McDonald’s Reports Good Results, To Continue Growth in 2019

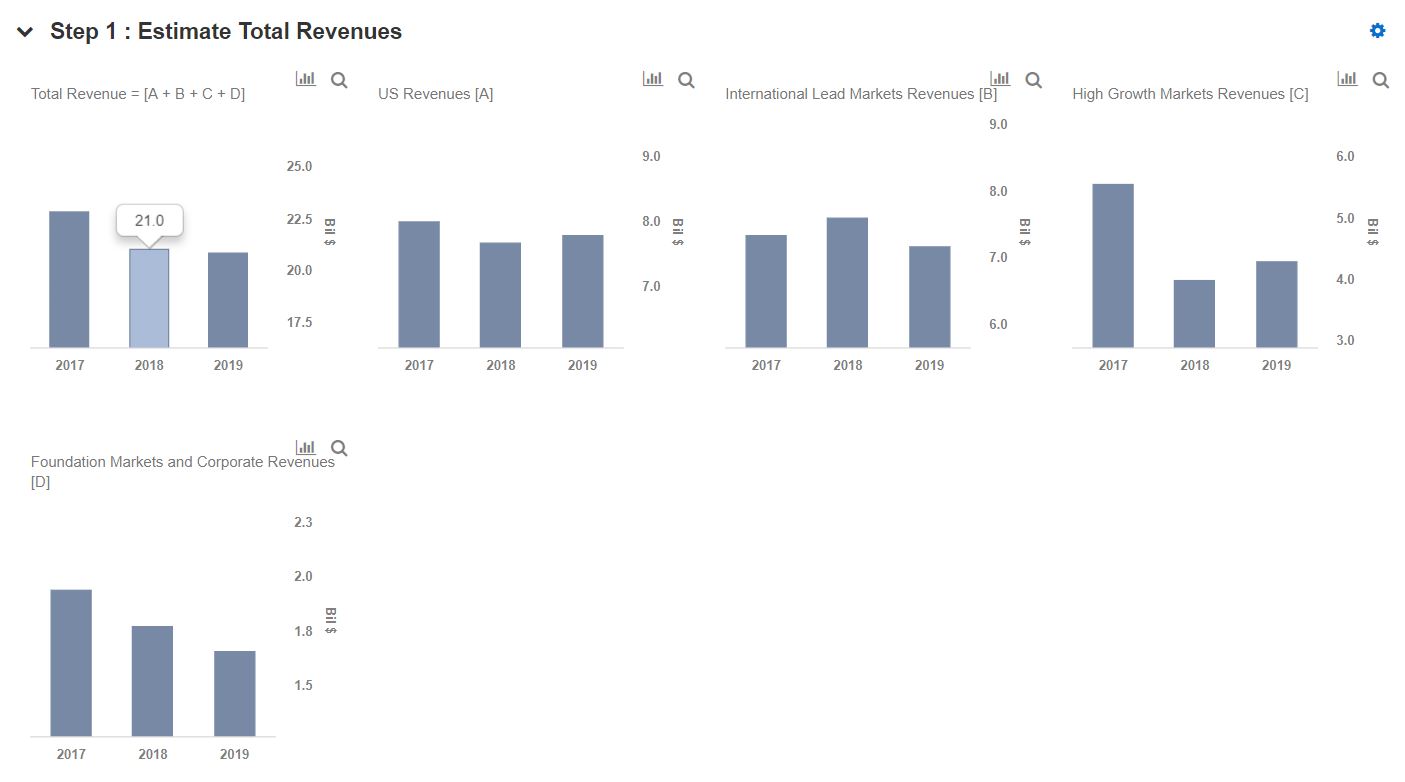

McDonald’s (NYSE: MCD) released its full year results on January 30, 2019. The company beat the consensus earnings but missed slightly on revenue for the 4th Quarter. This is primarily due to the refranchising of its restaurants that the company has been undertaking for a couple of years. The company’s long-term goal is for 95% of McDonald’s restaurants to be owned by franchisees, and at the end of FY 2018, this figure stood at 92.7%. Overall the company posted revenue of $21.03 billion with earnings of $7.50, up 18% year on year (YOY) as the strategy has also helped them in cutting down costs and thus improving margins. Global comparable sales also improved by 4.5% YOY.

We have a $191 price estimate for McDonald’s. The charts have been made using our new, interactive platform. The various driver assumptions can be modified by clicking here for our interactive dashboard on Our Outlook For McDonald’s in FY 2019, to gauge their impact on the revenue, earnings, and price per share metrics.

- What To Expect From McDonald’s Q4 After Stock Up 13% Since 2023?

- After A 14% Top-Line Growth In Q2 Will McDonald’s Stock Deliver Another Strong Quarter?

- What To Expect From McDonald’s Stock Post Q2 Results?

- McDonald’s Stock Likely To Trade Lower Post Q1 Results

- McDonald’s Stock Up 16% Over Last Year, Can It Grow More?

- What To Expect From McDonald’s Stock Post Q4?

Factors That May Impact Future Performance:

Refranchising Restaurants: This strategy has been afflicting the company’s revenues for a number of quarters now. Although, as mentioned, it has had a positive impact on the earnings. Another benefit of the franchise model is that the company can take advantage of the significant real estate portfolio it has built up over the years, and collect rent and royalty income.

Technology Initiatives: McDonald’s is revamping its stores to create “Experience Of The Future” restaurants which will have self-serve kiosks and table service. This is expected to be substantially complete by the end of 2020. The mobile ordering and payment system are expanding at a rapid pace and they are also effectively using the data captured via this platform for personalized marketing and customizations. The company has also partnered with UberEats and introduced delivery services. CFO Kevin Ozan has stated that the delivery check size is generally one-and-a-half to two times the in-store check. Consequently, an effective use of technology is another key growth factor for McDonald’s, as it can drive the average check higher. The delivery momentum has continued with 19,000 restaurants already providing delivery services.

New Launches: The company has also launched its premium burgers in other countries, such as Gourmet Creations in Australia and Mighty Angus in Canada. Increased sales of these products can help to increase the average revenue per consumer. The U.S. is following up by offering Bacon Big Macs and Quarter Pounders as well as cheesy bacon fries. In December the company also announced that they are partnering with suppliers and beef producers to reduce the overall use of antibiotics in the beef supply chains.

Positive Industry Environment: According to insights provided by TDn2K’s Black Box Intelligence, year-over-year restaurant same-store sales increased 2% in December which is the best monthly performance in over three years. On the other hand, the guest count metric continued to be weak, with store traffic declining 0.9% during the month, and 1.6% in the quarter. Although the average guests checks grew by 3.1% during the fourth quarter year over year. McDonald’s enjoyed a second successive year of growth in the number of guests.

In conclusion, McDonald’s has had a strong Fiscal Year 2018 and is expected to continue to build on the momentum in Fiscal 2019. ‘Experience Of The Future’ restaurants and higher Delivery equipped restaurants will be the forefront in the next fiscal year.

What’s behind Trefis? See How it’s Powering New Collaboration and What-Ifs

For CFOs and Finance Teams | Product, R&D, and Marketing Teams

Like our charts? Explore example interactive dashboards and create your own.