What Is McDonald’s Expected Revenue And EBITDA in FY 2019?

McDonald’s (NYSE: MCD) released its full year results on January 30, 2019. The company beat the consensus earnings but missed slightly on revenue for the 4th Quarter. This was primarily due to the refranchising of its restaurants that has been under process for a couple of years mow. The company’s long-term goal is for 95% of McDonald’s restaurants to be owned by franchisees, and at the end of FY 2018, this figure stood at 92.7%. Overall the company posted revenue of $21.03 billion while earnings were at $7.50, up 18% year on year (YOY) as the refranchising strategy has also helped them in cutting down costs and thus improving margins. Global comparable sales also improved by 4.5% YOY.

Based on Trefis analysis, we have maintained our long-term price estimate for McDonald’s at $196, which is around 5% ahead of the current market price. We have created an interactive dashboard on McDonald’s Revenue And EBITDA Breakdown, which details our forecasts for the company in the near term. You can modify our assumptions to see the impact any changes would have on the company’s revenue and EBITDA. In addition, here is more Consumer Discretionary data.

- What To Expect From McDonald’s Q4 After Stock Up 13% Since 2023?

- After A 14% Top-Line Growth In Q2 Will McDonald’s Stock Deliver Another Strong Quarter?

- What To Expect From McDonald’s Stock Post Q2 Results?

- McDonald’s Stock Likely To Trade Lower Post Q1 Results

- McDonald’s Stock Up 16% Over Last Year, Can It Grow More?

- What To Expect From McDonald’s Stock Post Q4?

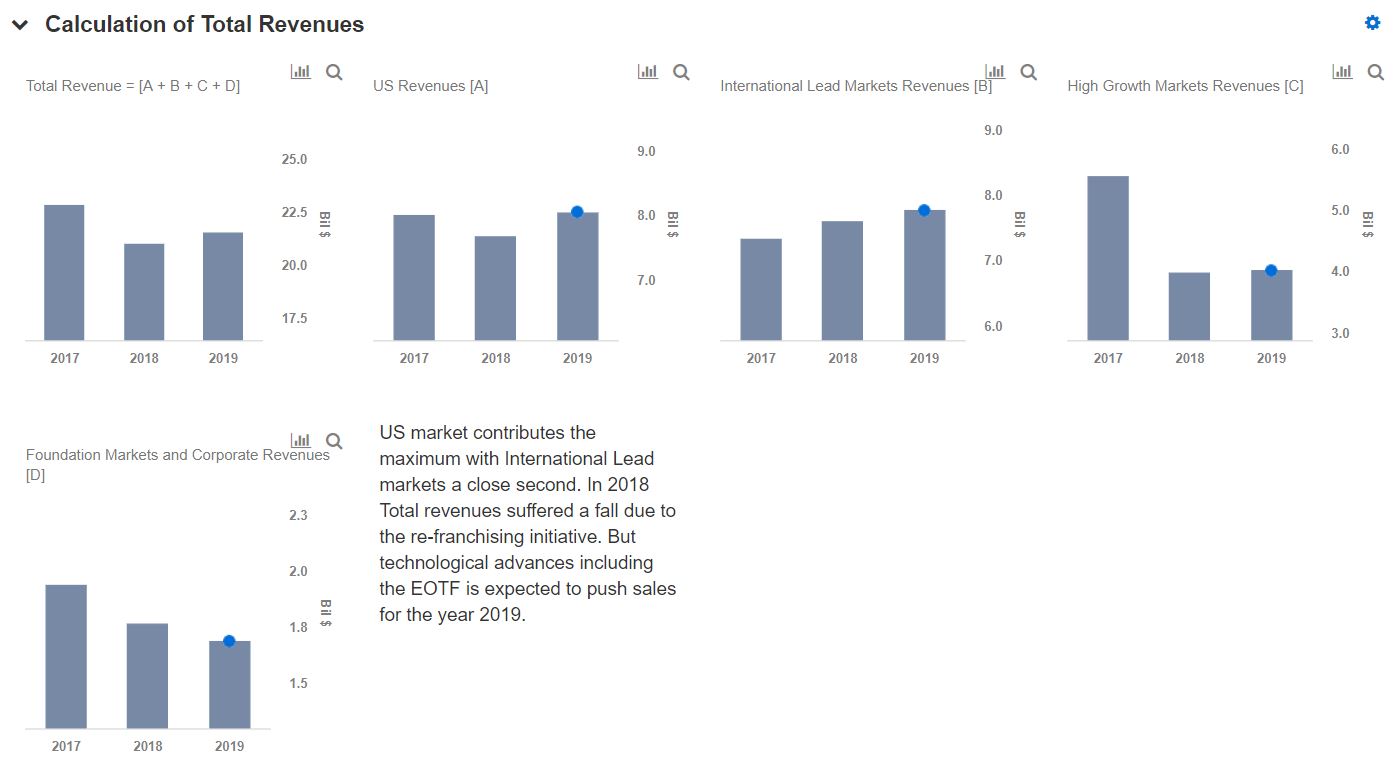

Overall we expect the company to generate around $21.5 billion in revenues, up by 2.3% year on year and $11.5 billion in EBITDA, up by nearly 12% year on year. Out of the total expected revenues from 2019, $8.05 is expected from the US segment, closely followed by International Lead Markets segment at $7.8 billion. For High growth markets our estimate is $4.01 billion while for Foundation Markets and corporate it is $1.7 billion. The overall revenue is still less than the number achieved in FY 2017 mainly due to the refranchising strategy of the company which translates into better earnings but lesser growth or negative growth in the near term in the top line.

In the US the company is executing significant initiatives in making foundational changes in the business and staying focused on the customers. Still, in 2018, they grew sales while continuing to invest billions of dollars in the restaurants. In 2019 we expect them to continue the growth for revenue and also improve the EBITDA margin. International lead market segment grew on the back of UK, where they now have 51 consecutive quarters of like-for-like sales growth with simultaneously increasing its share, and Australia with offerings such as the successful all-day favorites and the benefit of rising delivery sales. We expect these two regions to continue to add to the growth of the segment. We saw a fall in EBITDA and revenue of High growth markets in 2018 due to an impairment charge and refranchising in China and HongKong. Moving forward in 2019 we expect the segment to gain its previous traction and improve its EBITDA margin, too. Foundation Markets and Corporate saw a fall in EBITDA and revenue. The fall was mostly driven by higher investments in technology in the corporate segment and the company expects the same to continue for another year before the segment stabilizes.

Overall, McDonald’s is expected to do well in FY 2019 in terms of revenue and earnings on the back of refranchising, technological initiatives, new launches, and increasing share in certain markets.

What’s behind Trefis? See How It’s Powering New Collaboration and What-Ifs

For CFOs and Finance Teams | Product, R&D, and Marketing Teams

Like our charts? Explore example interactive dashboards and create your own.