How Will MGM Resorts Perform In The Second Half Of 2018?

MGM Resorts (NASDAQ: MGM) announced its Q2 earnings on August 2, missing on both earnings and revenue consensus estimates. Revenues in the quarter came in just under 8% higher than the year ago period, while diluted earnings per share came in at 21 cents (compared to 36 cents in the prior quarter). Las Vegas revenues remained fairly flat and came in at slightly under $2.2 billion, largely due to the slowdown in visitations. Much of the revenue growth came from Macau, largely driven by robust growth in both mass market and VIP games. Macau revenue was up nearly 32% year-on-year to just over $561 million, forming nearly 20% of the company’s net revenues. However, the company expects to see some pressure in its Vegas operations in Q3, driven by ongoing transformation of the Park MGM, fewer citywide conventions, and additional time required to recover at Mandalay Bay. The remodeling of Park MGM and NoMad floors, and the opening of Eataly later this year, coupled with increased conventions, should improve gaming and non-gaming services in the domestic market in Q4. Further, MGM’s recently signed deals with Ladbrokes and Boyd Gaming give the company a strong foothold in the sports betting market and should provide decent long-term growth opportunities. Below, we take a look at what to expect from MGM in the second half of 2018.

We have created an interactive dashboard analysis which outlines our expectations for MGM Resorts in the second half of 2018. You can modify the key drivers to arrive at your own price estimate for the company.

- A Strong Vegas Business And Recovery In Macau Will Drive MGM’s Q2 Results

- What’s Happening With MGM Resorts Stock?

- Up 16% Over The Past Month, What’s Next For MGM Stock?

- With A Strong Vegas Business And A Possible Recovery In Macau, What’s Next For MGM Stock?

- What’s Next For MGM Resorts After A Strong Q2?

- What’s Happening With MGM Resorts Stock?

Las Vegas contributes nearly 75% of the company’s overall revenue and has seen its revenue grow by under 1% to $4.26 billion in the first half of 2018. This was largely due to the slowdown in visitations, which impacted the company’s Hotel and Other revenue on a comparable basis. Despite the slowdown, MGM saw robust growth in Table games and Slot revenue on a comparable basis. In addition, company’s newest property, MGM National Harbor, was the standout performer in the first half of 2018. The company expects some pressure in Q3’18, largely due to fewer citywide conventions on a comparable basis. However, stronger than expected citywide conventions in Q4’18 should drive domestic resorts to grow in mid single digits in the second half of 2018. Further, the recently opened MGM Springfield, its Massachusetts resort, should boost Q4’18 revenue and provide for significant medium term growth. However, MGM expects to see some near term pressure in the Monte Carlo casino due to the ongoing transformation, which should likely impact company’s margins. We expect the domestic market to remain the driving force led by the improved outlook of the U.S. economy, coupled with several citywide conventions, recovery in the Vegas market – owing to recent tax cuts and higher customer spending – and its expansion into Massachusetts. This should boost the domestic revenue in the second half of the year.

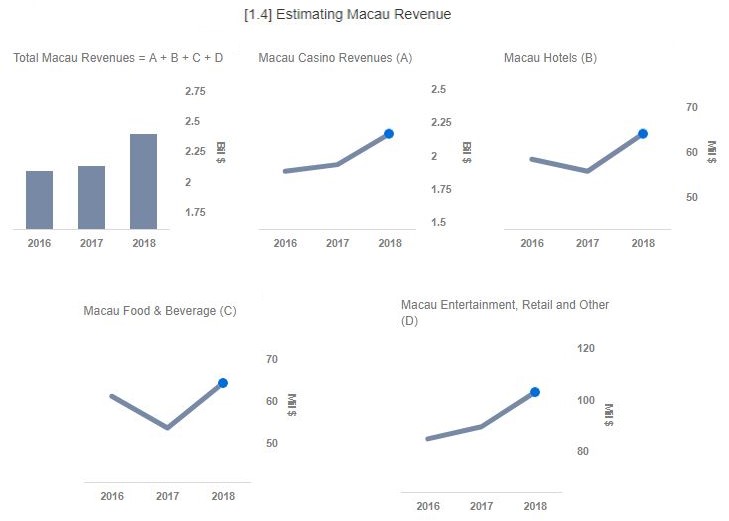

Macau continued its strong performance in Q2, as revenue improved as a result of robust growth in casino revenue – both VIP and Mass market, mainly due to increased visitations in the recently opened MGM Cotai. However, the margins decreased by slightly under 600 basis points to 23.5% due to MGM Cotai not yet attaining normalized business operations. Further, the gross gaming revenues (GGR) in Macau were slightly impacted by the FIFA World Cup, resulting in fewer visitations. Despite this, the GGR grew by nearly 17% y-o-y this quarter, indicating a strong first half. The Cotai strip has been witnessing strong traffic and higher occupancy rates, driven by the most recent addition of MGM Cotai. Further, the proposed opening of MGM Cotai’s VIP junket rooms, coupled with the opening of The Mansion – high-end villas and President’s Club – an exclusive gaming arena for premium mass market customers later this year should boost Q4’18 revenue and provide for decent medium term growth. We expect Macau to contribute significantly to MGM’s growth in second half of 2018, as a result of the recovery in gross gaming revenues (GGR) post-World Cup. The Macau GGR grew consistently for the 25th straight month in August 2018. In addition, the various new infrastructure developments in Macau should boost the mass market business for the company. Given the improved outlook of the casino market in Macau, we expect another strong year for MGM in Macau driven by rising outbound travel and strong spending growth.