What To Expect From Lockheed Martin’s Q4 Earnings

Lockheed Martin (NYSE: LMT) reported a rather mixed earnings last time around. The company missed on expected earnings marginally, while revenues missed the expectation significantly. However, the company mentioned that this shortfall is only timing related, and that the fourth quarter will see things bounce back significantly. Despite this clarification, Lockheed’s stock price fell by about 2% post the earnings call.

That said, the company managed to sign a slew of deals in the quarter gone by. We expect the top line to benefit greatly from this in Q4. Additionally, the company is expected to more than overcome the weakness in operating profits in the last quarter in Q4.

- As mentioned previously, the company is expected to benefit greatly from the number of deals signed in the quarter as order procurement continues to be a primary growth driver. In general, the company managed to take in orders in excess of $8 billion in the quarter. In the previous quarter, the company posted a record $104 billion in backlog. These new orders are only expected to increase this number even further.

- Overall, the company decided to raise its sales outlook at the Space Systems, Rotary and Mission Systems as well as Missiles and Fire Control business units. That said, Lockheed management was forced to slash its sales outlook at Aerospace owing to an updated forecast of subcontractor production costs that were incurred in the previous quarter.

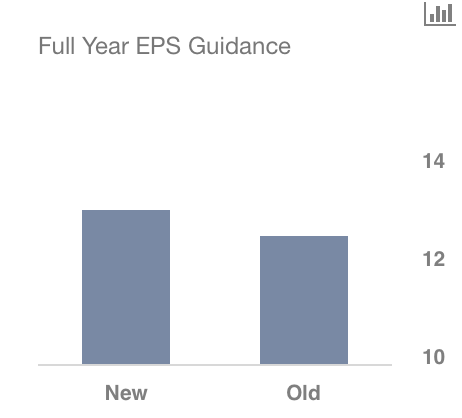

- Additionally, Lockheed’s management decided to raise its full-year guidance for earnings significantly. The company now hopes to take in, a notably higher earnings, of between $12.85 to $13.15 per share, up from $12.30 and $12.60 per share. We can expect this momentum to continue well through to the next year as well.

- Should You Pick Lockheed Martin Stock At $430 After Q4 Beat?

- Down 20% This Year Is RTX A Better Pick Over Lockheed Martin Stock?

- After An 8% Rise In A Month What’s Next For Lockheed Martin Stock

- Which Is A Better Pick – Lockheed Martin Stock Or Starbucks?

- Why The Space Theme Is Underperforming This Year

- Here’s What We Expect From Lockheed Martin’s Q2

View Interactive Institutional Research (Powered by Trefis):

Global Large Cap | U.S. Mid & Small Cap | European Large & Mid Cap

More Trefis Research