Here Are The Biggest Takeaways From MGM’s Q3

MGM Resorts (NASDAQ: MGM) reported better than expected Q3 results on October 30, comfortably beating consensus estimates. The strong performance was largely due to contributions from two new resorts – MGM Springfield and MGM Cotai. Revenues in the quarter came in just over 7% higher than the year ago period, while diluted earnings per share came in at 26 cents (flat y-o-y). MGM’s domestic revenues fell by about 1.5% y-o-y to slightly over $2.23 billion, largely due to a tougher year-on-year comparison – due to increased visitation from the blockbuster McGregor v. Mayweather boxing match last year – a slowdown in visitations, lower occupancy rates (down 2% y-o-y) and RevPar (down 4% y-o-y), partially offset by strong performance of MGM Springfield. Much of the revenue growth came from Macau, largely driven by robust growth in both mass market and VIP games. Macau revenue was up nearly 37% year-on-year to just over $606 million, forming nearly 20% of the company’s net revenues.

The opening of NoMad, and Eataly later this year, coupled with increased conventions, should improve MGM’s gaming and non-gaming services in the domestic market in Q4. However, we expect to see some pressure in its domestic operations in Q4, driven by increased expenses of surrounding its newly opened MGM Springfield resort, renovation of Park MGM, and further time required to recover at Mandalay Bay. Additionally, MGM’s multi-year partnership with NHL and NBA should further boost its gaming revenue and provide decent medium term growth opportunities. Further, MGM’s recently signed deals with Ladbrokes and Boyd Gaming give the company a strong foothold in the sports betting market and should provide decent long-term growth opportunities.

- A Strong Vegas Business And Recovery In Macau Will Drive MGM’s Q2 Results

- What’s Happening With MGM Resorts Stock?

- Up 16% Over The Past Month, What’s Next For MGM Stock?

- With A Strong Vegas Business And A Possible Recovery In Macau, What’s Next For MGM Stock?

- What’s Next For MGM Resorts After A Strong Q2?

- What’s Happening With MGM Resorts Stock?

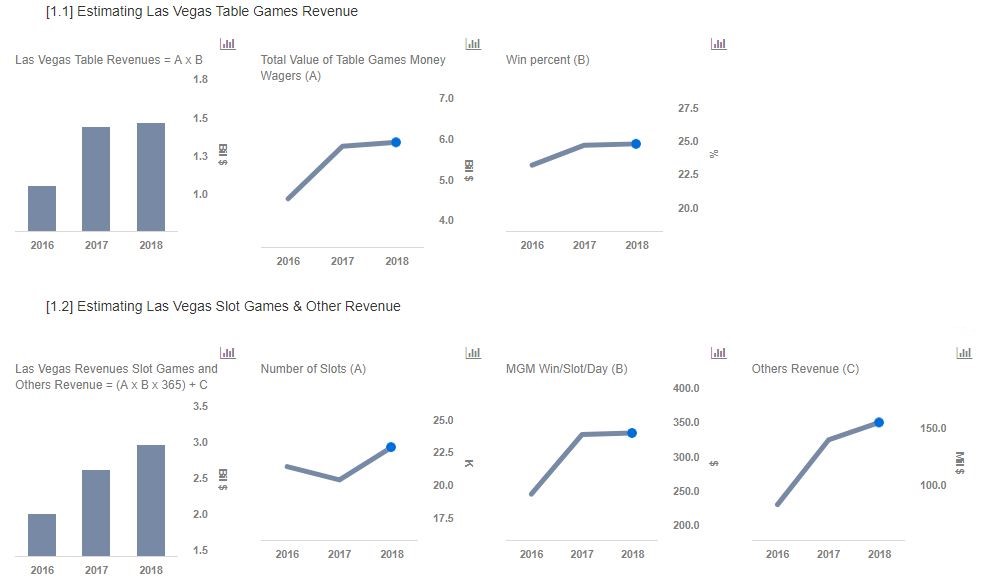

We have updated our model – cutting our price estimate for MGM Resorts slightly to $35, which is still significantly higher than the market price, based on the expected performance of the industry. Our interactive dashboard analysis on MGM’s Performance In Q3 And Expectations For 2018 details our expectations for the company. You can modify the different driver assumptions, and gauge their impact on the company’s earnings and valuation.

We have updated our model – cutting our price estimate for MGM Resorts slightly to $35, which is still significantly higher than the market price, based on the expected performance of the industry. Our interactive dashboard analysis on MGM’s Performance In Q3 And Expectations For 2018 details our expectations for the company. You can modify the different driver assumptions, and gauge their impact on the company’s earnings and valuation.