How Will Las Vegas Sands Perform In Second Half Of 2018?

Las Vegas Sands (NASDAQ: LVS) announced its Q2 earnings on July 25, reporting solid growth in its earnings and revenue, yet the stock fell by about 4% as earnings missed estimates. Revenues in the quarter came in just over 6% higher than the year ago period, while adjusted earnings per share came in at 73 cents (+ 4% year-on-year). Much of the revenue growth came from Macau, largely driven by robust growth in both mass market and VIP games. Macau revenue was up nearly 18% year-on-year to $2.1 billion, forming nearly 64% of the company’s net revenues. However, Singapore revenue fell by about 8% year-on-year to $705 million, as a result of a significant fall in VIP visitations, despite robust growth in mass market. We believe the company is likely to benefit from suite additions at the Parisian Macau, St Regis and Four Seasons properties, and the renovation of VIP gaming areas at the Venetian and Plaza Macau. This should drive the company’s full year results. Below, we provide a brief overview of the company’s results and what lies ahead.

- With The Stock Flat This Year, Will Q1 Results Drive Las Vegas Sands Stock Higher?

- Down 13% In Last Six Months, Will Macau Recovery Over Q4 Drive Las Vegas Sands Stock?

- Las Vegas Sands Stock Has Remained Flat This Year Despite Macau Recovery. What’s Next?

- Macau Recovery Will Drive Las Vegas Sands Q2 Results

- Singapore Strength And Macau Rebound Drive Las Vegas Sands Q1. What’s Next For The Stock?

- Is Las Vegas Sands Stock A Buy With Macau On Cusp Of Recovery?

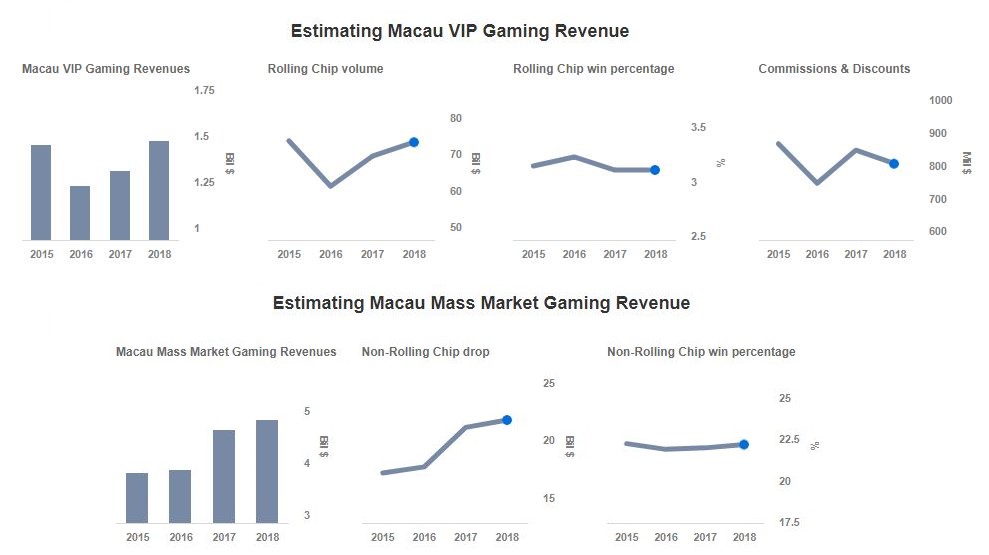

We have created an interactive dashboard analysis which outlines our expectations for Las Vegas Sands over 2018. You can modify the key drivers to arrive at your own price estimate for the company.

We have created an interactive dashboard analysis which outlines our expectations for Las Vegas Sands over 2018. You can modify the key drivers to arrive at your own price estimate for the company.