Southwest Q4 Earnings: Beats On Earnings; Promising Start To 2018

Southwest Airlines (NYSE:LUV) managed to post a better-than-expected earnings this time around. The company saw revenues and earnings beat the consensus estimates. Revenues were driven by increased passenger demand from the holiday season. Earnings in the quarter benefitted from better operational efficiency. Further, like many of its competitors, the airline realized a $1.4 billion one time benefit to its net income on the recent corporate tax cut. To celebrate this moment, the company paid out about $70 million in bonuses to its employees.

Looking ahead, it looks as though the company is poised for healthy year-over-year revenue growth for much of the next year. The company’s main aim is to maintain positive unit revenues throughout 2018.

The graphs below have been created using Trefis Dashboards.

- What’s Behind The 15% Fall In Southwest Airlines Stock Earlier This Week?

- What’s Next For Southwest Stock After A 20% Rise This Year?

- Gaining 20% In 2023 Will Delta Continue To Outperform Southwest Stock?

- Will Southwest Airlines Stock Recover To Its Pre-Inflation-Shock Level?

- Here’s A Better Pick Over Southwest Airlines Stock

- Southwest Airlines Stock Has Shed 30% Since Late 2019: Here’s Why

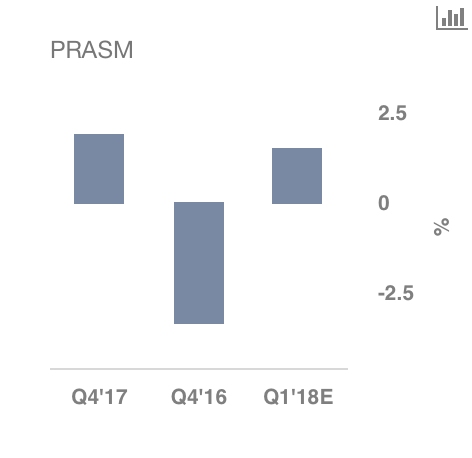

- Unit revenues in the quarter were up almost 1.9%, driven primarily on better-than-expected demand for air travel through the holidays. As mentioned previously, the company aims to maintain positive unit revenues going forward. In this respect, it expects the key metric to lie between 1-2% for the first quarter of 2018.

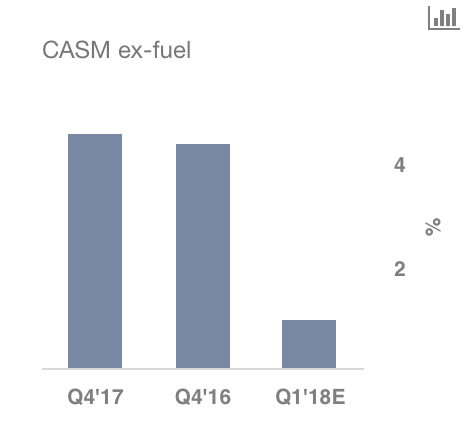

- Additionally, the company hopes to begin flights to Hawaii very soon. Salaries and advertising in this respect came in higher than usual leading to a 4.6% increase in ex-fuel CASM. That said, CASM ex-fuel is expected to only grow in the range of 0.5-1.5% in Q1 2018.

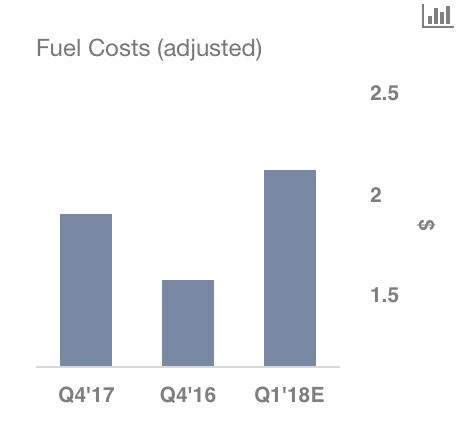

- The company’s earnings were hurt on rising costs that rising fuel costs. In the quarter, it reported fuel expenses to the tune of $2.09, of which, $0.19 represented fuel hedging losses. However, management is certain that the losses are behind them, and that 2018 will see better protection against cash drop prices and energy prices without the forward exposure. In Q1, the company is expecting to see fuel prices rise by about $2.10-$2.15.

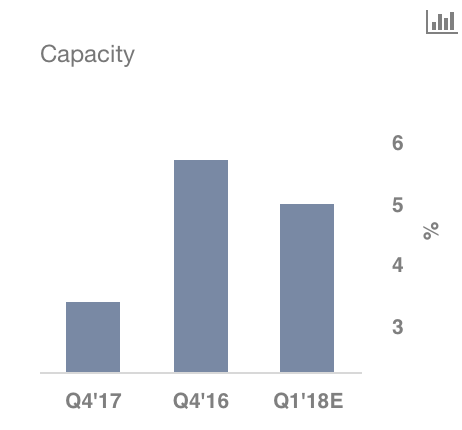

- Like much of its competition, Southwest too, is looking to increase capacity going forward. The company aims to increase the key metric by about 5% for the full-year. This comes at a time when legacy airlines have decided to up their capacity growth significantly in order to maintain market share.

View Interactive Institutional Research (Powered by Trefis):

Global Large Cap | U.S. Mid & Small Cap | European Large & Mid Cap