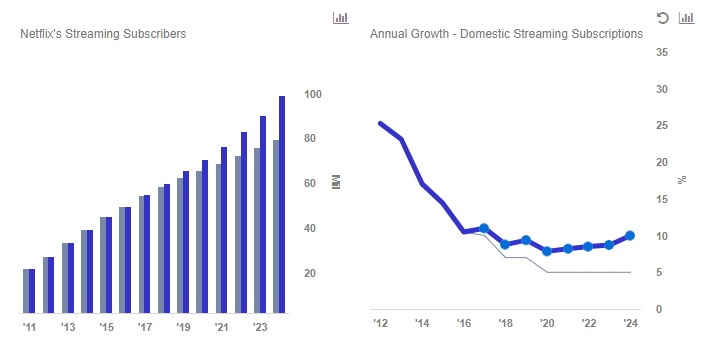

Netflix’s domestic subscriber base crossed the 50 million (paying subscribers) mark in Q2 and is growing at a steady pace. In the first nine months of 2017, it has added close to 3.34 million subscribers even though competition in the online streaming industry is intensifying. Driven by the favorable secular trends within the pay-TV industry, as consumers increasingly cut the cord in favor of streaming platforms, Netflix’s domestic user base continued to improve in 2017. While we currently forecast the subscriber base to grow to over 79 million over our forecast period, at a CAGR of 6%, the number of Pay-TV household base stands close to 100 million. With cord-cutting measures intensifying, it is possible that an even greater proportion of these households could potentially subscribe to Netflix’s services. If nearly all pay-TV households in the U.S. were to become Netflix subscribers, there would be a 15% upside to our price estimate for the company’s stock.

Upside To Average Fee Per Subscriber

Netflix has demonstrated significant pricing power in recent years, as it has been able to increase the average fees paid by subscribers without any material impact on subscriber numbers. For example, its average fee per subscriber has gone up by 12%, from $8.65 in 2016 to $9.70 in the first nine months of 2017 as it hiked prices in December 2016. Starting in December, Netflix will again be raising prices for its U.S. subscribers. While we currently estimate the company’s average fee per U.S. subscriber to grow to around $12.44 by 2024, it is possible that ensuing rate hikes over our forecast period will drive this higher, as has been the case in recent years. If the company’s average revenue per U.S. subscriber were to grow by a CAGR of 6.5% to nearly $15 over our forecast period, there would be an upside of around 13% to our price estimate.

Contribution Margins Can Improve Further

Netflix previously stated that it intends to improve its domestic streaming margins by 200 basis points (2%) per year, but now believes that they can improve even further as a larger portion of content costs will now be absorbed by the company’s ever-growing international territories. We currently forecast that the domestic contribution margins will grow to around 47% by 2024. However, as the company hikes its rates, the contribution margins could reach as high as 50%. While this would have a fairly minor impact on our price estimate, it would improve the company’s cash flows in the coming years.

Cumulatively, there is more than a 33% upside to the Trefis price estimate of $181 if this scenario were to pan out.

View Interactive Institutional Research (Powered by Trefis):

Global Large Cap | U.S. Mid & Small Cap | European Large & Mid Cap