Lululemon: Management’s Strategy Turning The Company Around?

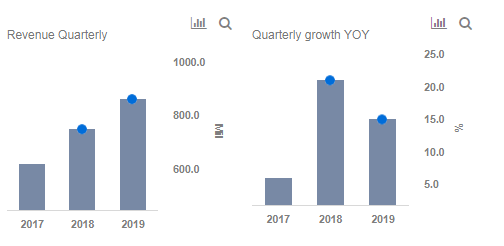

Lululemon (NASDAQ: LULU) had an impressive quarter, with sales growing 21% to $748 million, and sales rising by 17% on a constant dollar basis. Lululemon’s management’s strategy, that it laid about in previous quarters, is starting to pay-off. It is important to note Lululemon’s strategy of direct to consumer sales is paying-off. With that said, the stock continues to trade higher than our target price, which reflects what we estimate is a fair value considering expected earnings in the coming quarters.

We currently have a price estimate of $90 per share, which is 21% lower than the market price. You can use our interactive dashboard Lululemon’s Impressive Results? to modify key drivers and visualize the impact on Lululemon’s price estimate.

- Lululemon’s Stock Down 34% YTD, What’s Happening?

- Down 9% This Year, What’s Next For Lululemon’s Stock Past Q4 Results?

- Lululemon Stock Up 52% In Past Year. What Should You Expect Now?

- Will Lululemon Stock Trade Higher Post Q2?

- Will Lululemon Stock See Higher Levels Post Q1?

- Earnings Beat In The Cards For Lululemon Stock?

Lululemon can attribute the impressive turn around in the quarter for executing its previously outlined strategy. Management reiterated that it will continue to focus on a more consolidated product line, with increased emphasis on women’s wear. This should help operational efficiency, and improve Lululemon to focus its branding.

The company has also emphasized improving their sales channels. Collaborating on both brick and mortar and their direct to consumer channels. Customers now have an option of buying their product online, and picking it up at the store.

Furthermore the company’s increased focus on the North American market,rather than spreading themselves out too thin by aggressive expansion into foreign markets, meant sales have seen an upswing in the current quarter. Regardless, the company continues to emphasis the Greater China market, and expansion into surrounding areas like Hong Kong. Furthermore, Lululemon has avoided making the mistakes it made in the North American markets, recognizing the need for a digital emphasis, as 400 million millennials in China are adept at using digital platforms to do their shopping.

What’s behind Trefis? See How It’s Powering New Collaboration and What-Ifs

For CFOs and Finance Teams | Product, R&D, and Marketing Teams

Like our charts? Explore example interactive dashboards and create your own.