‘Active Cosmetics’ and ‘Luxe’ Boost Top Line For L’Oreal In Q2 2018

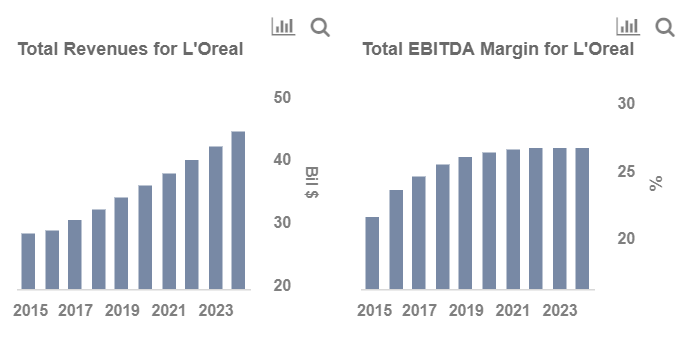

In continuation of its strong performance over the prior few years, L’Oreal (OTCMKTS: LRLCY), the world’s biggest cosmetics company, continued its momentum in Q2 2018 with 6.3% rise in sales to 6.61 Billion euros. The company’s earnings were primarily driven by strong performance in the active cosmetic division, L’Oreal Luxe segments, and emerging new markets, particularly Asia-Pacific which grew +16.8%. All the top brands of the Luxe segment posted more than 10% growth and the Active Cosmetics Division posted double digit growth driven by the success of its La Roche-Posay and SkinCeuticals brands, the new impetus of Vichy, and the dynamism of CeraVe. The Consumer Products Division saw an outstanding performance in China. In the New Markets, especially the Asia Pacific Zone, China’s consumers’ aspirations for iconic brands remained strong.

E-commerce and Travel retail remained strong in Q2. With the acquisition of the Canadian company, ModiFace, the company’s digital acceleration has moved up a gear, which provided the most innovative technologies to enhance services and the beauty experience for all the brands. E-commerce sales have increased strongly and continue to rise rapidly, and now account for 9% of the total sales.

Driven by this strong performance, we expect L’Oreal to post double digit growth in its full fiscal 2018 sales. Please refer to our dashboard analysis Takeaways From L’Oreal’s Q2 2018 Earnings.

- Is There More Room For Growth In L’Oreal Stock?

- After Underperforming The Markets, Can L’Oreal Stock Rally?

- L’Oreal Stock Poised For Bounce Back After Rough Month?

- After Dismal Performance Last Month, L’Oreal Stock Looks Set To Rebound

- L’Oreal Stock Looks Set For A Rally On The Back Of Strong Earnings Growth

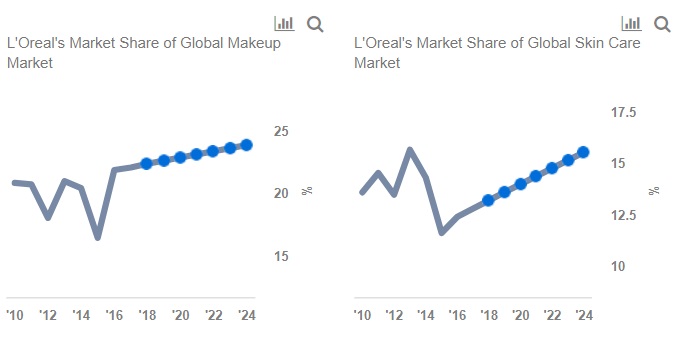

- Forecast Of The Day: L’Oreal Makeup Revenues

Highlights from Q2:

L’Oréal ‘Luxe’ and ‘Active Cosmetics’ Division continue to boost top line – Global growth of the prestige beauty segment is outpacing growth in the mass beauty segment. L’Oreal’s premium brands, as expected, earned the company higher profit margins. L’Oreal’s Luxe Segment delivered a strong 13% growth in Q2, driven by makeup and facial skincare sales in the Asia-Pacific region especially China and Hong Kong, and by Travel Retail. L’Oréal Luxe has made a solid start to the year in Western Europe, particularly in Spain. The division is continuing to perform well in e-commerce.

L’Oreal’s Active Cosmetics segment achieved 12.9% sales growth with La Roche-Posay (launching Hyalu B5), Vichy, CeraVe, and Skinceuticals as the best selling brands. L’Oreal is one of the leading names in the active cosmetics market. In an effort to further grow this segment, L’Oreal’s newly acquired skincare brands, CeraVe, AcneFree, and Ambi have been performing well, too. L’Oreal has the leading market position in Asia and North America, the fastest growing geographies for active cosmetics.

Accelerated growth in new markets of Asia and western Europe boost Sales – Sales from emerging markets which include Asia-Pacific, Latin America, Eastern Europe, Africa and the Middle-East have been on a growing trend, constituting nearly 40% of the company’s total sales. Growth from Asia-Pacific topped with 22.9% y-o-y growth in the Q2. In comparison, sales grew in single-digits from other geographies with a whopping 9.7% in Eastern Europe and 6.8% from Africa/Middle-East.

Within Asia-Pacific, China has been a key driver with Chinese travelers being one of the highest spenders both in the domestic and international markets, making this market one of the focus areas for the company to boost its travel retail sales.

Outlook for H2 and full fiscal 2018 – The company forecasts a confident outlook for the remaining fiscal 2018 with sales to continue to rise reflecting continuing momentum from Q2. We believe that L’Oreal has the key advantages in terms of innovation, brand power, digital prowess, and the quality of its teams all over the world to continue to drive growth and hold on to its leading position in the Beauty market.

What’s behind Trefis? See How it’s Powering New Collaboration and What-Ifs