Will Transaction Volume Growth Continue To Drive MasterCard’s 3Q’18 Results?

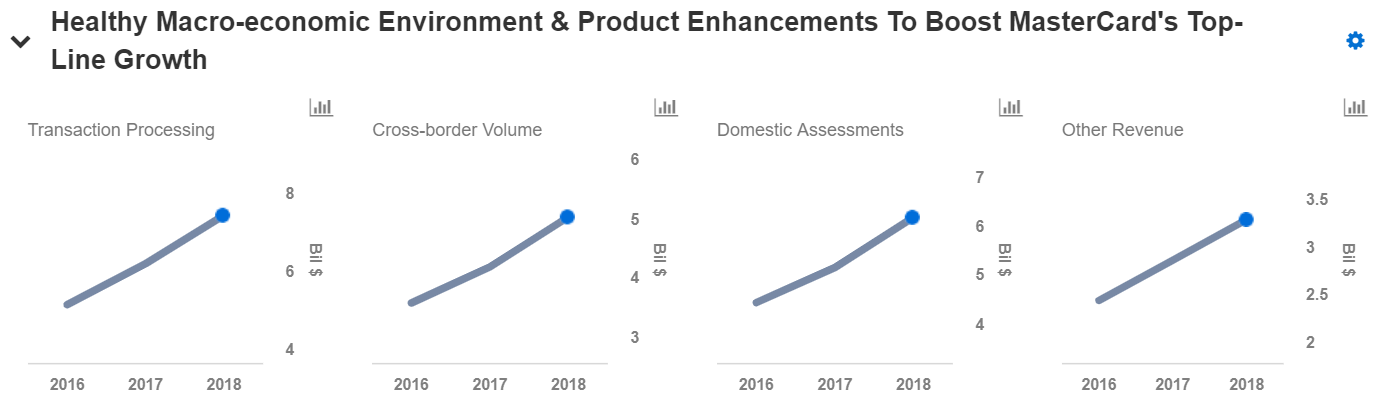

American financial services company MasterCard (NYSE: MA) is expected to release its third quarter financial results on 30th October 2018. The market expects the company to report a steady growth in its revenue (net of client incentives) for the quarter, backed by double digit growth in payments volume and processed transactions both in domestic and international markets. Further, the company’s focus on expanding its network of co-branding partners and improving technology to compete in the online payments segment will complement its top-line as well as bottom-line. Accordingly, the company expects to deliver high-teen revenue growth for 2018, driven by a healthy macro-economic environment and the company’s efforts to expand its product offerings.

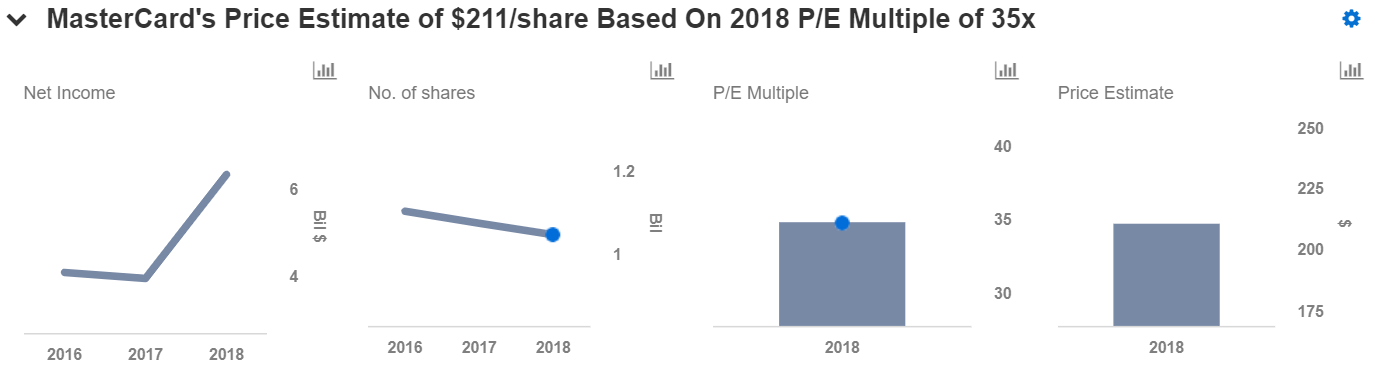

We currently have a price estimate of $211 per share for MasterCard. View our interactive dashboard – MasterCard’s Price Estimate – and modify the key drivers to visualize the impact on its valuation.

Key Trends To Watch For In 3Q’18

- Similar to the previous quarters, MasterCard’s revenue growth is likely to be driven by its transaction revenue. The company is expected to witness double-digit growth in its transaction volumes due to the favorable macro-economic environment.

- Further, the company’s focus on improving technology to enhance payments and securitize the process should enable it to expand its customer base and co-branding partners, which could further drive growth in volumes and revenues. For example, the company’s partnerships with PayPal, Bank of America, Santander, and Banque Travelex, among others, should enable it to grow its volumes at a steady rate going forward.

- Driven by these strategic relationships, MasterCard expects to deliver high teen revenue growth in 2018 and beyond, while its operating expenses are expected to grow in mid-teens.

- MasterCard has been actively enhancing its product portfolio in order to drive its top-line growth. Last quarter, the company expanded its existing solution – Mastercard B2B Hub – that currently optimizes accounts payable payments for small and medium-sized businesses in the US, to offer similar automation capabilities to mid-sized and larger businesses.

- Further, the company launched its inControl solutions for commercial payments and business travel in Italy with Nexi to expand its presence in the new geography. We believe that the company’s efforts to enhance its product offerings are likely boost its top-line growth as well as valuation in the coming years.

Disagree with our forecasts? Create your own price estimate for MasterCard by changing the base inputs (blue dots) on our interactive dashboard.

What’s behind Trefis? See How it’s Powering New Collaboration and What-Ifs

For CFOs and Finance Teams | Product, R&D, and Marketing Teams

Like our charts? Explore example interactive dashboards and create your own.