Is Coca-Cola’s Stock Fairly Valued?

Based on its current market price and future growth prospects, Coca-Cola (NYSE: KO) looks undervalued at present. Trefis has a price estimate of $57 per share for Coca-Cola’s stock, higher than its current market price of $53 (as on November 19, 2019), which reflects an upside of 7.5%.

To understand the primary factors that are driving a higher stock price estimate for Coca-Cola compared to its current market price, view the Trefis interactive dashboard – Coca-Cola’s Valuation: Expensive or Cheap?

About The Company

- Coca-Cola’s business includes the sale of beverages such as sparkling soft drinks; water, enhanced water and sports drinks; juice, dairy and plant-based beverages; tea and coffee; and energy drinks.

- All soft drink customers in all the geographies that the company functions in, are potential end buyers. The company sells the concentrate to its bottlers who then sell it to retail customers by adding water and the fizz.

- It faces competition from PepsiCo, Keurig Dr Pepper, Nestle, etc.

- Should You Pick Coca-Cola Stock At $60 After Q4 Beat?

- Down 10% This Year Is Coca-Cola Stock A Better Pick Over AbbVie?

- What’s Next For Coca-Cola Stock After 4% Gains In A Week Amid Q3 Beat?

- Down 15% This Year Will Coca-Cola Stock Rebound After Its Q3?

- Which Is A Better Beverage Pick – Coca-Cola Stock Or Monster Beverage

- Pricing Actions To Bolster Coca-Cola’s Q2?

How Have Revenues Trended And What Is The Outlook?

- Coca-Cola’s revenue has declined over the last two years, from $41.9 billion in 2016 to $31.9 billion in 2018, mainly due to the loss of revenue from extensive refranchising of its bottling operations (converting company-owned bottling plants to new franchisees, which leads to lower revenue but higher margin due to a sharper decline in cost).

- However, with most of the refranchising already done, total revenue is expected to increase in 2019 and 2020, led by higher demand for energy and sports drinks across geographies, along with benefits from major acquisitions.

- For the full year, revenue is expected to increase by 16.1% from $31.9 billion in 2018 to $37 billion in 2019, and further by 4.3% to $38.6 billion in 2020.

- Higher revenue is likely to be driven by growth across almost all major segments and the impact of acquisitions.

- Revenue growth would also be driven by inorganic growth strategies of Coca-Cola, with the company announcing several key acquisitions in 2018, including Costa Limited (completed in Q1 2019) and a strategic partnership with BODYARMOR. Additionally, it also announced the acquisition of full ownership in Chi Ltd, which is a fast-growing leader in expanding beverage categories, including juices, value-added dairy, and iced tea in Nigeria.

To understand how each revenue segment of Coca-Cola is performing, view our interactive dashboard.

Estimating Net Income

- Net income margin is expected to increase from 20.2% in 2018 to 21% in 2019 and further to 21.3% in 2020, driven by lower cost of sales and operating expenses due to refranchising of low-margin bottling business and benefits from the company’s productivity program, which aims to achieve additional efficiencies in both supply chain and marketing expenditures, as well as to transition to a new, more agile operating model to enable growth.

- Higher revenue and margins are expected to drive net income from $6.4 billion in 2018 to $7.8 billion and $8.2 billion in 2019 and 2020, respectively.

Estimating Earnings Per Share

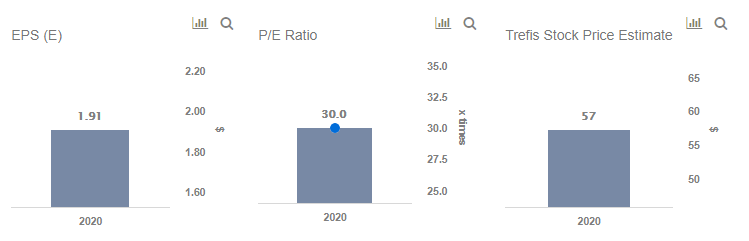

- EPS is expected to see a rise from $1.50 per share in 2018 to $1.80/share in 2019 and $1.91/share in 2020, driven by higher net income

Share Price Estimation

As per Coca-Cola’s Valuation by Trefis, we have a price estimate of $57 per share for Coca-Cola’s stock. The stock price estimate is arrived using the discounted cash flow valuation technique, which you can find in Coca-Cola’s detailed financial model. Based on a projected EPS of $1.91/share and stock price estimate of $57/share, Coca-Cola’s forward price-to-earnings (P/E) multiple stands at 30x.

To understand how Coca-Cola’s P/E multiple compares with that of its peers, view our interactive dashboard analysis.

What’s behind Trefis? See How it’s Powering New Collaboration and What-Ifs

For CFOs and Finance Teams | Product, R&D, and Marketing Teams

Like our charts? Explore example interactive dashboards and create your own.