Why Micron’s DRAM Business Will Continue To Grow Despite The Declining DRAM Prices

Micron Technology’s (NASDAQ:MU) stock price has declined by more than 60% over the past year, mainly on account of a weak PC market, disappointing earnings, and concerns about DRAM oversupply. Weak PC demand and the consequent oversupply situation were the primary reasons for the steep decline in DRAM prices in 2015. DRAM prices are expected to continue declining this year as supply outpaces demand. [1] Nevertheless, we forecast that the rate of decline in Micron’s DRAM revenue to slow in 2016. Additionally, we expect the decline in price to slow in 2017 as well, which will help the company re-accelerate DRAM revenue growth 2017 onward. Contributing as well will be the transition to the 20nm technology, which should allow Micron to gain some market shareas well.

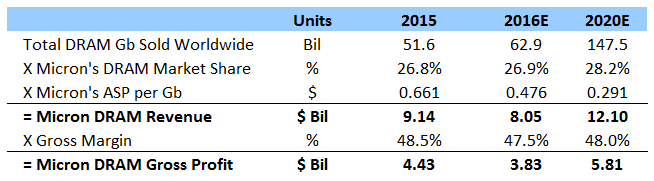

We believe that the falling DRAM selling price will be mitigated by cost reductions and increased volume.

- Up 30% This Year, Will AI Tailwinds Drive Micron Stock Higher?

- Up 12% This Year On AI Tailwinds, Will Micron Stock See Further Gains Following Q2 Results?

- Digital Infrastructure Stocks Including Micron Had A Solid Year. What Lies Ahead?

- Why Digital Infrastructure Stocks Such As Micron Are Outperforming

- Will Surging Demand For High-Bandwidth Memory Help Micron Stock?

- How Will The Chinese Chip Ban Impact Micron?

Rate of Decline in DRAM Prices To Slow Down

The market for memory products is highly cyclical in nature, and the product prices are heavily dependent on the balance of demand and supply. Due to the excess supply in the industry, as well as the increasing commoditization of memory products, the average selling prices (ASPs) have declined significantly in the last few years, at a CAGR of negative 24% between 2010 and 2015. We forecast DRAM prices to decline at a CAGR of 15% between 2015 and 2020.

Some Key Points

>> Consolidation in the industry has left only three main players in the DRAM market, so less competition.

>> The decline in PC DRAM demand will be offset by strong demand from the mobile, tablets and server market. Micron has been allocating less production to PCs and continuing to shift more bit production towards the other faster-growing segments.

>> As a % of Micron’s total revenue, PC is in the mid 20% range, mobile in the low-30% range, servers in the high-teens, and specialty DRAM (which includes networking, graphics, automotive and other embedded technologies) in the low-20%.

>> DRAM industry demand and supply will be relatively balanced going forward.

Transition To 20nm Can Help Increase Market Share

>> Transition to 20nm will lead to substantial growth in the volume of DRAM sales in Q3’16.

>> 20 nm will represent >50% of Micron’s DRAM fab bit output towards the end of the year.

>> Micron’s DRAM bit growth will be above the market in fiscal 2016. It lagged behind the market in 2015, which led to an approximate 2% decline (our estimate) in market share.

>> At present, Samsung is the only producer that makes a significant portion of its DRAM memory using 20nm fabrication technology.

>> Finer manufacturing technology allows the company to make memory ICs smaller and cheaper, which enables Samsung to sell its memory at lower price points without affecting its gross margin.

>> The increased transition to 20nm will increase Micron’s cost competitiveness in the market.

Smaller Node Will Give Micron A Competitive Cost Position

The transition to a lower node will enable Micron to lower its manufacturing cost, in turn helping the company retain its gross margin despite the decline in DRAM prices.

Have more questions about Micron? See the links below:

>> By What Percentage Did Micron’s Revenue & Gross Profit Grow In The Last 5 Years?

>> How Much Revenue Can Micron Earn From Its DRAM Business In The Next 5 Years?

>> How Fast Can Micron’s Revenue Grow From Its NAND Flash Business In The Next 5 Years?

>> Micron Technology: Calendar Year 2015 In Review

>> What’s Micron’s Fundamental Value Based On Expected 2016 Results?

>> Micron’s 2015-2020 Revenue CAGR To Decline To 4% If Memory Prices Decline By 20% Per Year

>> Micron’s Expected Growth In Calendar 2016: Trefis Estimate

>> Why We Have A Bullish Outlook On Micron Technology

>> Micron’s Q2’16 Earnings Review: Technology Transitions Will Lead To A Better Second Half

Notes:

View Interactive Institutional Research (Powered by Trefis):

Global Large Cap | U.S. Mid & Small Cap | European Large & Mid Cap

Notes: