How Much Of Nasdaq’s Revenues Come From Recurring Sources?

Nasdaq (NASDAQ: NDAQ) reported $4.27 billion in Total Revenues in 2018. Adjusting this figure for transaction-based expenses of $1.75 billion which are related completely with its trading commissions, this represents Net Revenues of $2.52 billion for the company last year. As we detail in our interactive dashboard for Nasdaq’s Revenues, we estimate that the company generates 70% of its net revenues from recurring sources such as corporate solutions and information services. Our dashboard also includes forecasts for each of Nasdaq’s revenue sources for FY2020.

Nasdaq is a global exchange group that provides trading, exchange technology, securities listing, and public company services. It operates multiple venues for cash equities and equity options in the U.S., a transaction-reporting facility for FINRA and some venues in Nordic and Baltic regions. It is the second-largest stock exchange in the world with a market capitalization of $11.1 trillion of the U.S. listed stocks.

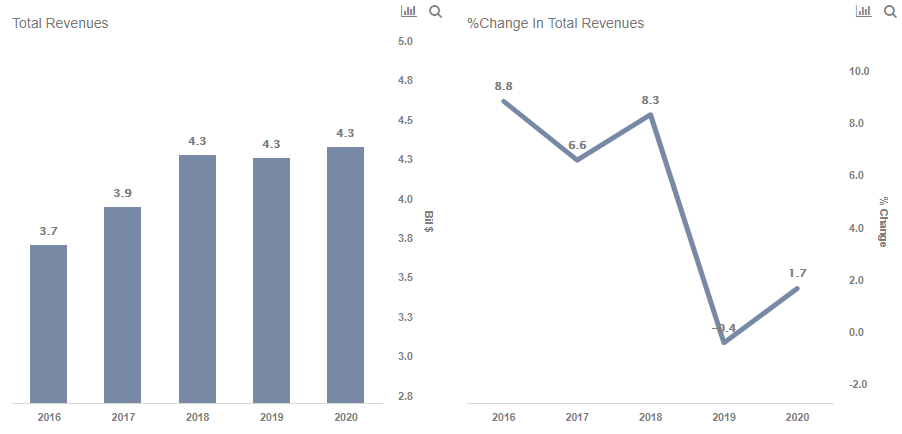

Nasdaq’s Total Revenues have grown at a CAGR of 7.5% from $3.7 billion in 2016 to $4.2 billion in 2018, and are expected to grow organically across business segments in the next two years

- Market Services Segment includes revenues from cash equity trading, equity derivatives trading, fixed income trading, and trade management services businesses. In 2018, the segment generated $2.7 billion of revenues, growing by 12% over the prior year due to an increase in market activity.

- Corporate Services Segment includes income from Nasdaq’s listing services and corporate solutions businesses. Investor relations management tools, corporate governance tools, regulatory compliance tools are key products offered as corporate solutions. The company earns listing fees from new listings as well as existing stocks. In 2018, the segment generated $528 million of revenues and is expected to grow at a slow pace in the coming years.

- Information Services Segment provides market data, licensed Nasdaq indices and investment analysis services to financial institutions, asset managers, and brokers. In 2018, the segment generated $714 million of revenues, growing by 21% over the prior year. The growth in 2018 was driven by acquisitions and higher data subscription sales.

- Market Technology Segment offers trading and settlement technology solutions to exchanges, banks, brokers, etc., as a technology provider. Despite a low share of just 7% of the total revenues, the segment is expected to grow at a stronger pace driven by offerings for non-financial markets.

What’s behind Trefis? See How it’s Powering New Collaboration and What-Ifs

For CFOs and Finance Teams | Product, R&D, and Marketing Teams

All Trefis Data

Like our charts? Explore example interactive dashboards and create your own