How Much Will Content Costs Impact Netflix’s Cash Flows?

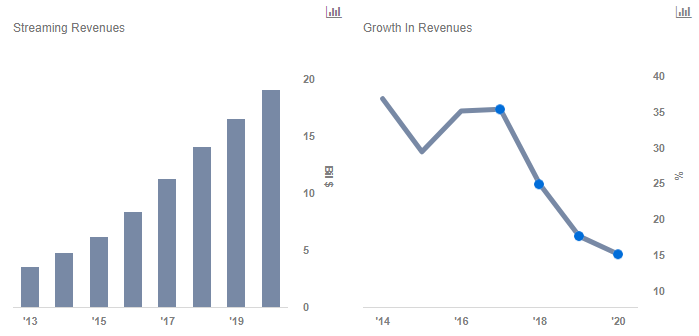

Netflix’s (NASDAQ:NFLX) streaming revenues have increased from $3.46 billion in 2013 to $8.29 billion in 2016, a compound annual growth rate (CAGR) of 34%. For the first three quarters of 2017, streaming revenues swelled to over $8 billion and are expected to reach over $11 billion for the year. Trefis projects revenues to grow at a CAGR of 32% to $19 billion by 2020 as the company adds more subscribers, especially in the international markets. At present, we have a price estimate of $181 per share for Netflix, which is slightly below its current market price.

Despite the rapid and impressive growth, Netflix’s streaming costs have also grown steadily. Streaming costs have increased from $2.6 billion in 2013 to $5.8 billion in 2016, a CAGR of about 30%. Most of the streaming costs stem from content costs, which are a function of content licensing and production costs. Trefis projects streaming costs to grow at a CAGR of 30% to $13.3 billion by 2020, as the company adds more content to its library, especially for international markets.

- Up 27% Year To Date, Will Q1 Results Drive Netflix Stock Higher?

- Netflix On A Roll As It Benefits From Paid Sharing And Ads. Is The Stock Undervalued At $610?

- Up 50% Over Last Year, Will Q4 Earnings Drive Netflix Stock Higher?

- Will Netflix Stock Rally 40% To Return To Pre-Inflation Shock Highs?

- How Will The Password Sharing Crackdown Help Netflix Q3 Results?

- Will Netflix Stock Return To Pre-Inflation Shock Highs Of Over $650?

Content obligations for Netflix are comprised of current content liabilities, non-current content liabilities and other content obligations that are not yet reflected on its balance sheet. Since 2013, the company’s content obligations have gone from $7.3 billion to $14.5 billion in 2016. While the company initially licensed content from companies such as Lionsgate and Disney, it is now developing and producing its own original content. This content has been valuable for the company in terms of attracting subscribers, but it does require significant upfront investments. The company plans to fund these investments largely through debt. The company plans to spend as much as $8 billion on shows and movies in 2018, up from $6 billion earmarked for content this year.

Due to these massive content expenditures, Netflix expects to have negative free cash flows for the foreseeable future. However, once this original content has been produced, the content library can be monetized and amortized over a number of years, which should lead to an improvement in profitability over the long run. By the start of the next decade, we expect this growth to outpace content costs and drive profitability for the company.

Check out the base case scenario dashboard for Netflix’s content obligation here.

Understand How a Company’s Products Impact its Stock Price at Trefis

View Interactive Institutional Research (Powered by Trefis):

Global Large Cap | U.S. Mid & Small Cap | European Large & Mid Cap