What Would Be The Downside To 3M’s Share Price If Industrial Revenues Remain Flat Till FY 2021?

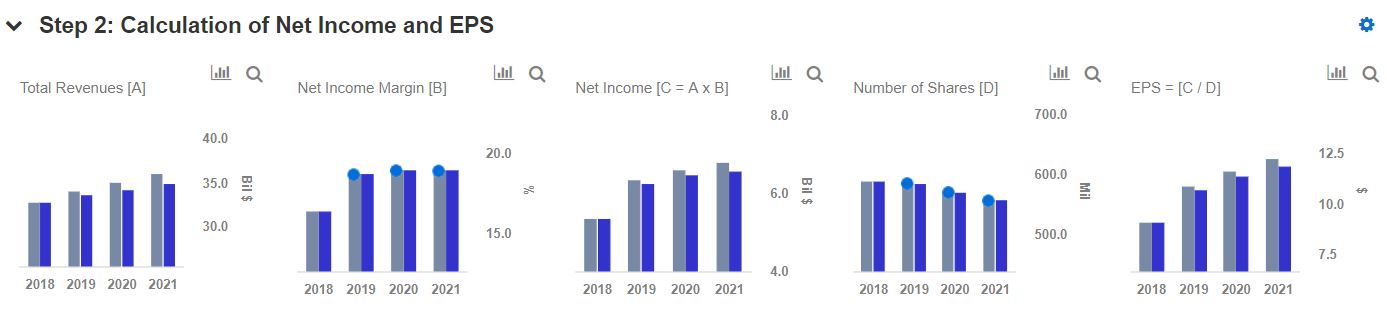

3M (NYSE: MMM) declared its results on January 29, 2018 and beat consensus estimates. The company posted revenue of $32.77 billion, up 3.5% year on year (YOY) and GAAP EPS was at $8.89, up 12.1% YOY. Out of the 3.5% revenue growth, 3.2% was due to organic growth, 0.1% was attributed to acquisitions (net of divestitures), and 0.2% was attributed to foreign currency translation. We expect the company to continue this growth momentum for the Fiscal Year 2019 with revenue to increase by approximately 3.6% YOY and EPS by approximately 18.5% YOY.

We maintain our $204 price estimate for the company. In our interactive dashboard How Will 3M’s Revenue And Valuation Change If Industrial Revenues Remain Flat Till FY 2021, we provide a scenario in which we estimate 3M’s price in a situation where due to a global slowdown the industrial revenues remain at 2018 levels till the year 2021. In addition, here is more Industrials data.

- What’s Next For 3M Stock After A 15% Fall This Year?

- After A 14% Fall This Year Is 3M Stock A Better Pick Over Honeywell?

- What’s Next For 3M Stock After A 24% Fall This Year?

- Should You Pick Starbucks Over 3M Stock For Next Three Years?

- What’s Happening With 3M Stock?

- Will 3M See A Sharp Decline In Q2 Earnings?

The Industrials segment of the company serves markets like automotive original equipment manufacturer (OEM), automotive aftermarket, electronics and automotive electrification, food and beverage, appliance, paper and printing, packaging, and construction. The company has several products in the segment like tapes, abrasives, adhesives, advanced ceramics, sealants, specialty materials, purification, closure systems for personal hygiene products, acoustic systems products, and components and products that are used in the manufacture, repair, and maintenance of automotive, marine, aircraft, and specialty vehicles. The industrial segment is spread out globally. Currently the global situation is a bit sensitive with the continued trade war between US and China, upcoming Brexit, tensions between India and Pakistan, which will also include China. All these political factors can contribute to a near term slowdown in the global economy.

As 3M is a very diversified company, a slowdown in a specific geographic area would not affect the company substantially, but a global slowdown might. So, in this scenario we will ascertain the effect on 3M’s revenue and valuation if the revenues from the industrial segment remains flat till the year 2021 due to a global slowdown. In the case if the revenue continues to remain at $11.36 billion till FY 2021, we estimate a 3% downside in the share price at the same P/E multiple and Net Income margin. The total revenue for FY 2021 would decrease from the estimated $35.92 billion to $34.85 billion. The Industrial segment is the highest revenue contributing segment for 3M, but it is expected to have moderate growth in the near term, and thus the growth remaining flat is not substantially affecting the share price.

What’s behind Trefis? See How It’s Powering New Collaboration and What-Ifs

For CFOs and Finance Teams | Product, R&D, and Marketing Teams

Like our charts? Explore example interactive dashboards and create your own.