Why We Cut Our Price Estimate For Micron To $38

We have reduced our price estimate for Micron (NYSE:MU) from $63 per share to about $38, on account of a weak memory pricing environment, particularly for DRAM, which is expected to put pressure on the company’s profitability and cash flows. Our revised price estimate values Micron at about 6x our projected FY’19 EPS for the company, and is about 10% ahead of the current market price. Our interactive dashboard analysis on What’s Driving Our Price Estimate For Micron? spells out our expectations for the company going forward. You can modify any of our key drivers and forecasts to gauge the impact that changes would have on the company’s earnings and valuation. Below, we take a look at some of the key trends driving our price revision.

DRAM Price Declines Will Hurt Micron

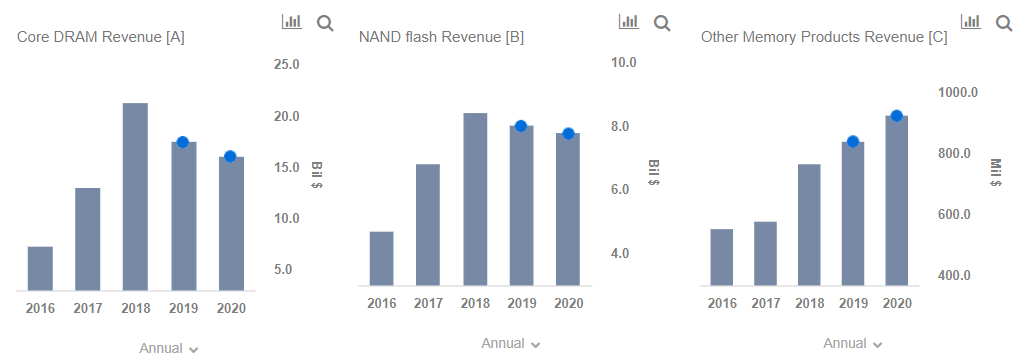

Micron’s DRAM business outperformed over the last two years, driven by demand from the cloud, enterprise, mobile, and graphics markets, and stronger sales to higher-value markets. Over FY’18, sales of DRAM products rose 64%, with ASPs rising by 35% and this was largely responsible for the company’s soaring margins (adjusted net margins came in at 40% in FY’18, compared to about 25% a year ago). However, the market is entering a phase of oversupply, with DRAMeXchange projecting that the price of DRAM could decline by 5% or more in Q4’18, ending a run of nine consecutive quarters of price growth, and it’s likely that the price declines will be steeper going forward.

- Up 30% This Year, Will AI Tailwinds Drive Micron Stock Higher?

- Up 12% This Year On AI Tailwinds, Will Micron Stock See Further Gains Following Q2 Results?

- Digital Infrastructure Stocks Including Micron Had A Solid Year. What Lies Ahead?

- Why Digital Infrastructure Stocks Such As Micron Are Outperforming

- Will Surging Demand For High-Bandwidth Memory Help Micron Stock?

- How Will The Chinese Chip Ban Impact Micron?

Unlike NAND chips, which see some price elasticity of demand, DRAM chips are relatively inelastic. While DRAMeXchange predicts a 15% to 20% year-over-year price decline in 2019, it’s possible that the declines could be sharper. Considering this, we forecast that Micron’s DRAM revenues will fall by 18% in 2019, although the company expects DRAM production to grow by ~15%. This could also have a significant impact on net margins and cash flows.

Bearish Trend In NAND Likely To Continue

The NAND market has been seeing headwinds as major vendors accelerated their transition from planar NAND to the more efficient 64-layer 3D NAND, which significantly increases bit density and available capacity in the industry. According to Gartner, average selling prices for NAND memory are projected to fall by about 24% in CY 2018 and 23% in CY 2019. That said, we expect the revenue declines for Micron’s NAND business to be less pronounced compared to DRAM, as the company expects bit growth to come in at 35% for 2019.

What’s behind Trefis? See How It’s Powering New Collaboration and What-Ifs

For CFOs and Finance Teams | Product, R&D, and Marketing Teams

Like our charts? Explore example interactive dashboards and create your own.