Macau Should Continue To Drive Growth For MGM Resorts

Despite missing consensus earnings estimates, MGM Resorts (NASDAQ: MGM) delivered a decent Q4, ending the year on a positive note. Revenues for the quarter came in about 17% higher than the year ago period, driven by marked improvement at both gaming and non-gaming facilities across both its domestic and Macau properties. As expected, much of this revenue growth was largely driven by contributions from two new casinos – MGM Springfield and MGM Cotai – as well as growth in both mass market and VIP games in Macau, owing to the opening of MGM Cotai and the addition of VIP junket rooms. As a result, Macau revenue was up nearly 33% year-on-year to just over $687 million, forming about 22% of the company’s net revenues. In addition, MGM’s domestic revenues grew by nearly 10% to slightly under $2.2 billion, largely due to improved visitations, better than expected occupancy rate (up 4% y-o-y) and RevPAR (up 8% y-o-y) – as a result of the opening of MGM Springfield. Further, we expect its newly opened casinos to be the driving force in the near term. Additionally, the remodeled Park MGM casino and NoMad floors, coupled with the recently opened Eataly, should provide for decent near-term opportunities. In addition, the company announced its “MGM 2020” plan, with the focus of improving margins, reducing costs, and driving revenue growth through varied digital ventures, which should help improve the guest experience through data, pricing, digital and loyalty capabilities. Moreover, its acquisition of Empire City in New York should not only help the company tap into the underserved New York market, but also help complement its MGM Springfield casino – driven by cross marketing opportunities. This, coupled with the soon to be acquired Northfield Park in Ohio, should expand its domestic portfolio and provide for decent medium term opportunities. Below we take a look at what to expect from the company in 2019. We have a $35 price estimate for MGM’s stock, which is slightly higher than the current market price. We are in the process of updating our model based on Q4 results. Our interactive dashboard on what to expect from MGM Resorts in 2019 details our expectations for the company’s 2019 earnings. You can modify the charts in the dashboard to gauge the impact that changes in key drivers for MGM would have on the company’s earnings and valuation, and see all of our Consumer company data here.

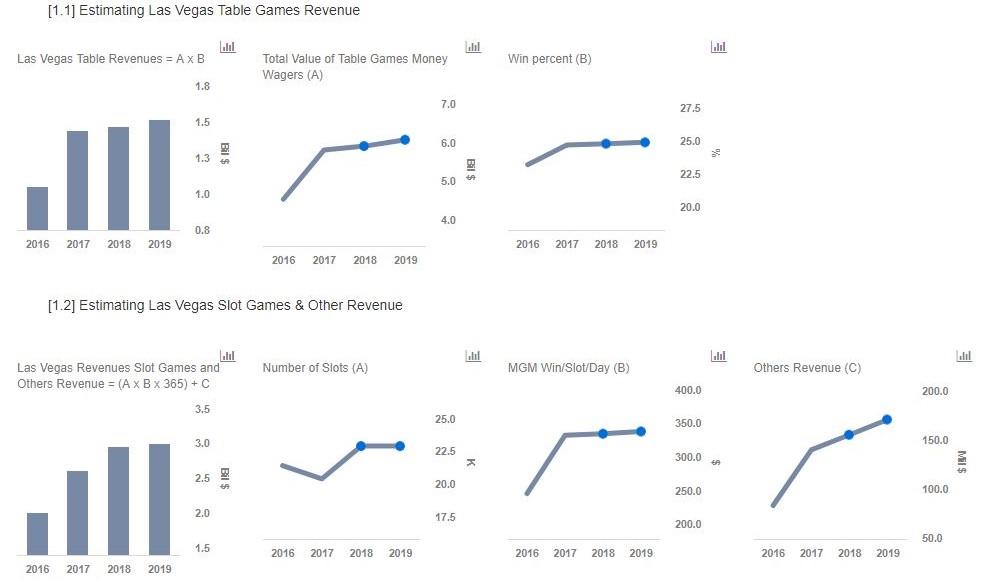

We have a $35 price estimate for MGM’s stock, which is slightly higher than the current market price. We are in the process of updating our model based on Q4 results. Our interactive dashboard on what to expect from MGM Resorts in 2019 details our expectations for the company’s 2019 earnings. You can modify the charts in the dashboard to gauge the impact that changes in key drivers for MGM would have on the company’s earnings and valuation, and see all of our Consumer company data here.

What’s behind Trefis? See How It’s Powering New Collaboration and What-Ifs

For CFOs and Finance Teams | Product, R&D, and Marketing Teams

- A Strong Vegas Business And Recovery In Macau Will Drive MGM’s Q2 Results

- What’s Happening With MGM Resorts Stock?

- Up 16% Over The Past Month, What’s Next For MGM Stock?

- With A Strong Vegas Business And A Possible Recovery In Macau, What’s Next For MGM Stock?

- What’s Next For MGM Resorts After A Strong Q2?

- What’s Happening With MGM Resorts Stock?

Like our charts? Explore example interactive dashboards and create your own.