MasterCard’s Profits Surge Backed By Strong Transaction Volume Growth

American financial services company, MasterCard (NYSE: MA), posted solid second quarter financial results, backed by the strong global macro-economic environment that augmented transaction volume growth. Further, the company’s focus on expanding its network of co-branding partners and improving technology to compete in the online payments segment augmented its top-line as well as bottom-line. The company expects to deliver high-teen revenue growth for 2018 driven by a healthy macro-economic environment and the company’s efforts to expand its product offerings.

We currently have a price estimate of $211 per share for MasterCard. View our interactive dashboard for MasterCard and alter the key drivers such as revenue and earnings to visualize the impact on its valuation.

Key Highlights of 2Q’18 Results

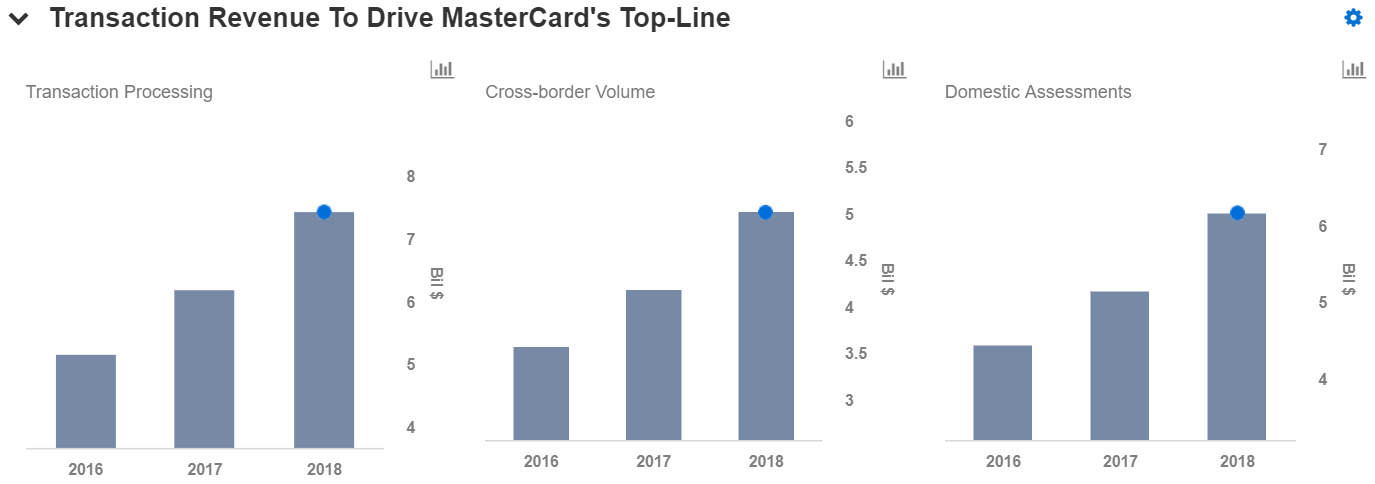

- MasterCard’s 2Q’18 revenue rose 14% (nominal basis) primarily driven by strong volume and transaction growth as well as growth in services. Cross-border volume grew around 19% due to the double digit growth in all the regions, particularly Europe.

- The company’s total operating expenses increased 6% (excluding special items on a currency neutral basis), due to the investments in strategic initiatives, such as digital infrastructure, safety and security platforms, data analytics, and geographic expansion.

- MasterCard continued to grow the network of its co-branding partners. For instance, the company won the L.L.Bean consumer credit program, and renewed its relationship with Hawaiian Air for both consumer and business co-brand cards. In addition, the company also partnered with leading healthcare company, Anthem, and cemented a strategic relationship with JPMorgan Chase.

- The company expects to deliver high teen revenue growth for 2018 driven by a healthy macro-economic environment and the company’s efforts to expand its product offerings. Further, it expects its operating expenses to grow in mid-teens for the full fiscal year 2018.

Disagree with our forecasts? Create your own price estimate for MasterCard by changing the base inputs (blue dots) on our interactive dashboard.

What’s behind Trefis? See How it’s Powering New Collaboration and What-Ifs

For CFOs and Finance Teams | Product, R&D, and Marketing Teams

Like our charts? Explore example interactive dashboards and create your own.