What Are Lululemon’s Main Sources Of Revenue?

Lululemon Athletica (NASDAQ:LULU) is one of the leading sports apparel manufacturers in the world. In particular, the company has established itself as one of the premier brands for yoga pants and sports bras. Its financials were really bolstered in the recent past on a huge push for athleisure wear, that took the world by storm. This phenomenon, driven primarily by the clothing choices of millennials, has allowed the company to capitalize on a still nascent market, establishing itself as major contender in the space.

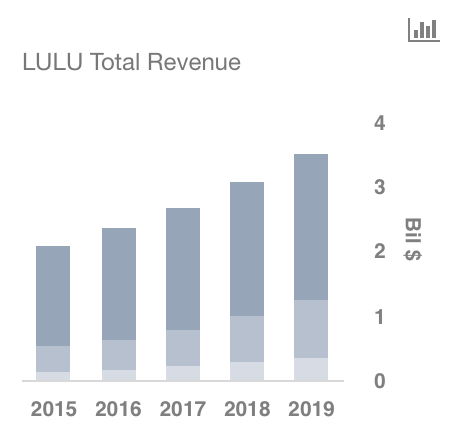

So far in the year, the company has managed to post stellar results. In general, financials were driven by continued implementation of its growth strategies, strong men’s and digital performance, coupled with strong synergies from its website. But what are the main sources of revenue for the company?

To best explain this, we have created an interactive dashboard display titled, Where Does Lululemon Derive Its Revenues? Please click on the link to learn more.

- Lululemon’s Stock Down 34% YTD, What’s Happening?

- Down 9% This Year, What’s Next For Lululemon’s Stock Past Q4 Results?

- Lululemon Stock Up 52% In Past Year. What Should You Expect Now?

- Will Lululemon Stock Trade Higher Post Q2?

- Will Lululemon Stock See Higher Levels Post Q1?

- Earnings Beat In The Cards For Lululemon Stock?

Retail

The first of three segments is the company operated stores or retail segment. As of January 2018, Lululemon operates about 408 stores worldwide, with a majority of the stores located in North America. That said, in the recent past, much like its competitors, Lululemon has decided to raise its stake in newer international markets, specifically in Asia. In this respect, the company has increased the number of stores in China from about 6 in 2017 to 15 at present. Further, it has shut down a number of its less successful ivivva brand stores and replaced them with regular stores in the U.S. All these strategies are expected to greatly benefit the segment in the coming quarters.

Direct To Consumer

Direct to consumer is a substantial part of the company’s business, representing approximately 21.8% of the net revenue in fiscal 2017. In today’s world, it is imperative for any company to have a digital presence that quickly and intuitively allows potential customers to learn more about the brand and purchase products. Further, the direct to consumer channel makes the company’s products accessible to more markets than its company-operated store channel alone. Hence, we believe that expanding this segment will be extremely effective in building brand awareness, especially in new markets. With continued investments in this space, we expect DTC to account for a larger part of the revenues in the coming quarters.

Other Channels

Other net revenue accounted for about 8.9% of total net revenue in fiscal 2017, compared to 8.0% in fiscal 2016, and 6.9% of total net revenue in fiscal 2015. Sales in this segment come from five primary channels:

- Outlets and warehouse sales – The company utilizes outlets as well as physical warehouse sales, which are held from time to time, to sell slow moving inventory and inventory from prior seasons to retail customers at discounted prices.

- Temporary locations – Its temporary locations, including seasonal stores, are typically opened for a short period of time in markets in which the company may not already have a presence.

- Wholesale – Wholesale accounts include premium yoga studios, health clubs, and fitness centers. These premium wholesale locations, in essence, offer an alternative distribution channel that is convenient for Lululemon’s core consumer and enhances the image of the brand.

- Showrooms – The showrooms are typically small locations that are opened when the company enters new markets and feature a limited selection of the product offering.

- License and supply arrangements – The company enters into license and supply arrangements from time to time when they believe that it will be to their advantage to partner with companies and individuals with significant experience and proven success in certain target markets.