3M Disappoints in Q1 2019, Will Growth Pick Up In The Next Quarters?

3M (NYSE: MMM), a diversified technology company with a global presence, announced its Q1 2019 results on April 25, 2019, followed by a conference call with analysts. The company missed consensus for revenue which was recorded at $7.8 billion, down by 5% year on year. The decrease is mainly due to Organic local-currency sales decline of 1.1 percent among other factors. The earnings were recorded at $1.51, up by 54.1% year on year.

We have summarized our key expectations from the earnings announcement in our interactive dashboard – What Has Driven 3M’s Revenues & Expenses Over Recent Quarters, And What Can We Expect For Full-Year 2019? In addition, here is more Industrials data.

- What’s Next For 3M Stock After A 15% Fall This Year?

- After A 14% Fall This Year Is 3M Stock A Better Pick Over Honeywell?

- What’s Next For 3M Stock After A 24% Fall This Year?

- Should You Pick Starbucks Over 3M Stock For Next Three Years?

- What’s Happening With 3M Stock?

- Will 3M See A Sharp Decline In Q2 Earnings?

Key Factors Affecting Earnings:

Revenue falters in Q1 2019:

- 3M’s Total Revenue in Q1 2019 was recorded at $7.9 billion, down 5.0 percent year-on-year.

- This was attributed mainly to Organic local-currency sales decline of 1.1 percent, while divestitures (net of acquisitions) decreased sales by 0.5 percent. Further, foreign currency translation decreased sales by 3.4 percent year-on-year. Also, the company suffered mid-single-digits fall in China, automotive, and electronics collectively.

Trend in Expenses:

- Cost of Sales forms more than 60% of Total Expenses for 3M. This trend continued in Q1 2019 as Cost of Sales was 61.9% of Total Expenses.

- Research and Development is a major part of 3M as the company focuses a lot on innovation and it formed around 7% of Total Expenses in the last 2 years. In Q1 2019 this was recorded at 477 million (6.9% of Total Expenses).

- 3M Q1 2019 results were impacted by two litigation issues for which the company established a reserve of $235 million. It also increased its respirator reserve by $313 million to address the cost of resolving all current and expected future coal mine dust lawsuits in Kentucky and West Virginia, resulting in a litigation-related pre-tax charge of $548 million.

Full Year Outlook:

- For the full year, we expect gross revenue to increase by 3.9% to $34 billion in 2019.

- Growth is expected to come from Health care and Consumer business.

- Industrial segment will continue to be the highest contributor to revenue at 34.7% of Total Revenue in 2019

- EBITDA margin is expected to increase to around 33.6%.

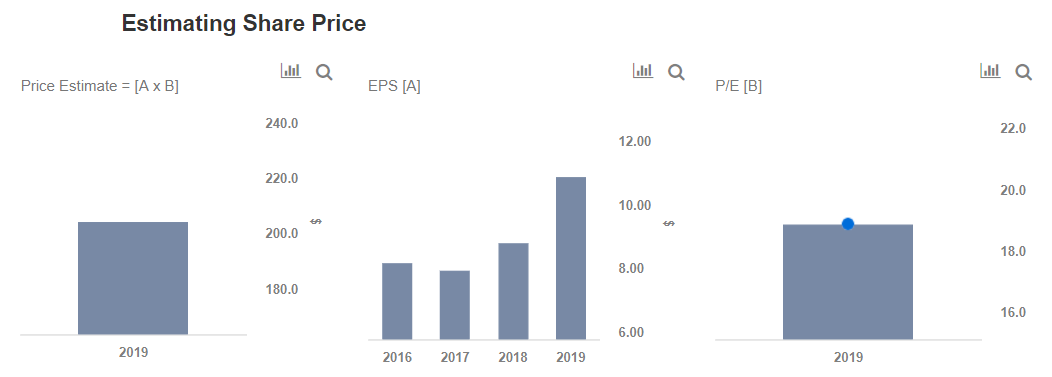

Trefis has an estimate of $205 for 3M’s stock. Growth from the Health care segment and China are expected to push the stock price higher over time.

What’s behind Trefis? See How It’s Powering New Collaboration and What-Ifs

For CFOs and Finance Teams | Product, R&D, and Marketing Teams

Like our charts? Explore example interactive dashboards and create your own.