Can Microsoft Sustain Its Growth Momentum Post-Q2?

Microsoft (NASDAQ:MSFT) reported its fiscal Q2 earnings on January 30. The company delivered another quarter of strong growth, with total revenues of $32.5 billion (+12% y-o-y). Microsoft’s assessment of growth momentum in the business remains sanguine, and the company’s outlook of the IT spending environment remains also remains relatively upbeat. However, the impact of FX headwinds and potentially tougher comps due to strong performance in the previous quarters could potentially show up in the second half.

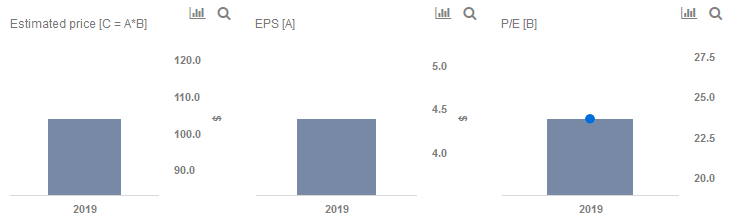

We are maintaining our price estimate of $104 per share for Microsoft, which is around the current market price. Our interactive dashboard on Microsoft’s Price Estimate outlines our forecasts and estimates for the company. You can modify any of the key drivers to visualize the impact of changes on its valuation.

- Up Nearly 70% Since The Beginning Of 2023, Where Is Microsoft Stock Headed?

- Up 63% Since The Beginning Of 2023, How Will Microsoft Stock Trend After Q2 Earnings?

- Microsoft Stock Is Up 45% YTD And Outperformed The Consensus In Q1

- Microsoft Stock Outperformed The Expectations In Q4

- Microsoft Stock Is Fairly Priced At The Current Levels

- What To Expect From Microsoft Stock In Q3?

Q2 Performance, Q3 Guidance

- Productivity and Business Processes: Q2 revenues grew to $10.1 billion (+12.8% y-o-y), driven by 30% growth in LinkedIn revenues and 34% growth in Office 365 Commercial revenue (with 27% seat growth). For Q3, the company guides for revenue of $9.9 to $10.1 billion including 2% of FX headwinds.

- Intelligent Cloud: Q2 revenues grew to $9.3 billion (+20% y-o-y), driven by 76% growth in Azure and 24% growth in server products and cloud services. Azure might have benefitted from certain clients (especially in healthcare and retail) feeling uncomfortable about working with AWS given that Amazon’s ambitions make Amazon a competitor to some AWS clients. Also, despite the 2% growth pull forward in server products and cloud services last quarter, due to impending price revision, the divisional KPIs remained stable with management remaining upbeat about the outlook. The acquisition of GitHub, now a part of the Intelligent Cloud division, is likely to close by the end of June 2019. For Q3, the company guides to a revenue of $9.15 to $9.35 billion including 2% of currency headwinds.

- More Personal Computing: Q2 revenues grew to $13 billion (+7% y-o-y), with the OEM business as the only spot of weakness. For Q3, the company guides for revenue of $10.35 to $10.65 billion, including 1% of currency headwinds.

While Microsoft noted that the company “continued to benefit from favorable secular trends and IT spending conditions”, management also acknowledged the possibility of volatility showing up in large contracts should macroeconomic conditions see any volatility.

Do not agree with our forecast? Create your own price forecast for Microsoft’s Price Estimate by changing the base inputs (blue dots) on our interactive dashboard.

Like our charts? Explore example interactive dashboards and create your own.