What Is Nasdaq’s Equity Trading Volumes Outlook?

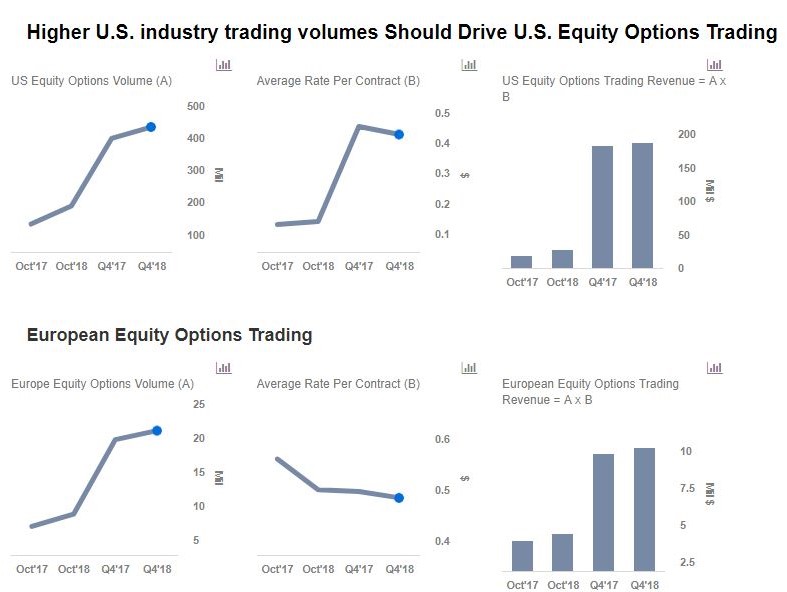

NASDAQ (NASDAQ:NDAQ) sustained its growth trend in equity options trading volumes in October, with around 189 million contracts traded in the U.S. market, about 42% more than the prior year period. This was primarily due to higher U.S. industry trading volumes, partially offset by a slight decline in market share. Additionally, we expect increased volatility in the market as a result of the strengthening of the U.S. GDP and other macro factors. Consequently, this should drive trading volumes. However, a decline in revenue per contract, driven by strong competition, should offset the overall revenue growth. NASDAQ generates about 20% of its revenues from this asset class. We expect decent top line growth from this segment, driven by solid growth in volumes, slightly dampened by increased competition.

We have a $94 price estimate for NASDAQ’s stock, which is significantly ahead of the current market price. Our interactive dashboard shows our expectations for the company’s Q4 equity trading volumes; you can modify the key value drivers to see how they impact the company’s revenue.

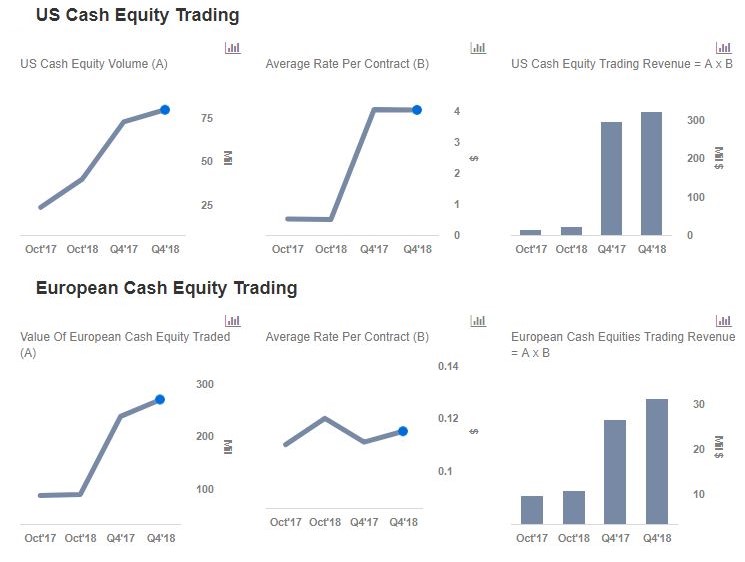

NASDAQ’s cash equity trading volumes continued their strong growth, with around 40 billion shares traded in the U.S. market, in comparison to the previous October’s 23.7 billion shares. We attribute that to the growth in the overall U.S. cash equity market as well as robust growth in industry trading volumes. Further, improving economic conditions in the U.S. should lead to increased volatility, which should drive growth in equity options trading volumes. As a result, we expect solid near-term growth in the cash equities segment.

What’s behind Trefis? See How it’s Powering New Collaboration and What-Ifs

For CFOs and Finance Teams | Product, R&D, and Marketing Teams

More Trefis Research

Like our charts? Explore example interactive dashboards and create your own