Microsoft’s Path To A $1 Trillion Market Cap

Microsoft’s (NASDAQ:MSFT) stock recently hit an all-time high, and its market capitalization reached over $700 billion. Some analysts on Wall Street have recently predicted that the company’s market cap could reach $1 trillion in the coming years, on the back of the increasing popularity of its cloud services across the Productivity and Intelligent Cloud businesses. We have created an interactive dashboard which illustrates the growth and margin improvements across the company’s divisions that would need to occur in order to reach this valuation. You can modify assumptions such as projected revenue and margins to see how the valuation changes.

We currently have an $87 price estimate for Microsoft, which is in line with the current market price.

- Up Nearly 70% Since The Beginning Of 2023, Where Is Microsoft Stock Headed?

- Up 63% Since The Beginning Of 2023, How Will Microsoft Stock Trend After Q2 Earnings?

- Microsoft Stock Is Up 45% YTD And Outperformed The Consensus In Q1

- Microsoft Stock Outperformed The Expectations In Q4

- Microsoft Stock Is Fairly Priced At The Current Levels

- What To Expect From Microsoft Stock In Q3?

Productivity And Business Processes Business To Power Valuation

Microsoft’s Productivity and Business Processes revenues, which include the Office suite, Dynamic CRM and ERP and LinkedIn, has grown from $27 billion in 2014 to $30.5 billion in fiscal 2017, primarily due to the growth in Office 365 cloud services and Dynamics cloud software. Currently, we project those revenues to improve to $45 billion by the end of our forecast period as the company continues to strengthen its presence in the rapidly growing productivity market through sales of cloud-based Office 365. However, as Office 365 and Dynamic cloud are witnessing robust adoption, it is possible that that the actual performance will exceed our forecasts. While Office 365 commercial seats grew by 40% from 85 million in 2016 to 120 million active users in 2017, Dynamics software revenue grew by 8.3% in first three quarters of 2017. Considering this growth across these two verticals, it is possible that revenues from this segment could grow to $60 billion by 2024 if this rate of growth is maintained.

Furthermore, operating margins in 2017 declined to historic lows as the company completed the acquisition of LinkedIn, which negatively impacted margins due to an acquisition-related operating loss of $361. While we expect margins to improve to 42.5% by the end of our forecast period as the company is increasingly selling more cloud subscriptions compared to perpetual licenses, the margins could improve even more – to above 52% – as hosted solutions are generally higher-margin in nature than the traditional suite. An increasingly favorable sales mix could boost margins even more than we forecast. Cumulatively, the superior growth in revenues and margins will result in an upside of $186 billion, or $24 per share, to our existing valuation.

Intelligent Cloud Still Growing

While Microsoft’s server products such as Windows Server OS and MySQL were a gold standard in the industry, its cloud platform Azure has been a relatively late entrant in the infrastructure- and platform-as-a-service (IaaS and PaaS) market. Azure is gradually catching up with incumbent Amazon AWS, and its market share has inched up to 10% recently. The company continues to add capabilities such as AI to its Azure hybrid cloud offering, and as a result Azure is fast emerging as an attractive platform for Microsoft’s clients for Infrastructure as a Service (IaaS) and Platform as a Service (PaaS) solutions. Based on these trends, we expect this segment to become an important driver of Microsoft’s value in the coming years. While in our base case scenario, we project revenues to grow to $37.4 billion, increased adoption of Azure platform could boost the revenues for this division even further to $55 billion by 2024. Microsoft’s clients are increasingly adopting the Azure platform for their IaaS and PaaS needs. This will not only result in revenue growth but also margin expansion in the coming years, as many services can be rolled into a value-added bundle through the platform. While we project operating margins to improve to 35% by 2024 as the cloud service ARR grows in the coming years, it is possible that the margins could rebound to the historical average of 40% due to better cost control measures and increased automation in this segment. Cumulatively, this growth in revenues and margins would lead to an upside of $138 billion, or $18 per share, to our existing valuation.

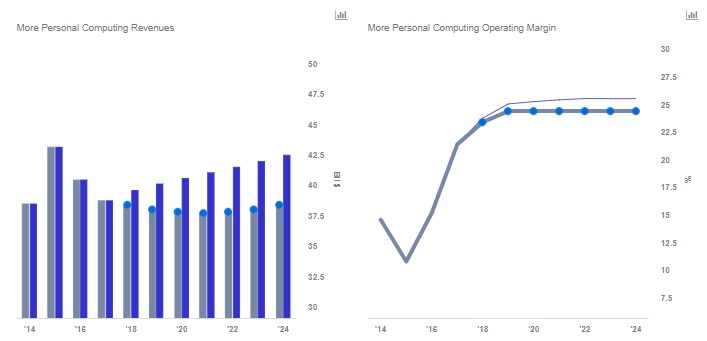

PCs Still Likely Report Tepid Growth

Microsoft’s Personal Computing division did fairly well in 2017, largely due to the adoption of Windows OS, the launch of its Surface line of devices and growth in Bing’s online search ad revenues. Still, the revenues declined by 4% in fiscal 2017 to $38.7 billion due to secular pressures. While we expect that Windows OS sales for both Windows OEM non-Pro and Pro will continue to outperform PC sales in the coming years, the secular decline in PCs will continue to impact revenues. As a result, we project revenues from the PC division to grow marginally to around $38 billion by 2024, aided by growth in revenues from Xbox, the Surface line of devices and Bing search. If revenues were to grow to $42.5 billion by 2024 and margins were to improve slightly to 25.5% due to the popularity of Windows OS and hardware devices, the upside to our valuation would be $2.5 billion, or 80 cents per share.

These Scenarios Could Cumulatively Lead To $1 Trillion Market Cap

Should all of the above scenarios come to fruition – which seems relatively unlikely in the near term – Microsoft could certainly see a path to a $1 trillion market cap in the coming years. Even if they don’t, the company is clearly well-positioned for strong long-term growth.

See More at Trefis | View Interactive Institutional Research (Powered by Trefis)