Which Segments Will Drive Microsoft’s Revenue Growth Through 2020?

Microsoft’s (NASDAQ:MSFT) increasingly accommodating stance towards open source to drive growth in its cloud business has opened up several opportunities for the company. While we expect the Intelligent Cloud and More Personal Computing segments to register strong growth, the Productivity and Business Processes division is likely to be the company’s fastest-growing segment.

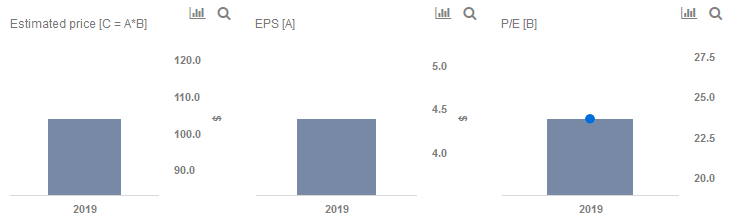

We have a price estimate of $104 per share for Microsoft, which is about in line with the current market price. Our interactive dashboard on Microsoft’s Price Estimate outlines our forecasts and estimates for the company. You can modify any of the key drivers to visualize the impact of changes on its valuation, and see all of our Technology company data here.

- Up Nearly 70% Since The Beginning Of 2023, Where Is Microsoft Stock Headed?

- Up 63% Since The Beginning Of 2023, How Will Microsoft Stock Trend After Q2 Earnings?

- Microsoft Stock Is Up 45% YTD And Outperformed The Consensus In Q1

- Microsoft Stock Outperformed The Expectations In Q4

- Microsoft Stock Is Fairly Priced At The Current Levels

- What To Expect From Microsoft Stock In Q3?

Segment Overviews

Microsoft’s Azure competes with AWS and Google Cloud in the cloud services space. While the company is a clear number two behind AWS, the movement of budgets towards edge computing and hybrid cloud environments could potentially cool down the scorching pace of cloud growth over the last few years. Microsoft’s own quarterly growth rates for Azure have declined from 98% a year back to 76% in the last quarter, though a larger base factor certainly contributes to that as well.

In addition to global macro environment changes, the U.S.-China trade dispute has taken a toll on hardware OEMs, including chip and PC manufacturers. This had resulted in softening growth for the company’s More Personal Computing segment. Going forward, while Windows refresh cycles are likely to keep the growth healthy, the excess inventory situation at OEMs may take another few quarters to clear out before becoming a tailwind for the segment’s growth.

The resilience in Productivity and Business Processes is predicated on the cloud architecture on which Office 365 is delivered across commercial and consumer categories. Dynamics 365 also continues to see strong growth driven by IoT projects on Azure. As highlighted above, the company’s single cloud backbone is helping drive application growth, with Office and Dynamics likely to continue witnessing strong growth due to their relative lack of dependence on hardware. LinkedIn – which is part of Productivity and Business Processes – has a strong position in the professional social networking space, where feed engagement is becoming a tool to supplement resumes in showcasing one’s skills.

Overall, due to the aforementioned trends, we expect Productivity and Business Processes to be Microsoft’s biggest value driver over the coming two years.

See More at Trefis | View Interactive Institutional Research (Powered by Trefis)