Lowe’s Posts A Top and Bottom Line Miss, But Growth Continues

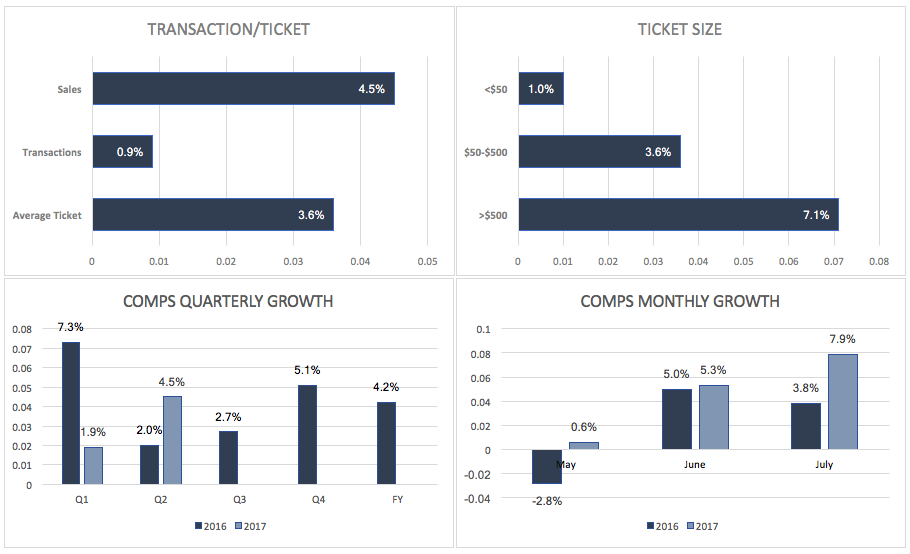

While the earnings posted by Lowe’s (NYSE:LOW) may not have been as high as the market expected, the company was able to deliver a strong growth in its EPS and revenues. Impressive 4.5% comparable sales growth, as well as an increase in the store count, drove the improvement in sales. These factors in conjunction with an effective cost strategy pushed up the margins, resulting in bottom-line improvement. While these growth figures seem considerable, the company’s stock price fell on the earnings announcement. The miss coupled with the deceleration expected in the second half can be held responsible for this. Sales and comps growth in FY 2017 are expected to come in at 5% and 3.5%, substantially lower than the figures posted in the second quarter. Lowe’s also lowered its operating margin growth to 80 to 100 basis points improvement, as compared to 120 bps earlier. This resulted in the lowering of the EPS guidance to a range between $4.20 to $4.30, from $4.30 earlier. However, the lesser number of days in FY 2017, as compared to FY 2016, should be kept in mind as a factor causing uneven comparisons.

Housing Improvement Drives Comps Growth

Lowe’s home improvement comps registered a 4.6% growth in the quarter, driven by broad-based demand across the different product categories and geographies. The solid growth seen in the sector should continue in the second half of the year as well, providing a boost to the company’s results. Favorable consumer and economic indicators will ensure the growth of the sector for the rest of the year. Improvements seen in the job market, as well as income growth, bodes well for the home improvement industry. These factors have been responsible for the bright outlook for the housing market. Similarly, Lowe’s consumer sentiment survey indicated a favorable view of the national economy and the consumer’s financial position. Moreover, over one-half of the consumers believe their home value is appreciating. This growth seems to be encouraging home owners to carry out their remodeling investments.

The growth in home prices coupled with the upward trajectory of home sales are indicative of a healthy sector. These two activities together evince another strong year for the home improvement industry. While things have not returned to the boom times, the number of new houses built last year was the most since 2007. People who buy new homes spend money on improving their homes, installing appliances, buying furnishings, etc. It is not just the new homes, but remodeling existing houses is also on an upswing. Homeowners who remodel this year are expected to spend about $6,148 per project, as compared to $5,800 in 2016, according to a National Association of Home Builders analysis of Census Bureau data. First time buyers, who are mostly millennials and baby boomers, are set to drive this growth in the coming years.

A Focus On The Pro Customer

The acquisition of Maintenance Supply Headquarter this year is likely to give Lowe’s a better control over its “Professional Segment” – an area where its competitor Home Depot is currently ahead. Professional customers place larger orders compared to the do-it-yourself segment, and serving these customers better can boost revenues for Lowe’s in the long term. While the recovery in the housing segment has benefited players such as Home Depot and Lowe’s, the latter’s growth has not been as stellar, primarily due to its focus on the do-it-yourself consumer segment. While the do-it-yourself segment is lucrative and accounts for the bulk of Lowe’s revenues, these customers are small ticket buyers and many are just one time customers. On the other hand, pro-customers account for only 30% of Lowe’s revenues, and 50% of the home improvement market, but they enter into big-ticket transactions and are usually repeat customers. The company expects that after this acquisition its multifamily maintenance, repairs, and operations business will generate more than $400 million in incremental annual sales. We believe this acquisition is a key part of Lowe’s future growth strategy and should drive revenues for the company in the long term.

In the quarter, the company continued to drive comps growth among the pro customers, which came in higher than the company average. An improved assortment helped to drive the growth in the Plumbing & Electrical, and Lumber & Building Materials segments. Besides the improved assortment, the company is driving growth in this segment with its omnichannel offerings, such as through its pro services team and LowesForPros.com, as well as its value propositions, including “Five Ways To Save.”

See our complete analysis for Lowe’s.

Have more questions on Lowe’s? See the links below.

- Lowe’s Steps Up Its Canada Operations With RONA Acquisition

- Lowe’s Unable To Match Up To Home Depot’s Solid Q1 Performance

Notes: